Browsing: BlackRock Bitcoin ETF

The current U.S.spot Bitcoin ETF price has captured the attention of investors and analysts alike, standing at approximately $83,000.

BlackRock Bitcoin ETF has made headlines recently as it grapples with five consecutive weeks of fund outflows, totaling over $2.7 billion.This unprecedented trend reflects a significant withdrawal of capital from the iShares Bitcoin Trust, causing many to question the sustained interest in cryptocurrency investment.

Bitcoin as an asset of fear has entered the spotlight following recent comments by BlackRock CEO Larry Fink during the DealBook Summit.Fink emphasized that individuals often resort to investing in Bitcoin during times of heightened uncertainty and instability, ultimately using it as a safeguard for their personal financial security.

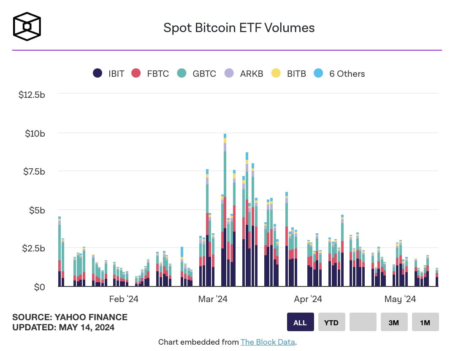

The Bitcoin spot ETF has taken center stage in the cryptocurrency landscape, especially with the recent fluctuations in market activity.Yesterday, Bitcoin ETF outflows amounted to $14.8983 million, prompting discussions about the overall stability and appeal of these investment vehicles.

Last week, Bitcoin spot ETFs made headlines with a significant net inflow of $70.05 million, signaling a positive turn following four weeks of losses.This shift in the Bitcoin ETF market trends underscores growing investor confidence, especially with major players such as the Fidelity Bitcoin ETF leading the charge, boasting an impressive weekly inflow of $230 million.

Bitcoin spot ETFs have become a focal point in the investment landscape, showcasing their potential to revolutionize how individuals and institutions invest in cryptocurrency.Recently, the total net inflow of Bitcoin spot ETFs reached an impressive $21.1228 million, signaling significant interest from investors.

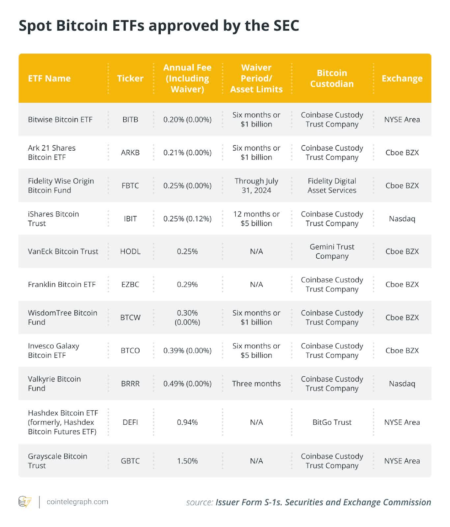

Nasdaq Bitcoin ETF options are set to undergo a significant transformation with a proposal that seeks to quadruple the trading limits for BlackRock’s iShares Bitcoin Trust (IBIT).This move not only emphasizes the growing interest in Bitcoin derivatives among institutional investors but also aligns these options with major equities like Apple and NVIDIA.

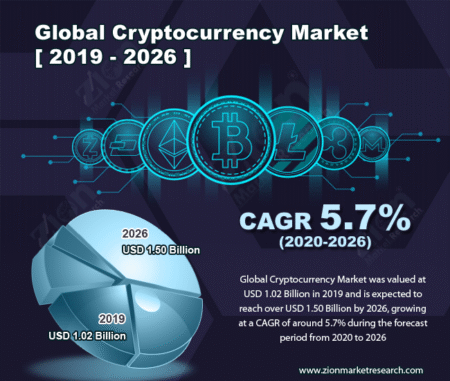

In the realm of cryptocurrency market analysis, understanding current trends and fluctuations is crucial for investors and traders alike.Recently, there has been a notable focus on the BTC price prediction and ETH analysis as both cryptocurrencies hover around significant price levels.

JPMorgan structured notes Bitcoin ETF has made waves in the investment community by introducing a unique financial product linked to BlackRock’s groundbreaking Bitcoin ETF.This structured investment offering is strategically aligned with Bitcoin’s four-year halving cycle, promising to capture the cryptocurrency’s price dynamics.

The emergence of the BlackRock Bitcoin ETF marks a significant milestone in the evolving landscape of cryptocurrency investments.Recently, Texas made headlines by committing $10 million to this groundbreaking fund, solidifying its position as the first U.S.