Browsing: crypto market trends

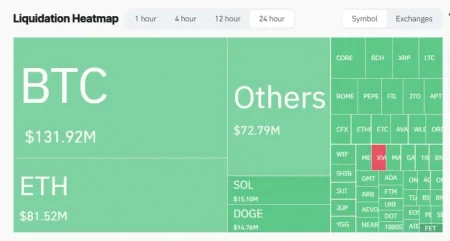

Cryptocurrency liquidation has emerged as a significant concern for traders navigating the volatile landscape of digital assets.In the past 24 hours alone, the cryptocurrency market has faced a staggering $67.6237 million in total liquidations, driven predominantly by long positions which accounted for $38.9888 million.

Bitcoin price analysis reveals a significant moment as BTC eyes a potential breakthrough at $94,000, marking its highest level in nearly a month.This surge comes amidst rising investor confidence influenced by geopolitical events, with Bitcoin’s performance mirroring gains in both equities and gold.

The Bitcoin bear market has captured the attention of traders and enthusiasts alike, as recent data suggests a significant decline began in November.With many eyes focused on crypto market trends, analysts are closely monitoring Bitcoin’s price prediction, which indicates a potential dip to between $56,000 and $60,000 by 2026.

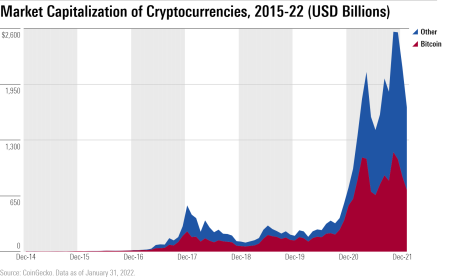

In the ever-evolving landscape of blockchain technology and innovation, understanding crypto market trends is crucial for investors and enthusiasts alike.As we dive into 2026, significant fluctuations are observed, particularly in Bitcoin analysis, where key moving averages signal potential turbulence ahead.

Ethereum price has recently captured the attention of investors and crypto enthusiasts alike as it breaks through the significant barrier of 3000 USDT.This movement marks a notable 24-hour increase of 0.7%, reflecting the volatile nature of the crypto market trends that can shift dramatically in a matter of hours.

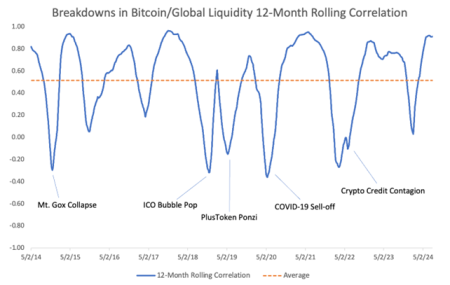

Bitcoin liquidity has become a key topic of discussion in the wake of significant shifts in the cryptocurrency market.Recently, Bitcoin has lost an estimated $2 trillion in its liquidity safety net, leaving the asset vulnerable to unprecedented volatility.

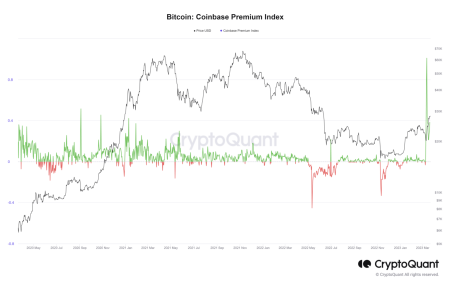

The Coinbase Bitcoin Premium Index has significantly drawn the attention of traders and investors alike, particularly as it has recorded a negative premium for 15 consecutive days, currently sitting at -0.0858%.This index tracks the disparity between Bitcoin’s price on Coinbase, a major player in the U.S.

Cryptocurrency trading volume has captured considerable attention in recent discussions surrounding the vibrant world of digital currencies.According to a recent report, there has been a notable decline in trading activity, which echoes broader cryptocurrency market trends.

In a significant shift for the crypto landscape, a whale withdraws RLS from Coinbase, moving a staggering 2.94 million RLS tokens valued at around $47,230 just 13 hours ago.This transaction has caught the attention of cryptocurrency enthusiasts, particularly amidst current RLS transaction news highlighting notable market movements.

The **Bitcoin bearish flag** is a crucial concept in the realm of cryptocurrency analysis and can significantly impact future BTC price predictions.This pattern, characterized by a brief consolidation phase after a decline, hints at a potential continuation of the downward trend.