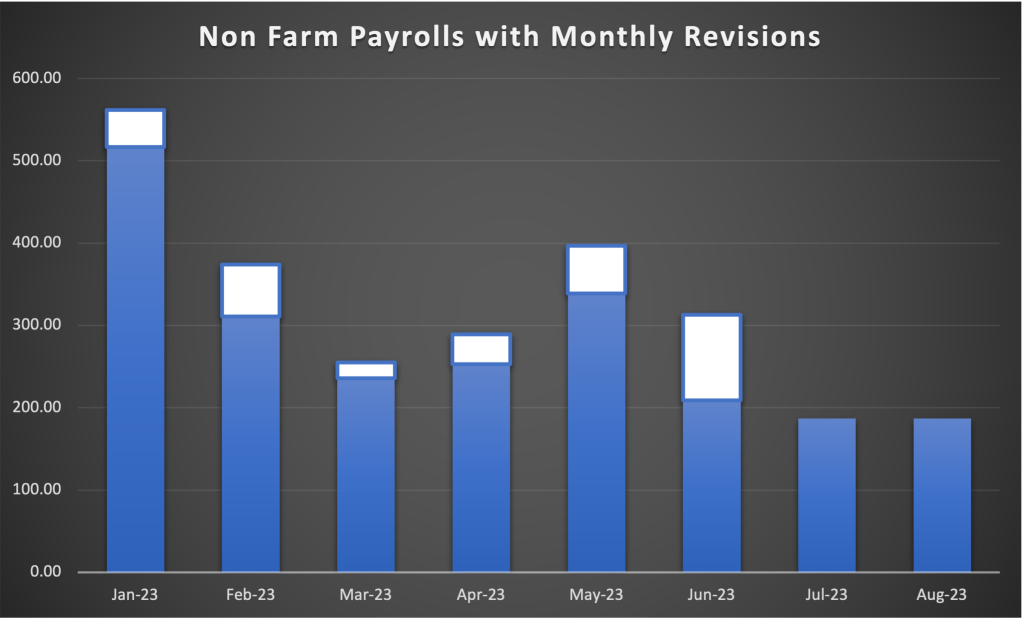

The U.S. non-farm payroll data is a crucial indicator of economic health, reflecting the number of jobs added or lost in the economy, excluding farm workers and certain other job categories. Scheduled for release next week, this data will be closely analyzed alongside the January CPI report, which will provide insights into inflation trends within the U.S. economy. As both reports are expected to influence market volatility predictions, traders are preparing for potential shifts in the financial landscape. Investors should watch for any significant movements as these February economic reports could significantly impact the overall market sentiment. Understanding the implications of the non-farm payroll data can be essential for making informed financial decisions in this dynamic economic environment.

When examining employment trends in the United States, one cannot overlook the vital non-farm employment statistics, which reflect the current job market’s strength outside traditional sectors. These indicators are essential for gauging the nation’s economic resilience, especially as the forthcoming employment and inflation data are anticipated. With the upcoming data releases next week, analysts expect potential shifts that may create notable surges in market activity. As such, understanding the ramifications of these employment metrics is crucial for stakeholders looking to navigate the complexities of the U.S. economic landscape. This backdrop is particularly important considering the close tie between market fluctuations and employment trends.

| Key Point | Description |

|---|---|

| No Non-Farm Data Tonight | There will be no non-farm payroll data released tonight. |

| Postponed Reports | The U.S. non-farm payroll report for January has been rescheduled to February 11. |

| Impact of Government Shutdown | The delay in the non-farm payroll report is due to the last U.S. government shutdown. |

| Upcoming Market Volatility | The release of the non-farm payroll and CPI reports next week may impact market stability. |

| Investor Advisory | Investors should monitor these key economic indicators closely this coming week. |

Summary

U.S. non-farm payroll data is highly anticipated, especially with the upcoming double release of key reports. The delay in the January non-farm payroll report due to the government shutdown has heightened focus on its next Wednesday release. Investors are advised to prepare for potential market fluctuations resulting from these important economic metrics, making it crucial to stay informed.

Understanding U.S. Non-Farm Payroll Data

U.S. non-farm payroll data serves as a critical economic indicator, reflecting the health of the labor market. It provides insights into job creation across various sectors, excluding farm workers, government, and a few other job categories. Investors closely monitor this data because significant fluctuations can signal economic growth or contraction, influencing market trends. The upcoming release date of the January non-farm payroll report, set for February 11, is expected to bring pivotal insights as it follows a notable governmental shutdown, which has likely impacted employment figures.

The implications of the non-farm payroll data extend beyond mere employment statistics; it affects consumer confidence and spending, which are essential components of the U.S. economy. When the non-farm payroll number exceeds expectations, it typically correlates with positive market activity, instilling investor optimism. Conversely, disappointing figures can lead to heightened market volatility as investors adjust their forecasts and risk assessments in response to the changing economic landscape.

CPI Report January 2023: Anticipated Impacts

The January Consumer Price Index (CPI) report, scheduled for release on February 13, 2023, is another vital economic indicator that can influence market behavior. This report measures inflation by tracking changes in the prices paid by consumers for a basket of goods and services. A significant shift noted in this report can provide clues on how inflation is affecting purchasing power, subsequently guiding Federal Reserve policy and interest rate decisions.

With the imminent release of the CPI report, investors are gearing up for potential market volatility, especially since it follows closely on the heels of the non-farm payroll data. If the CPI figures reveal a higher-than-expected inflation rate, there may be concerns regarding escalating living costs which could lead to tighter monetary policy. Therefore, the market’s reaction to the appropriateness of current federal economic strategies will be closely monitored.

February Economic Reports and Market Predictions

February’s economic reports, particularly the non-farm payroll and CPI figures, are pivotal for shaping market predictions. Investors are cautious as they prepare for the ‘double bomb’ of economic data that could markedly sway investor sentiment. Analysts anticipate that the results from these reports could redefine expectations for economic growth and recovery, impacting both short-term trading strategies and long-term investment planning.

Furthermore, the release of these vital economic metrics is expected to contribute to market volatility. Insights gained from these reports will help financial experts interpret the current state of the U.S. economy and predict future trends. For example, a strong employment report might instill confidence, while adverse CPI results could induce corrective measures in equity markets. As such, savvy investors are advised to stay informed and agile in their trading approaches.

How U.S. Economic Indicators Influence Market Volatility

U.S. economic indicators such as the non-farm payroll and CPI figures are essential tools for predicting market volatility. These indicators provide a snapshot of economic performance and consumer behavior, enabling investors to make informed decisions. Increased uncertainty in these indicators can lead to significant swings in the equity markets as traders react to perceived risks and opportunities. When economic reports signal a robust job market or rising inflation, they can result in heightened alertness among investors, leading to increased trading activity.

Moreover, the relationship between these indicators and market performance showcases the interconnectedness of economic health and investor confidence. For instance, when non-farm payroll data reflects strong job growth, it tends to bolster stock prices due to expected consumer spending increases. Conversely, negative trends in CPI may trigger fears of inflation rising too quickly, which could prompt a tightening of monetary policy, thus impacting market confidence and stability.

Investing Strategies During Periods of Economic Transition

During periods of economic transition, particularly when significant reports like the non-farm payroll and CPI are on the horizon, adjusting investment strategies is crucial. Investors should embrace a more agile approach, considering market conditions and potential outcomes from upcoming reports. Diversification becomes key, as it can help mitigate risks associated with economic uncertainty. Fixed income investments may offer stability during volatile periods, while equities may provide growth opportunities based on anticipated economic recovery.

Additionally, monitoring real-time news and analysis surrounding these economic indicators can provide critical insights for decision-making processes. As trends become apparent in the non-farm payroll report and CPI releases, informed investors can capitalize on market movements by either hedging their positions or exploring sectors expected to perform well. Ultimately, maintaining a flexible strategy can enable investors to navigate changing economic landscapes effectively.

The Role of Consumer Spending in Assessing U.S. Economic Health

Consumer spending is a cornerstone of the U.S. economy, accounting for a significant portion of economic activity. The insights gleaned from the non-farm payroll and CPI reports can provide valuable context for assessing consumer behavior. Higher employment rates typically correlate with increased consumer confidence, leading to greater spending, which in turn stimulates the economy. Conversely, stagnant job growth from non-farm payroll data could hint at declining consumer willingness to spend, ultimately impacting overall economic health.

As CPI reports indicate changes in inflation, the purchasing behavior of consumers is also influenced by the cost of living adjustments reflected in these figures. When prices rise without corresponding wage growth, consumer spending may dwindle, creating a cyclical impact on economic growth. Investors must remain vigilant, as shifts in consumer spending patterns can preemptively indicate economic strength or weakness, providing critical data points for future investment decisions.

Historical Context of Non-Farm Payroll Data Trends

Understanding the historical trends of non-farm payroll data aids in contextualizing current economic conditions. Historically, periods of significant job growth have often corresponded with broader economic expansions, while job losses have typically indicated recessionary phases. Analyzing past reports can help investors gauge the current economic climate and predict potential future shifts based on current conditions. For example, if recent trends show consistent job gains, this may hint at a resilient economy poised for sustained growth.

Moreover, the analysis of past non-farm payroll data provides valuable lessons on market reactions to these figures. In previous years, strong job reports have led to bullish market movements, while disappointing data has caused sell-offs as investors recalibrate their expectations. Thus, a sophisticated understanding of these historical patterns places investors in a better position to interpret upcoming reports and navigate market volatility effectively.

Addressing Market Volatility: The Impact of Economic Reports

Market volatility is often exacerbated by the release of significant economic reports, particularly the non-farm payroll and CPI figures. These reports can create uncertainty among investors, leading to rapid changes in market dynamics. As anticipation builds for the January non-farm payroll data and the subsequent CPI report, market participants brace for shifts in investor sentiment that could lead to market corrections or advancements.

Furthermore, how well the actual data aligns with market expectations can lead to pronounced volatility. If the non-farm payroll data shows unexpected strength, it may result in positive momentum across equities, while weaker-than-anticipated CPI results could spook investors, leading to more conservative market behavior. Such dynamics underscore the importance of closely watching economic indicators as they play a critical role in determining investment strategies moving forward.

Frequently Asked Questions

What is the significance of the U.S. non-farm payroll data for investors?

The U.S. non-farm payroll data is a crucial economic indicator that measures employment changes in the economy, excluding farm workers, government employees, and a few other job categories. Investors closely monitor this data because significant changes often indicate economic health and can influence market volatility predictions.

How does the U.S. non-farm payroll data interact with the CPI report January 2023?

The U.S. non-farm payroll data and the CPI report are both vital U.S. economic indicators that provide insights into employment and inflation, respectively. Changes in non-farm payrolls can affect consumer spending, which in turn impacts inflation levels reported in the CPI. Therefore, these indicators often influence each other and are analyzed together for a comprehensive view of the economy.

Why is the February economic report important regarding the U.S. non-farm payroll data?

The February economic report, which includes the U.S. non-farm payroll data, is essential because it reflects employment trends and economic activity following potentially dark periods, such as government shutdowns. This report can predict upcoming market trends and volatility, making it particularly critical for investors.

What are market volatility predictions based on the upcoming U.S. non-farm payroll report?

Market volatility predictions are often based on expectations surrounding the U.S. non-farm payroll report. Analysts look for changes in job growth to gauge economic recovery or recession signals, leading to market reactions. Investors should be prepared for fluctuations when the report is released.

When will the postponed U.S. non-farm payroll data be released and what to expect?

The postponed U.S. non-farm payroll data for January is set to be released on February 11 at 21:30. Investors should expect potential market volatility as this report will provide insight into employment trends which can significantly impact economic outlooks.