SpaceX revenue continues to dominate headlines, especially with the company’s soaring valuation, now speculated to reach $800 billion as it eyes a potential IPO. Elon Musk has recently addressed these claims, clarifying that while the company enjoys substantial cash flow, NASA contracts represent a mere 5% of its overall earnings. The primary drivers of SpaceX’s financial success include the thriving Starlink service, which has emerged as a significant source of income, alongside contracts that showcase the company’s competitive advantages in the aerospace industry. As SpaceX moves towards an initial public offering, investors remain keen on understanding how elements like Starlink revenue and government contracts will impact the company’s long-term strategy and valuation. With such robust financial underpinnings, the anticipation surrounding SpaceX’s future is palpable, marking it as a formidable player in both the public and private sectors of space exploration.

The financial landscape of SpaceX has become a pivotal topic of discussion, particularly in relation to its impressive revenue streams and burgeoning market presence. In recent statements, Musk has highlighted the critical role of commercial projects, specifically Starlink, as essential contributors to the company’s financial health. With only a small fraction of income derived from government orders, it is crucial to reassess how private ventures are shaping SpaceX’s ability to innovate and grow. As plans for a public stock offering unfold, investors and observers alike are closely monitoring the interplay between SpaceX’s commercial success and its partnerships with entities like NASA. This dynamic is not only redefining the metrics of success for aerospace companies but is also setting the stage for a new era in space commerce.

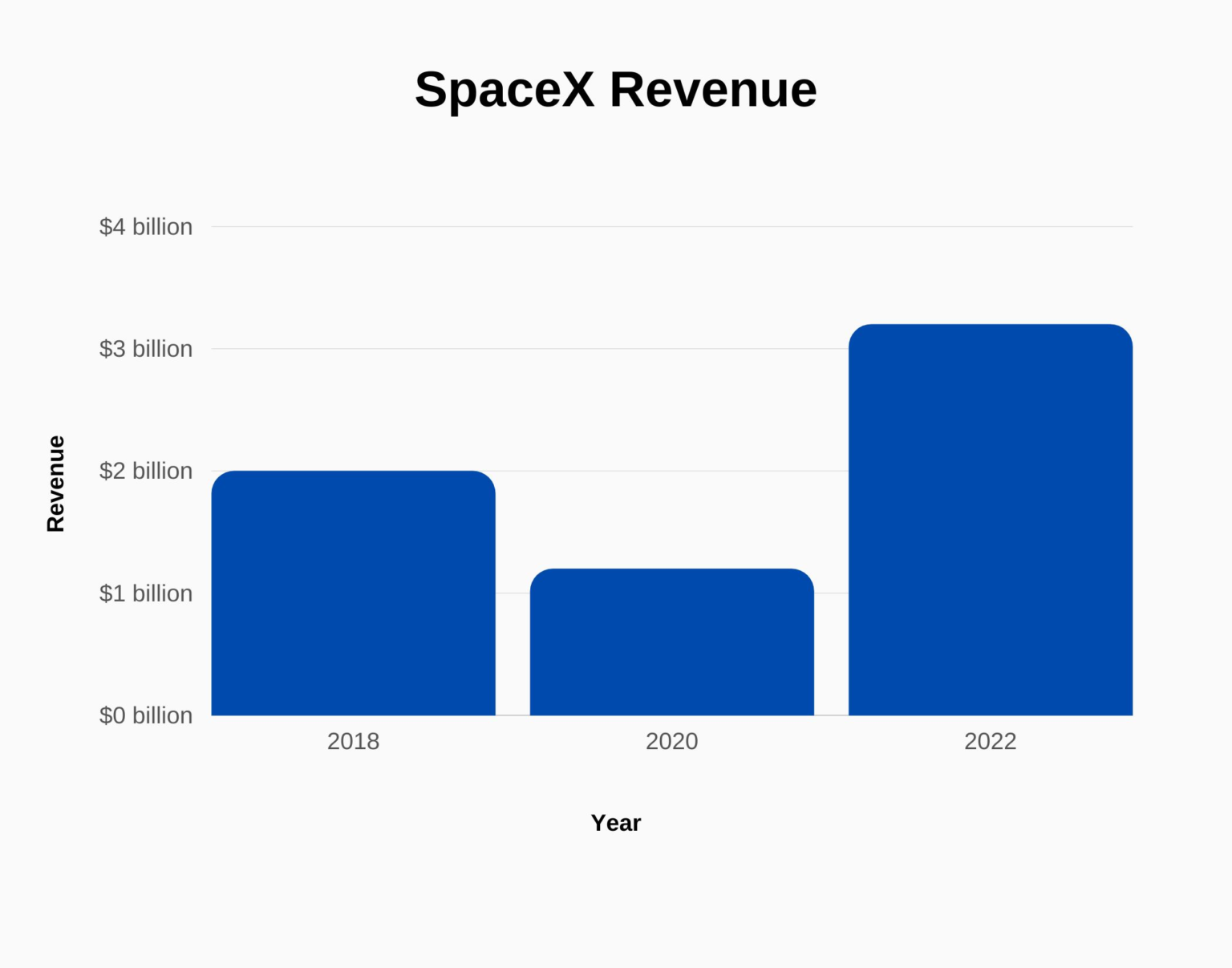

SpaceX Revenue Breakdown: Beyond NASA Contracts

SpaceX has developed a robust revenue model that significantly relies on its commercial ventures, particularly through its Starlink satellite internet service. Despite common misconceptions, the contribution of NASA contracts to SpaceX’s overall revenue is minimal, accounting for less than 5%. This showcases the effectiveness of SpaceX’s business model, which emphasizes a diverse revenue stream. The company’s continuous investment in innovative projects such as Starship has allowed SpaceX to carve out a substantial presence in the commercial space launch market.

The main source of revenue for SpaceX stems from commercial spaceflight operations and satellite communications. As Musk pointed out, Starlink has emerged as the leading revenue generator for the company, highlighting the growing demand for reliable internet connectivity worldwide. The surge in Starlink subscriptions aligns with the increasing need for broadband services in remote and underserved communities, ensuring that SpaceX maintains a competitive advantage in the sector.

Elon Musk’s Vision: The Future of SpaceX

Elon Musk’s insights into SpaceX’s operations provide a glimpse into the ambitious vision that drives the company forward. His comments regarding SpaceX’s valuation and its IPO plans indicate strong confidence in the company’s trajectory. Musk emphasizes the importance of product innovation and cost-effective solutions as key to attracting both commercial clients and governmental contracts. The commitment to excellence in service and technology has not only enhanced SpaceX’s credibility but has also positioned it favorably in discussions about the future of commercial space travel.

Musk has been proactive in addressing speculation surrounding SpaceX’s funding and operational strategies. By clarifying misconceptions regarding the influence of NASA contracts and emphasizing the real drivers of revenue, Musk reaffirms his strategy of building a sustainable company. The IPO plans for the latter half of next year may further propel SpaceX into the limelight, attracting increased investor interest and solidifying its status as a leading entity in the aerospace industry.

The Impact of Starlink on SpaceX Valuation

Starlink has played an instrumental role in boosting SpaceX’s valuation, leading to speculation about the potential for an IPO. With millions of users worldwide, Starlink has emerged as a significant player in the telecommunications landscape, offering high-speed internet where traditional providers cannot reach. This revenue stream has not only helped in covering operational costs but has also positioned SpaceX to reinvest in further projects, enhancing its overall valuation.

Moreover, as Starlink continues to expand its services, its financial impact on SpaceX will only grow. The promise of improved connectivity for both urban and rural areas has attracted widespread attention and investment. This expansion aligns with Musk’s vision of providing internet access globally, further justifying the projected valuation and potential IPO, as Starlink’s success paves the way for other ambitious projects.

Understanding SpaceX’s Competitive Edge

One of the critical factors behind SpaceX’s competitive edge is its ability to deliver high-quality products at competitive prices. Musk has echoed statements supporting the notion that SpaceX secured NASA contracts by offering the best products at the lowest prices. This philosophy not only resonates with governmental clients but also with commercial partners seeking reliable launch services. The capacity to provide services that meet stringent safety standards is further evidence of SpaceX’s capability.

Through innovation and efficiency, SpaceX has set high standards in the aerospace industry that competitors must strive to meet. The company’s technological advancements, such as the reusable Falcon rockets and the developing Starship transport system, are pivotal to maintaining its market leadership while driving down costs, further widening its competitive advantage. Such strategic foresight places SpaceX in a unique position as it navigates through various opportunities, including partnerships and contracts in emerging markets.

Strategic Partnerships and NASA Contracts

SpaceX has established strategic partnerships that have been key to its success, including its collaborations with NASA. While some critics argue that SpaceX’s achievements are a result of government subsidies, Musk firmly states that the NASA contracts were earned through competitive bidding, reflecting their superior capabilities. This acknowledgment of merit reinforces the credibility of SpaceX’s operations and its standing in the aerospace sector.

Additionally, this relationship with NASA has solidified SpaceX’s reputation as a reliable partner for space missions, a necessary factor for any company looking to sustain long-term success in the industry. The ongoing collaboration illustrates how government partnerships can drive profitable innovation, ensuring that SpaceX remains at the forefront of developments in space exploration. The continued success of such contracts supports Musk’s broader ambitions for his company and the space industry as a whole.

The Role of Starship in SpaceX’s Growth

Starship embodies the future of space exploration, representing SpaceX’s ambitions to facilitate missions to Mars and beyond. As the next-generation spacecraft, its successful testing is crucial for enhancing SpaceX’s capabilities and expanding potential revenue streams. With Elon Musk at the helm, underlining the strategic importance of Starship, it is clear that the vehicle will not only contribute to SpaceX’s valuation but also redefine humanity’s relationship with space.

As SpaceX continues its development of Starship, the implications for economic growth are significant. The spacecraft’s potential for interplanetary travel opens doors for unprecedented commercial opportunities, including space tourism and off-world colonization. Musk’s vision for Starship aligns with long-term growth and profitability goals, indicating that SpaceX is not just focused on near-term financial gains but is also strategically planning for the future of humanity’s presence in space.

Navigating the Challenges of Space Exploration

The path to commercializing space travel is fraught with challenges, and SpaceX is no stranger to these hurdles. From technical difficulties faced during the development of its rockets to regulatory hurdles when launching new services like Starlink, the company has navigated numerous obstacles. Elon Musk’s leadership style, centered around rapid iteration and problem-solving, has proven effective in maintaining momentum despite setbacks, and this adaptability is crucial for long-term success.

Furthermore, challenges such as competition with other space companies and fluctuating government policies present ongoing hurdles for SpaceX. Nonetheless, Musk has consistently embraced these challenges as opportunities for growth. SpaceX’s focus on innovation and cost efficiency enables it not only to sustain its operations through turbulent phases but also to emerge stronger each time, continually reinforcing its position as a leader in the aerospace industry.

The Road Ahead: Future IPO Plans

The speculation surrounding SpaceX’s IPO plans highlights investor interest and the anticipation of new capital inflows. Musk’s hints about the potential timing for an IPO in the second half of next year signify strong confidence in the company’s continued growth and profitability. As the business evolves, an IPO could provide the necessary resources to scale operations further and pursue new ventures, solidifying SpaceX’s role in shaping the future of space travel.

Moreover, an IPO would not only enhance SpaceX’s financial capabilities but also allow it to attract a broader base of investors. This increased visibility in the stock market could correspondingly boost its valuation, particularly if Starlink and other commercial projects continue to thrive. As the aerospace landscape transforms, SpaceX’s IPO plans will likely play a critical role in its strategic vision, fostering innovation, and ensuring that it remains at the forefront of the industry.

Frequently Asked Questions

What is the current revenue structure of SpaceX and how does NASA impact it?

SpaceX’s revenue is primarily driven by commercial ventures, with NASA contracts accounting for less than 5% of its total revenue. The company has been able to maintain positive cash flow over the years through its various commercial initiatives, especially through the revenue generated from Starlink.

How does Starlink revenue contribute to SpaceX’s overall valuation?

Starlink revenue plays a crucial role in SpaceX’s overall financial health, becoming the company’s largest revenue contributor. This influx from Starlink has significantly bolstered SpaceX’s valuation and its ability to innovate and expand into new markets.

What did Elon Musk say regarding the valuation of SpaceX at $800 billion?

Elon Musk clarified that reports about SpaceX aiming for an $800 billion valuation to fund an IPO do not accurately reflect the company’s financial strategy. Instead, Musk emphasized that SpaceX has consistently maintained a positive cash flow and that its valuation is tied to advancements in projects like Starship and Starlink.

Are there any SpaceX IPO plans and how might they affect future revenue?

While there are discussions about potential IPO plans for SpaceX, Elon Musk stated that the company has maintained a healthy cash flow without relying on an IPO for immediate revenue needs. The focus remains on growing revenue from existing operations, particularly through Starlink.

How does SpaceX’s valuation compare with its revenue from NASA and commercial projects?

SpaceX’s valuation reflects its growth potential from commercial projects, especially Starlink, which stands in contrast to its minimal revenue from NASA contracts, which make up only about 5%. This discrepancy highlights SpaceX’s strong position in the commercial market.

| Key Point | Details |

|---|---|

| Valuation Clarification | SpaceX is not planning to sell shares at an $800 billion valuation despite media reports. |

| Revenue Sources | NASA orders will account for less than 5% of SpaceX’s revenue next year. |

| Positive Cash Flow | SpaceX has maintained positive cash flow for years, regularly repurchasing shares for liquidity. |

| Main Revenue Driver | Commercial Starlink is the largest revenue contributor for SpaceX. |

| Myth of Subsidies | Claims that SpaceX receives subsidies from NASA are false. |

| Competitive Advantage | SpaceX has the best product at the lowest price for its launches. |

Summary

SpaceX revenue is a testament to the company’s innovative capabilities and strategic market positioning. Despite rumors of selling shares at an $800 billion valuation, Elon Musk has clarified that a small portion of their revenue stems from NASA contracts, highlighting the strength of SpaceX’s commercial ventures, especially Starlink. The company has proven its financial stability with continuous positive cash flow, rebutting any claims of dependency on NASA subsidies. As SpaceX continues to expand its market reach, its revenue trajectory appears promising.