Browsing: Federal Reserve interest rates

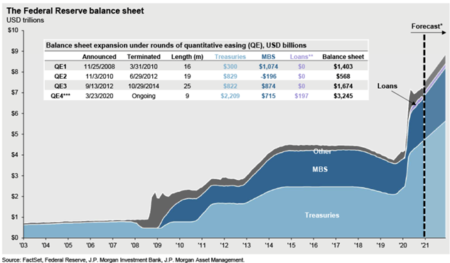

In recent discussions surrounding the Federal Reserve balance sheet expansion, market participants are closely monitoring potential shifts in the central bank’s monetary policy.With assets currently surging to a staggering $6.5 trillion, the Federal Reserve’s strategy is set to become a focal point, particularly as Bank of America predicts a monthly increase of $45 billion starting January 2026.

The stock market outlook presents a compelling narrative as we observe ongoing shifts influenced by recent fiscal policies and investor behaviors.According to J.P.

The forecast for the U.S.economy indicates we are on the brink of a golden year in economic history, as articulated by Hassett, the Director of the National Economic Council.

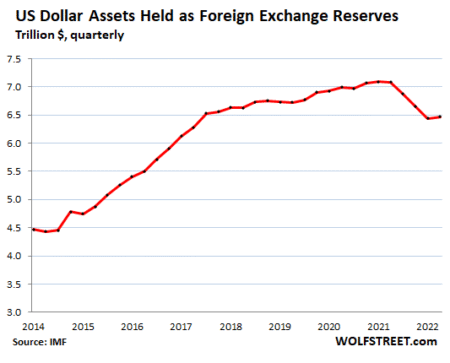

The dollar exchange rate decline is drawing attention as recent U.S.economic data hints at a possible shift in the Federal Reserve’s interest rate policy.

Currently, Bitcoin resistance at $92,000 is a pivotal topic capturing the attention of analysts and investors alike.As highlighted by Matrixport, the leading cryptocurrency is struggling to break past this key threshold, with upward momentum showing signs of stagnation.

Federal Reserve interest rates are a crucial topic for investors and consumers alike, as they dictate the cost of borrowing and shaping the economy.Currently, the probability of the Federal Reserve cutting interest rates by 25 basis points in December stands at an impressive 87.4%, according to the latest CME Fed Watch information.

The Federal Reserve interest rates play a pivotal role in shaping the economic landscape of the United States.Recent data from Polymarket highlights a striking 88% probability that the Fed will initiate a rate cut of 25 basis points by December.

Tether interest rate trading is emerging as a pivotal strategy amidst growing market uncertainties, particularly with the Federal Reserve interest rates being a significant influencer.As Tether’s operations evolve, they are banking on the premise that a potential cut in interest rates will impact their overall interest income.

As we look ahead to the Emerging Markets Outlook 2026, Wall Street is exuding confidence about the potential growth in this sector.With a weaker dollar expected to boost trade and an influx of artificial intelligence investments, major financial institutions foresee significant opportunities in investing in emerging markets.

The recent discussions surrounding Federal Reserve interest rates have garnered significant attention as economists adjust their forecasts for the upcoming months.With JPMorgan now predicting potential rate cuts starting in December, the financial landscape may shift dramatically from earlier assessments that projected no changes until January.