Browsing: Ethereum trading

An ETH long position can be a strategic move for traders looking to capitalize on the rising value of Ethereum.Recently, the trader known as pension-usdt.eth made headlines by switching from a short position to an ETH long position, leveraging their investment threefold.

The ETH short position has become a focal point in Ethereum trading, especially as one address now holds a staggering $106 million short position while raking in a profit of $6.22 million just this past week.Established on December 30, 2025, this strategic move on Hyperliquid illustrates the potential for profit through short selling ETH, capitalizing on market fluctuations.

The ETH price has recently caught the attention of traders and investors alike as it breaks through the pivotal 3100 USDT mark, currently sitting at 3100.3 USDT.This significant movement reflects a 24-hour increase of 1.58%, indicating a bullish trend in the cryptocurrency market.

An ETH long position can be a game changer in the world of Ethereum trading, allowing investors to capitalize on the cryptocurrency’s upward price movement.In recent news, a notable address leveraged its ETH long position to earn a staggering profit of 1.285 million USD, demonstrating the potential rewards that come with successful blockchain investments.

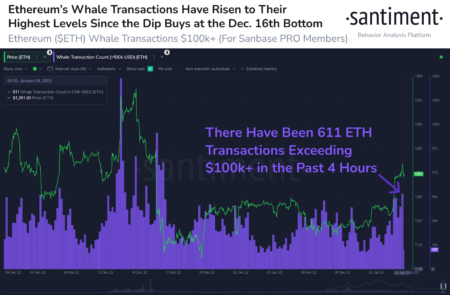

Whale ETH transactions are making waves in the crypto market news, as significant sales and purchases by major holders can greatly influence Ethereum trading activity and ETH price fluctuations.Recently, a notable whale identified as 0x3aFE sold 1,900 ETH at a peak price of $4,574 on August 25, raising a staggering $8.69 million.

This week has witnessed a notable rise in Ethereum purchases, particularly by large holders, signaling confidence amid a recovering cryptocurrency market.Following a swift downturn earlier in the week, major investors have resumed their buying activities, with one wallet acquiring an impressive $55 million in ETH from BitGo.

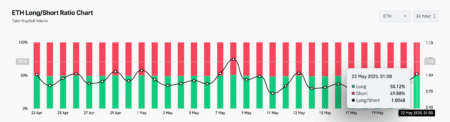

In the dynamic world of cryptocurrency, ETH trading strategies have become essential for traders seeking to maximize their gains.With Ethereum’s increasing price volatility, savvy traders are leveraging various tactics to capitalize on market movements, whether through long positions or short selling.

In the exciting world of cryptocurrency, Brother Ma Ji has made headlines by significantly increasing his Ethereum long position to an impressive 8,400 ETH.This bold move signals confidence in the Ethereum trading market, particularly as he strategically places multiple sell orders for both HYPE and ETH.

The recent ETH price decline has raised concerns among investors as Ethereum drops below 3000 USDT, currently trading at 2997.21 USDT with a 24-hour decline of 0.48%.This movement in the market has sparked significant interest in ETH market analysis, highlighting the crypto news cycle’s focus on Ethereum trading activity.

Hyperliquid whale activity is making headlines as a notable player recently deposited 4 million USD into the platform, subsequently opening a short position of 20 million USD in HYPE.This intriguing maneuver has attracted attention, particularly within the realm of Ethereum trading and decentralized exchanges, as it signals significant market confidence or strategic foresight.