Browsing: Bitcoin ETF outflows

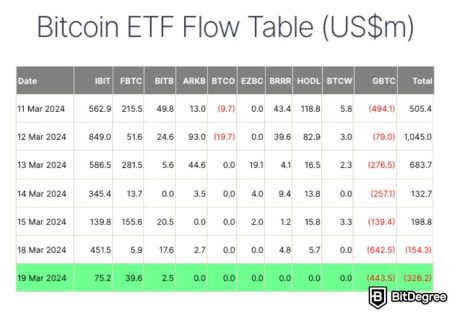

Bitcoin ETFs have been making headlines recently, particularly for their astonishing $1.1 billion in losses within just 72 hours.As the landscape of the cryptocurrency market shifts, these exchange-traded funds are grappling with unprecedented outflows that reflect the changing dynamics of Bitcoin investment strategies.

Bitcoin ETF outflows have surfaced, marking a notable shift following an explosive start to 2026.After drawing in more than $1.16 billion in net inflows during the first two trading days of the year, the latest data reveals a sudden exit of $243 million from Bitcoin exchange-traded funds.

Bitcoin ETFs have become a hot topic in the investment world, particularly as recent data reveals a staggering outflow of $194.6 million, marking the highest returns in two weeks.This sharp decline raises questions about the behavior of institutional investors as they navigate the complexities of the Bitcoin market analysis.

BlackRock Bitcoin ETF has made headlines recently as it grapples with five consecutive weeks of fund outflows, totaling over $2.7 billion.This unprecedented trend reflects a significant withdrawal of capital from the iShares Bitcoin Trust, causing many to question the sustained interest in cryptocurrency investment.

The Bitcoin spot ETF has taken center stage in the cryptocurrency landscape, especially with the recent fluctuations in market activity.Yesterday, Bitcoin ETF outflows amounted to $14.8983 million, prompting discussions about the overall stability and appeal of these investment vehicles.

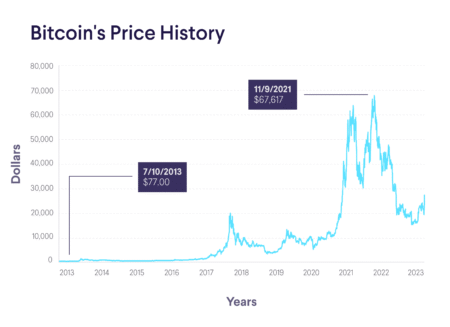

Bitcoin market volatility has become a significant focal point for investors as global economic conditions shift.Recently, as expectations of a rate hike by the Bank of Japan intensified, Bitcoin suffered a steep one-day price drop of over 6%.

Bitcoin price analysis reveals a recent bounce off the $85,000 mark, which places the cryptocurrency in a pivotal decision zone between $87,000 and $89,600.This narrow movement illustrates Bitcoin’s interaction with critical liquidity levels, with identified resistance around $92,800 to $93,400 and support structures leading down to $79,000.

Bitcoin ETFs have recently experienced one of their worst weeks, suffering extraordinary outflows amounting to $1.2 billion.This dramatic shift in the market comes as investors flee due to a significant Bitcoin price decline, which has plummeted almost 33% since its peak earlier this October.

Bitcoin ETF outflows Bitcoin is currently trading at $100,758.70, reflecting a decline of 0.8% as $1.2 billion in weekly ETF outflows exert downward pressure on the cryptocurrency. This situation has caused Bitcoin’s price to dip… (via Bpaynews real-time desk)

Bitcoin ETF outflows Bitcoin exchange-traded fund outflows have reached $1.2 billion, even as Wall Street increases its investments in cryptocurrency. This significant outflow highlights the ongoing volatility and uncertainty in the crypto market. Despite this… (via Bpaynews real-time desk)