Browsing: Ethereum investment

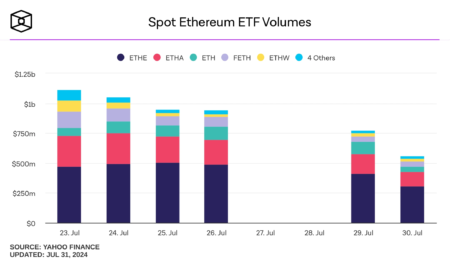

Ethereum spot ETFs have emerged as a significant player in the cryptocurrency investment landscape, but recent trends indicate a troubling pattern of net outflows.Just yesterday, these investment vehicles saw a striking net outflow of $9.6308 million, marking the fourth consecutive day of losses.

Ether, the native cryptocurrency of the Ethereum blockchain, has emerged as a pivotal asset in the cryptocurrency market, particularly as investors gear up for 2026.With increasing Ethereum investment by various firms, market trends reflect a divergence in corporate strategies towards Ether.

The analysis of Ethereum spot ETFs reveals some striking trends in the cryptocurrency market, notably a staggering net outflow of $75.2065 million reported yesterday.With none of the nine Ethereum ETFs experiencing any net inflows, this raises critical questions about the future of Ethereum investments and market sentiment.

Ethereum investment is attracting substantial interest as many analysts suggest that the cryptocurrency is significantly undervalued.Recent discussions, especially around ETH price predictions, indicate a bullish outlook despite recent market fluctuations.

Cryptocurrency ETFs are gaining significant traction in today’s financial landscape, as evident from the recent influx of $1.1 billion into these investment vehicles last week.This remarkable surge, primarily driven by Bitcoin inflow of $461 million and Ethereum investment of $308 million, highlights a potential recovery in the crypto market rebound.

Whale investment in ETH has recently gained significant attention as savvy investors maneuver through the volatile landscape of cryptocurrencies.A noteworthy case involves a crypto whale who allocated a whopping $11.128 million to amass 3,468 ETH, revealing not just confidence in Ethereum investment but also strategic insight into ETH price strategy amid prevailing market fluctuations.

The Vanguard Bitcoin Ethereum XRP ETF marks a pivotal moment in the world of crypto investing, as Vanguard finally embraces the growing demand for digital assets.This strategic shift allows Vanguard’s brokerage customers to delve into crypto ETFs that include not just Bitcoin and Ethereum, but also XRP—a move that positions Vanguard as a competitor in the rapidly evolving financial landscape of cryptocurrencies.

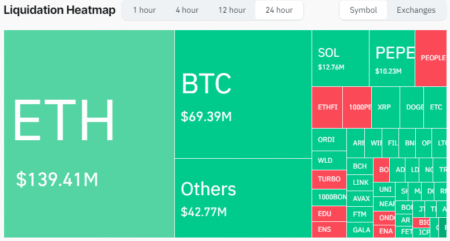

Ethereum liquidation has become a hot topic among crypto traders and investors, especially with the volatility surrounding the ETH price analysis.Recently, Brother Maji’s substantial long position of 400 ETH was liquidated at a staggering price of $2,792, highlighting the importance of having a well-thought-out ETH trading strategy to mitigate liquidation risk.

Ethereum spot ETFs are experiencing an unprecedented surge, with a remarkable net inflow of $60.8176 million recorded just yesterday.This positive trend reflects a growing interest in cryptocurrency investments, particularly in Ethereum, as Blackrock’s ETF continues to lead the way with significant inflows.

Ethereum price prediction has become a hot topic among investors and crypto enthusiasts alike, especially with the recent bounce back to the $3000 mark.As the panicked atmosphere surrounding the cryptocurrency industry begins to dissipate, many analysts are turning their focus to the ETH price analysis, anticipating future movements based on current market trends.