Browsing: Bitcoin price trends

Bitcoin market sentiment is showing signs of improvement as the new year unfolds, according to a recent chart released by Matrixport.This shift is illustrated by our self-developed “Greed and Fear Index,” which indicates a potential bottom formation—historically a reliable indicator of Bitcoin price trends nearing pivotal reversals.

Market analysis is critical in today’s ever-evolving financial landscape, especially as traders navigate through intricate data on Bitcoin price trends and Ethereum market signals.Understanding the underlying forces behind these cryptocurrencies is essential, as capital flows from ETFs and options volatility can greatly influence trading outcomes.

The Cathie Wood Bitcoin Cycle has captured the attention of investors and enthusiasts alike, particularly as the renowned founder of ARK Invest shares her bold predictions for the cryptocurrency.Wood suggests that the well-established four-year cycle of Bitcoin may soon be disrupted, possibly indicating that we have already witnessed the cryptocurrency’s lowest price point in this trend.

Bitcoin ETFs have become a hot topic in the investment world, particularly as recent data reveals a staggering outflow of $194.6 million, marking the highest returns in two weeks.This sharp decline raises questions about the behavior of institutional investors as they navigate the complexities of the Bitcoin market analysis.

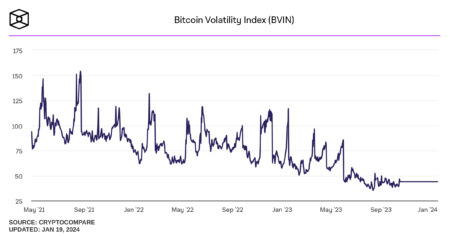

Bitcoin price volatility has become a hot topic among investors and analysts alike, as it often reflects the digital currency’s tumultuous nature.Recently, Bitcoin’s price experienced a staggering drop of about 36% from its historical high of $126,000, plunging below $81,000.

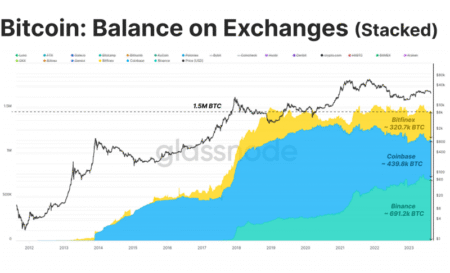

Bitcoin exchange balances have become a significant topic of discussion as they reveal key insights into market dynamics and investor behavior.Recent data from Matrixport indicates a persistent decline in the Bitcoin held on exchanges, a trend that often signals bullish price movements.

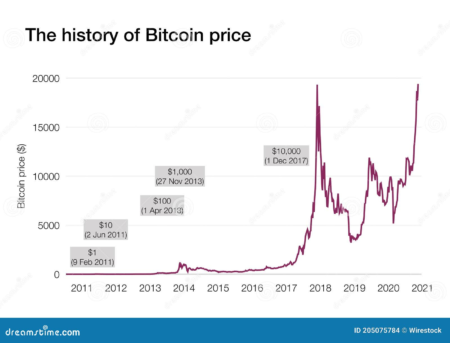

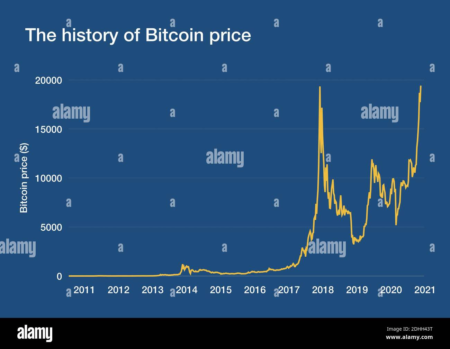

Bitcoin price trends have long been a focal point for investors keenly watching the shift of market dynamics.Notably, analysts like Negentropic from Glassnode have observed that when commodities such as copper, silver, and gold witness simultaneous price increases, it often signals positive momentum for Bitcoin, leading to enhanced altcoin performance and even bull market signals.

In recent Ethereum staking news, there has been a significant update regarding about 1.5 million ETH expected to exit staking by the end of December.This shift highlights the dynamic nature of ETH staking, especially amidst fluctuating Bitcoin price trends and recent discussions by Vitalik Buterin on related cryptocurrencies like Zcash.

In the evolving landscape of cryptocurrencies, Bitcoin market analysis is essential for understanding price movements and investor sentiment.Recently, Bitcoin has been hovering around the high $80,000 range, buoyed by a cautious optimism regarding future interest rate cuts, projected to reach an 85% probability in December.

Bitcoin price trends have been a focal point for investors as they navigate the unpredictable tides of the cryptocurrency market.Recent reports highlight a significant divergence in short-term perspectives, with bullish traders eyeing a breakthrough past the $90,000 mark, potentially even reaching $100,000.