OKX Launches CeDeFi Trading Platform, Bridging Centralized and Decentralized Exchanges

Key Takeaways

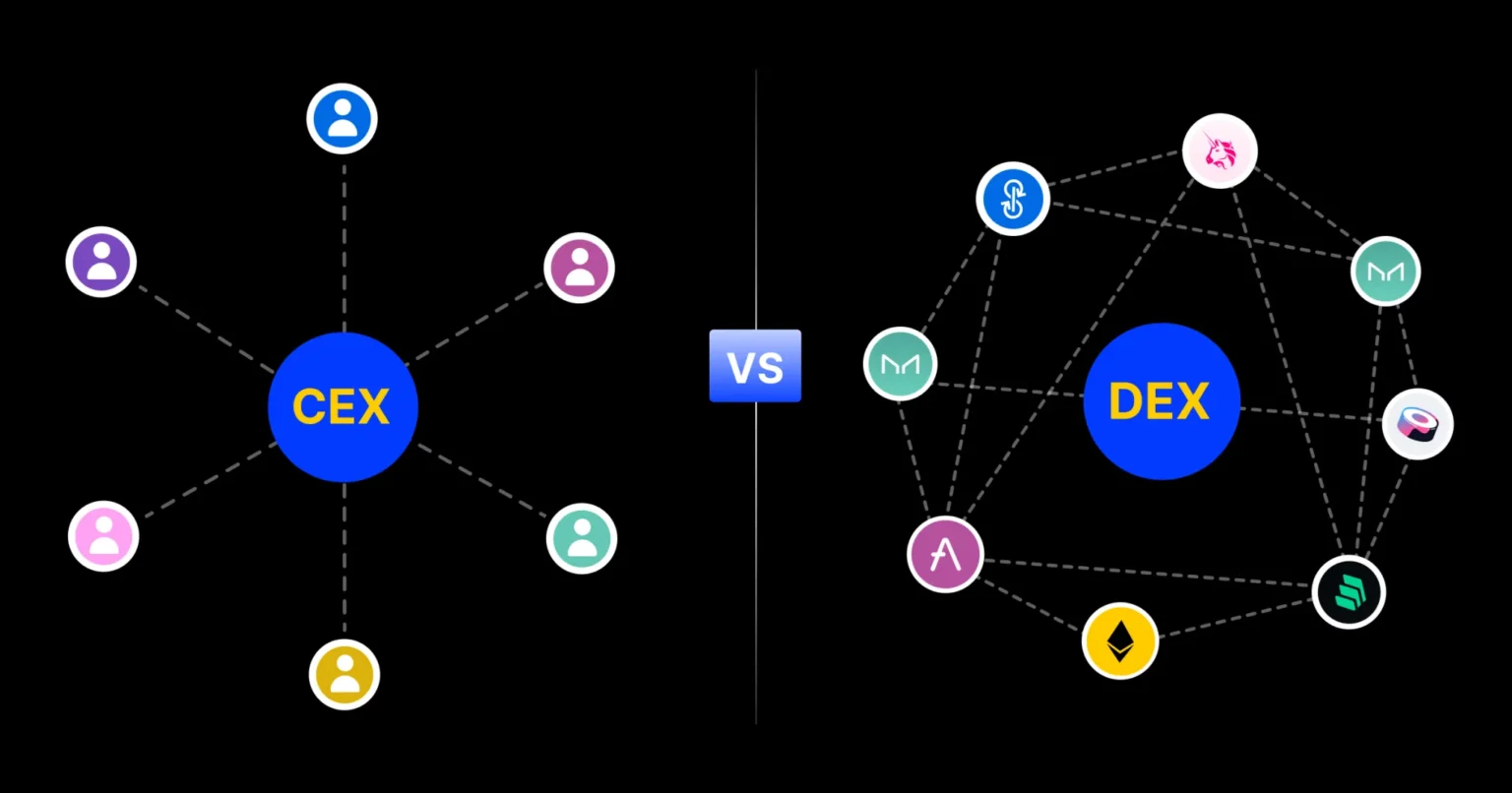

In a significant move that blurs the boundaries between centralized (CEX) and decentralized (DEX) crypto exchanges, OKX, a leading player in the cryptocurrency space, has announced the launch of a breakthrough CeDeFi trading platform. This innovative step is set to redefine the trading landscape by offering a hybrid model that combines the best elements of both worlds, thus enhancing user experience and broadening market access.

Understanding CeDeFi

Before delving into OKX’s new venture, it’s pivotal to understand what CeDeFi is. CeDeFi, or Centralized Decentralized Finance, is an emerging concept in the cryptocurrency arena. It blends the user-friendly features and regulatory assurance of centralized finance (CeFi) with the flexibility and autonomous trading protocols of decentralized finance (DeFi). Essentially, CeDeFi aims to mitigate the limitations of purely centralized exchanges and purely decentralized models by providing a balanced ecosystem.

OKX’s Role in CeDeFi

OKX has been at the forefront of innovation in the cryptocurrency markets, and its latest initiative marks another milestone. The CeDeFi platform by OKX is designed to provide traders with seamless access to both CEX and DEX markets through a single interface. This integration means that traders can enjoy the liquidity, speed, and user-friendly experience of centralized platforms while leveraging the trustless, permissionless, and transparent nature of decentralized platforms.

Key Features of OKX CeDeFi Trading

-

Enhanced Liquidity and Lower Slippage: By aggregating liquidity from both CEX and DEX pools, OKX aims to lower slippage rates for its users, making large trades more viable and less costly.

-

Unified Interface: Users no longer need to manage multiple wallets or navigate through different platforms. OKX’s single, unified interface allows direct interactions with both centralized and decentralized ecosystems, simplifying the trading process.

-

Robust Security Framework: Security is paramount in the hybrid CeDeFi approach. OKX incorporates the stringent security measures of CEXs with the non-custodial perks of DEXs, intending to protect user assets against hacks and frauds.

- Regulatory Compliance: Operating in a regulated framework, OKX’s CeDeFi platform adheres to regulatory requirements, bringing a level of security and compliance that purely decentralized platforms may lack.

The Future of Trading with OKX CeDeFi

The launch of the CeDeFi platform by OKX is not merely a technological evolution; it’s a strategic move that could alter the dynamics of cryptocurrency trading. For everyday users, the platform promises to deliver simplicity and efficiency, reducing the technical barriers associated with DEXs and the trust hurdles linked with CEXs.

Moreover, by fostering a regulated yet flexible trading environment, OKX is positioning itself to appeal to a broader range of traders, including institutional participants who may have been hesitant about diving into the DEX market due to concerns over liquidity and regulatory oversight.

Conclusion

With this bold step into CeDeFi, OKX is paving the way for a future where the benefits of both centralized and decentralized exchanges are accessible under one roof. This could not only spur innovation in the trading of digital assets but could also trigger greater adoption by ensuring more secure, transparent, and efficient trading experiences.

As the crypto world continues to evolve, it remains to be seen how the market will respond to this new hybrid model. However, one thing is clear: initiatives like these are crucial for the sustained growth and maturation of the cryptocurrency markets, potentially leading to more inclusive and expansive financial systems worldwide.