Browsing: crypto investment strategies

In an exciting development within the cryptocurrency sector, Bitmine recently completed a substantial purchase, acquiring 32,977 ETH.This significant move, reported by Odaily Planet Daily, further solidifies Bitmine’s position in the ETH market, as it now boasts a remarkable total of 4,143,502 ETH holdings valued at an impressive $13.08 billion.

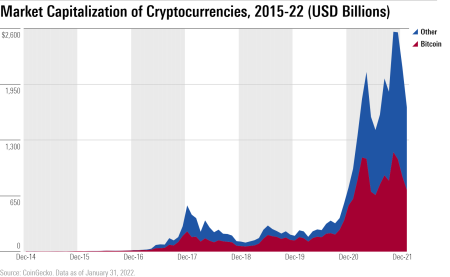

As the cryptocurrency market trends evolve, investors and enthusiasts alike must navigate the complex landscape shaped by fluctuations in the sector’s total market capitalization, currently sitting at $3.1 trillion, reflecting a 14% decline over the last year.This downturn emphasizes the urgent need for strategic crypto investment strategies, particularly as experts prepare for 2025 cryptocurrency predictions that signify the end of excessive speculation.

In the evolving landscape of digital finance, crypto index funds are poised to redefine how investors engage with the crypto market.Recognized for their ability to streamline investments across various cryptocurrencies, these funds provide a practical solution for those seeking exposure without the intricacies of direct trading.

The concept of a crypto treasury is gaining traction among corporations looking to leverage digital assets for strategic growth and financial stability.Recently, significant activities from major players like Bitcoin’s Strategy and Ethereum’s BitMine underline the importance of diversifying corporate crypto holdings.

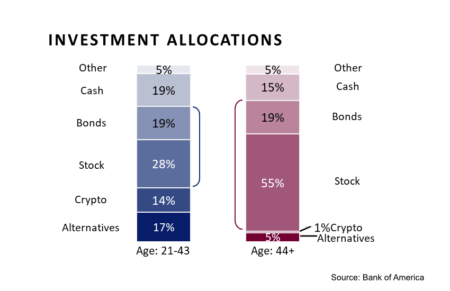

Bank of America cryptocurrency allocation marks a significant step in the financial landscape, as the bank now actively encourages its wealth management clients to consider integrating digital assets into their investment portfolios.By advising an allocation of 1-4% of funds to cryptocurrencies, Bank of America is acknowledging the growing importance of cryptocurrency funds in modern investment strategies.

Vanguard crypto ETFs represent a pivotal shift in the world of digital asset investment, marking the asset manager’s significant entry into the burgeoning crypto market.With $9.3 trillion in assets under management, Vanguard’s decision to unlock its platform for investments in Bitcoin and Ethereum ETFs could potentially generate substantial new demand from clients eager for crypto exposure.

The Maelstrom investment portfolio, helmed by notable figures in the cryptocurrency space, is generating considerable buzz amid discussions on token viability.Recently, Arthur Hayes highlighted the predicament faced by various projects within this portfolio, particularly regarding their locked token supply.

Whale trade MON cryptocurrency is making waves in the market as large investors take significant positions, showcasing a growing confidence in this digital asset.Recently, a prominent whale has gone long on 171.68 million MON, leveraging 3x to amplify their potential gains, which translates to an investment worth 5.6 million USD.

Whale ETH investment has become a focal point in the crypto community, especially following recent developments highlighted in the latest crypto whale news.A notable case involves a whale who capitalized on a staggering $200 million profit from shorting the market just before the significant market drop on October 11.

In the dynamic world of crypto trading, understanding HYPE accumulation analysis is essential for investors seeking to navigate market fluctuations.Recently, an address has amassed an impressive $6.585 million in HYPE within just 24 hours, illustrating the potent market trends influencing investor behavior.