Browsing: cryptocurrency regulations

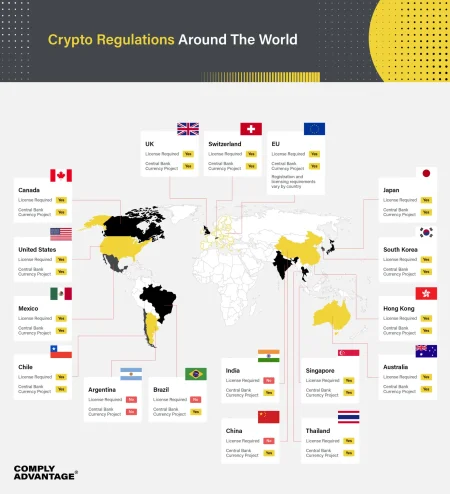

In recent years, cryptocurrency regulations have become a focal point for governments around the world as they strive to create a balanced approach to digital currencies.Russia is stepping up its fight against illegal cryptocurrency miners, aiming to deter unregistered operations that proliferate in the shadows of the economy.

Cryptocurrency tax compliance is an increasingly critical concern for both taxpayers and regulators in Canada.As the Canada Revenue Agency (CRA) reports, nearly 40% of individuals engaged with cryptocurrency platforms may be participating in tax evasion or high-risk non-compliance behaviors.

The recent conclusion of the Ondo Finance SEC investigation marks a pivotal moment for the burgeoning field of tokenized assets.Over the past two years, the U.S.

The Argentine central bank cryptocurrency initiative represents a pivotal change in the nation’s financial landscape.For years, traditional financial institutions in Argentina faced stringent regulations, including a sweeping ban on offering cryptocurrency trading and crypto custody services.

The SEC roundtable on cryptocurrency, scheduled for December 15, promises to be a pivotal event as the U.S.Securities and Exchange Commission engages with key stakeholders on the pressing issues surrounding cryptocurrency regulations.

CFTC cryptocurrency trading has transformed the landscape of digital finance, bridging the gap between conventional investment and blockchain technology.With the U.S.

In a recent Paul Atkin interview, the SEC Chairman made waves discussing the future of cryptocurrencies and the pressing need for coherent cryptocurrency regulations in the United States.He asserted that the nation’s undue resistance to embracing digital currencies has persisted for far too long, which could be detrimental to the development of the crypto market news landscape.

The upcoming introduction of the cryptocurrency innovation exemption in January 2026 marks a pivotal moment for the crypto landscape, as highlighted by the SEC Chairman.This policy is set to redefine cryptocurrency regulations, offering companies a roadmap to navigate the complexities of compliance while fostering innovation in the cryptocurrency space.

As global interest in digital currencies grows, stablecoin regulations are becoming a focal point for financial authorities worldwide.With the emergence of the digital shekel in Israel on the horizon, regulators are increasingly concerned about the systemic risks posed by the dominance of issuers like Tether and Circle.

In the realm of UK cryptocurrency tax reporting, the landscape is undergoing significant change as the government tightens regulations to enhance compliance measures.Starting January 1, 2026, UK crypto exchanges will be mandated to collect detailed information from traders, aligning with the global Cryptoasset Reporting Framework established by the OECD.