Dollar Slides as Markets Price In December Fed Cut; AI Hardware Shake-Up Hits Nvidia, Lifts Alphabet and Broadcom

Key Takeaways

The US dollar weakened and Treasury yields fell as traders ramped up bets on a Federal Reserve rate cut in December, while the AI hardware complex whipsawed after reports that Google and Meta may shift major workloads to custom Tensor Processing Units, pressuring Nvidia and AMD.

Dollar Softens on Policy Repricing – Fed-dated OIS now implies roughly 80% odds of a December rate cut, up sharply from the 30% area last week, boosting risk appetite and weighing on the greenback across FX. – The repricing followed remarks from New York Fed President John Williams, San Francisco Fed President Mary Daly and Fed Governor Christopher Waller that investors interpreted as leaning more dovish into the December meeting. – With consensus building among senior policymakers, markets see policy normalization accelerating if growth slows and inflation continues to trend lower, supporting a softer USD and richer duration.

Treasury Yields Edge Lower – US yields dipped across the curve as rate-cut expectations firmed: – 2-year: 3.479% (-0.8bp) – 5-year: 3.589% (-1.5bp) – 10-year: 4.019% (-1.7bp) – 30-year: 4.660% (-1.6bp) – The modest move lower reflects steady demand for duration and cooler rate-volatility, with positioning skewing toward carry and curve steepening into year-end.

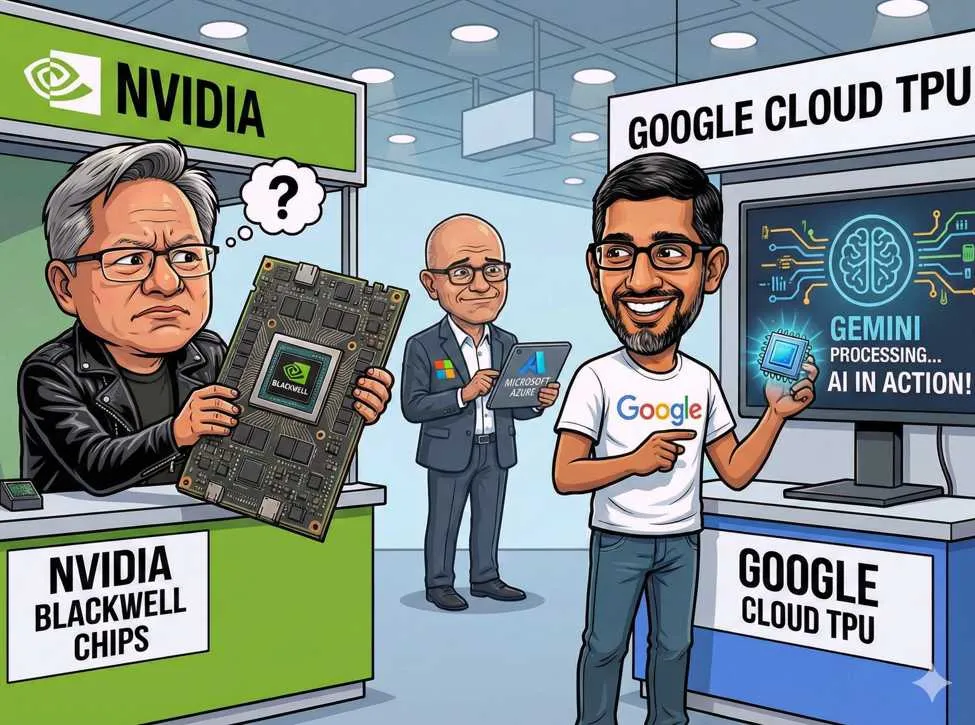

AI Hardware Shake-Up Rattles Chip Complex – Google and Meta are in talks to redirect significant AI workloads toward Google’s custom TPUs, according to The Information, a shift that could curb reliance on Nvidia and AMD GPUs. – Meta is weighing a multi-billion-dollar investment to deploy TPUs in its own data centers by 2027 and may rent TPU capacity from Google Cloud as soon as next year. – The prospect of Google’s Gemini platform scaling further intensified competitive pressures on OpenAI—an important SoftBank investment—sending SoftBank shares sharply lower. – Nvidia and AMD slid on potential GPU demand erosion, while Alphabet and Broadcom—Google’s TPU fabrication partner—advanced as investors reassessed the AI stack’s profit pools.

Equities Mixed as Megacap Tech Diverges – Alphabet shares rose 4.44% and Broadcom added 3.25%, while Nvidia fell 3.63% and AMD declined 4.5% in early trade. – Microsoft edged down 0.87%; Micron slipped 1.1%; Intel gained 0.77%. – Index-level price action was choppy: Dow Jones Industrial Average +18 points, S&P 500 +3.38 points, Nasdaq Composite -11.85 points, reflecting rotation within tech and recalibration around AI hardware market share.

Commodities and Crypto – Crude oil fell $1.14 to $57.72 as supply considerations and demand uncertainty weighed on energy risk. – Gold eased, trading near $4,132 per ounce amid lower yields and a softer dollar. – Bitcoin retreated $895 to $87,372, tracking waning risk momentum in digital assets.

Market Highlights – December Fed cut probability rises to ~80% from the 30% area last week. – USD softer as rate differentials and FX volatility compress. – US 10-year yield near 4.02%, curve modestly richer across maturities. – Alphabet +4.44%, Broadcom +3.25%; Nvidia -3.63%, AMD -4.5%. – Oil $57.72 (-$1.14); Bitcoin $87,372 (-$895).

What’s Next – Traders will watch incoming US economic prints and additional Fed communication for confirmation of a December pivot. – In AI, any formal announcements from Google, Meta, and key cloud providers on TPU deployment timelines or procurement could further shift market positioning in semis.

Questions Traders Are Asking

Q: What’s driving USD weakness today? A: A sharp repricing of the Fed path toward a December rate cut—now seen near 80% probability—has pressured the dollar as rate differentials move against it and risk sentiment stabilizes.

Q: Who stands to benefit if TPU adoption accelerates? A: Alphabet and Broadcom could capture more AI infrastructure spend if TPUs gain share, while Nvidia and AMD face incremental demand risk for GPUs in certain workloads.

Q: How are yields reacting to the cut narrative? A: Yields are modestly lower across the curve, with the 10-year near 4.02%, reflecting softer policy expectations, improved liquidity conditions, and steady demand for duration.

Q: What should investors monitor from here? A: Forward guidance from Fed officials, high-frequency inflation and labor data, and concrete procurement signals from hyperscalers and large AI customers that could reframe the AI hardware competitive landscape.

This article was prepared for global markets readers by BPayNews.

Context

Current positioning around Market Analysis remains sensitive to primary-source updates, policy interpretation, and execution risk across major venues.

What To Watch

Key confirmation signals include sustained spot demand, funding stability, and whether price can hold reclaimed levels after headline-driven volatility.

If momentum weakens, traders will likely prioritize downside liquidity zones and risk-control positioning before adding new directional exposure.

Related: More from Market Analysis | BANK LATEST QUARTER REPORT OUT NOW in Crypto Market | Tokenized Gold Surpasses CME Futures Prices This Weekend in Crypto Market