Browsing: Bitcoin market value

Hyperscale Data Bitcoin Holdings have experienced a notable increase, with approximately 451.85 BTC now in reserve, supported by a robust investment of $34 million earmarked for future expansion.As of December 7, 2025, Hyperscale Data’s Bitcoin reserves amount to about $75 million, which astonishingly represents nearly 83% of the company’s overall market value.

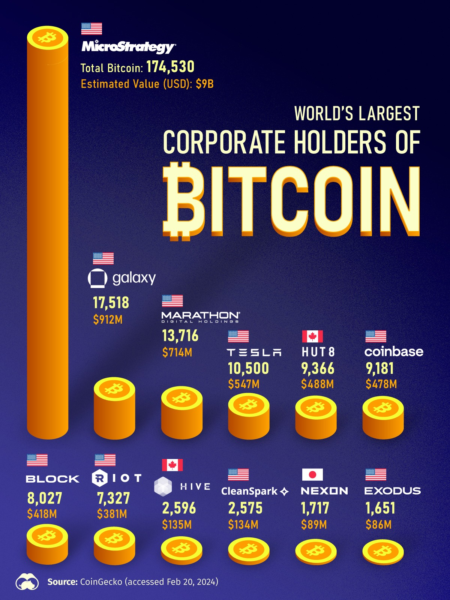

Publicly traded companies Bitcoin purchases have surged recently, reflecting a growing trend among corporations to integrate cryptocurrency into their financial strategies.Last week alone, these firms collectively acquired a staggering $968.89 million in Bitcoin, with MicroStrategy leading the charge by investing $962.70 million to add 10,624 bitcoins to their portfolio.

The Monochrome Spot Bitcoin ETF is making waves in Australia as it recently announced its impressive holdings of over 1,200 Bitcoins, reflecting a notable market value exceeding 170 million Australian dollars.This innovative fund, known for its robust approach to Bitcoin ETF holdings, provides investors with a unique opportunity to gain exposure to the burgeoning cryptocurrency market.

In the ever-evolving landscape of cryptocurrency, a prudent Bitcoin selling strategy has become essential for both investors and corporations looking to navigate the volatile market.Major players like Strategy, formerly MicroStrategy, are now adopting innovative tactics to manage their vast holdings, including a substantial reserve to safeguard against market fluctuations.

In a significant move within the Bitcoin purchasing landscape, companies have recently ramped up their investments in this leading cryptocurrency, with a total net purchase of $21.86 million reported by global publicly listed companies last week.Notably, Strategy, formerly known as MicroStrategy, spearheaded this trend by acquiring 130 bitcoins for $12 million, pushing its corporate Bitcoin holdings to an impressive total of 650,000 bitcoins.