Browsing: cryptocurrency market analysis

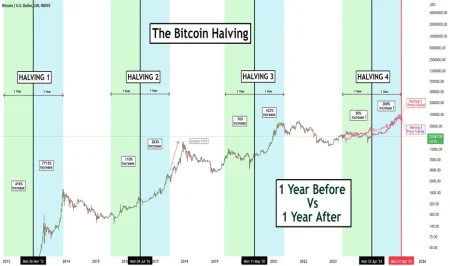

The Bitcoin halving cycle is a pivotal event in the cryptocurrency ecosystem, occurring approximately every four years and fundamentally impacting Bitcoin’s supply and market dynamics.Historically, these halvings have led to significant price increases, capturing the attention of both retail and institutional investors, who recognize their potential to shape Bitcoin market trends.

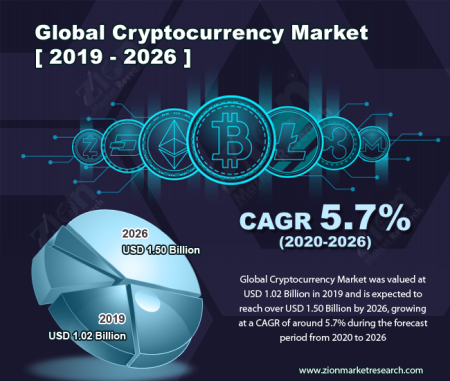

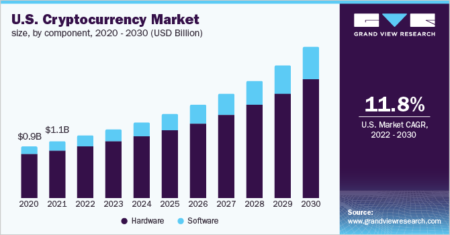

The cryptocurrency market analysis is essential for investors seeking to navigate the ever-evolving digital finance landscape.Insights from Matrixport reveal that the recent large-scale deleveraging in the derivatives market may set a robust foundation for crypto assets in the coming years.

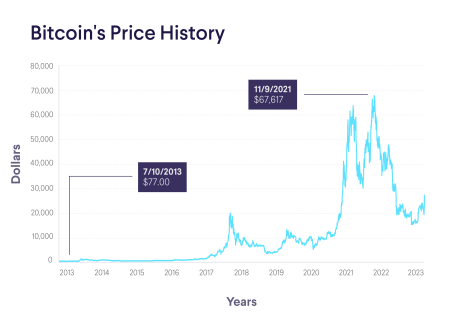

Bitcoin price news is once again making waves in the cryptocurrency community as BTC approaches a pivotal $92,000 mark.Following a remarkable rise, the digital asset reached highs of $91,266, drawing the attention of traders who are now analyzing potential BTC price predictions and strategic entry points.

In an intriguing development within the cryptocurrency landscape, a savvy investor has initiated a BTC short position, employing 10x leverage to amplify potential returns.This strategic move, valued at $36 million and involving 409.58 BTC, highlights a significant player leveraging whale trading strategies amid a turbulent market.

The Cathie Wood Bitcoin Cycle has captured the attention of investors and enthusiasts alike, particularly as the renowned founder of ARK Invest shares her bold predictions for the cryptocurrency.Wood suggests that the well-established four-year cycle of Bitcoin may soon be disrupted, possibly indicating that we have already witnessed the cryptocurrency’s lowest price point in this trend.

Ethereum whale positions play a crucial role in shaping market dynamics, especially in the wake of significant events like the recent flash crash.According to on-chain analyst Ai Yi, after this downturn, whales capitalized by opening short positions while simultaneously amassing over 70,000 ETH in long positions.

The cryptocurrency market offers promising opportunities for savvy investors eager to navigate its volatile landscape.With lowering market sentiment and significant shifts in current trends in cryptocurrency, there are still avenues to capitalize on making money in cryptocurrency.

The recent trends in the US stock market and cryptocurrency markets have sparked widespread interest among investors and analysts alike.On December 5th, the stock market showcased a positive shift, with the Dow Jones performing well, gaining 0.22%, while the S&P 500 update reflected a modest increase of 0.19%.

In a striking maneuver within the cryptocurrency market, a giant whale borrowed ETH from Aave, engaging in a bold strategy involving the short sale of 5,000 ETH valued at a staggering $15.66 million.This recent borrowing highlights the significant impact that whale transactions can have on Ethereum’s dynamics, particularly as market analysts closely monitor the implications for Ethereum’s price trends.

Cronos CRO growth has been notably impressive, particularly following the recent appointment of Edward Adlard as the Head of Ecosystem at Cronos Labs.The CRO token experienced a remarkable surge of over 10%, jumping to approximately $0.11 within just 24 hours, aligning perfectly with the bullish sentiment in the cryptocurrency market.