Japan’s SBI Leads RWA Stock Push: Pioneering a Regulated On-Chain Market

In an innovative move towards integrating traditional finance with modern blockchain technology, Japan’s SBI Holdings has taken a significant step forward by leading the push towards tokenizing real-world assets (RWAs) on the blockchain. This venture not only heralds a new era for financial markets but also sets a precedent for regulated on-chain transactions, offering a blend of security, transparency, and efficiency.

Key Takeaways

Bridging Traditional Finance and Blockchain Technology

SBI Holdings, a financial giant in Japan, has always been at the forefront of adopting and integrating new technologies to enhance financial services. Their latest initiative involves the utilization of blockchain technology to create a regulated market for tokenized real-world assets. These assets range from stocks and bonds to real estate and even fine art, encompassing any tangible or intangible asset that has value.

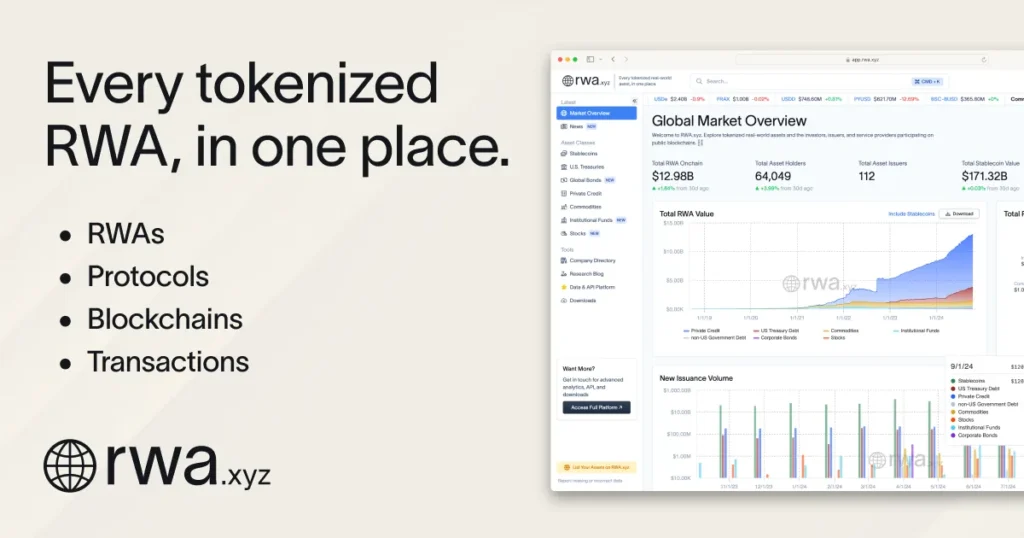

The concept of tokenizing such assets involves the issuance of digital tokens that represent ownership or a stake in the underlying real-world asset. These tokens then can be traded, sold, or bought on digital platforms, utilizing blockchain technology for transactions. This not only ensures the immutability and transparency of records but also significantly reduces transaction times, thereby increasing efficiency.

Regulatory Framework and Market Confidence

One of the key aspects of SBI’s strategy is the establishment of a robust regulatory framework that aligns with global financial regulations. By working closely with Japanese financial regulators, SBI aims to ensure that the market for tokenized real-world assets adheres to the stringent measures that govern traditional financial systems. This is crucial in maintaining investor confidence and ensuring the stability of the financial system.

The regulated on-chain market proposed by SBI will operate under compliance guidelines that manage anti-money laundering (AML) policies, know your customer (KYC) norms, and other regulatory requirements. This compliance is integral in making the platform trustworthy and in protecting against financial crimes, thus making it a viable alternative to conventional financial markets.

Technological Implementation and Future Prospects

SBI’s platform leverages blockchain’s distributed ledger technology to facilitate the seamless transfer and verification of ownership of tokenized assets. The use of smart contracts automates various processes involved in the transfer of assets, including compliance checks and transaction settlements. Moreover, blockchain technology ensures that all transactions are securely logged, making them easily verifiable and free from tampering.

Looking ahead, the potential for tokenizing real-world assets on a regulated blockchain platform is vast. It not only democratizes access to investment opportunities but also opens up new avenues for liquidity in markets that were previously considered illiquid. For instance, real estate, traditionally a highly illiquid asset class, can achieve increased liquidity if fractional ownership through tokens is facilitated.

Impact on Global Markets

As Japan’s SBI Holdings continues to pioneer this innovative approach, the implications for global financial markets could be profound. If successful, this model may encourage other financial institutions across the world to explore similar implementations, leading to a more interconnected and harmonized global financial ecosystem. This would also encourage innovation in other areas of fintech, potentially leading to more efficient and inclusive financial services worldwide.

Conclusion

With SBI’s move to spearhead the tokenization of real-world assets and the creation of a regulated on-chain market, the convergence of traditional finance and blockchain technology is set to accelerate. As the regulatory and technological landscape continues to evolve, the initiative by SBI could well be looked back upon as a pivotal moment in the transformation of global financial services. More than ever, the fusion of these sectors promises to reshape investment landscapes and broaden access to capital in unprecedented ways.