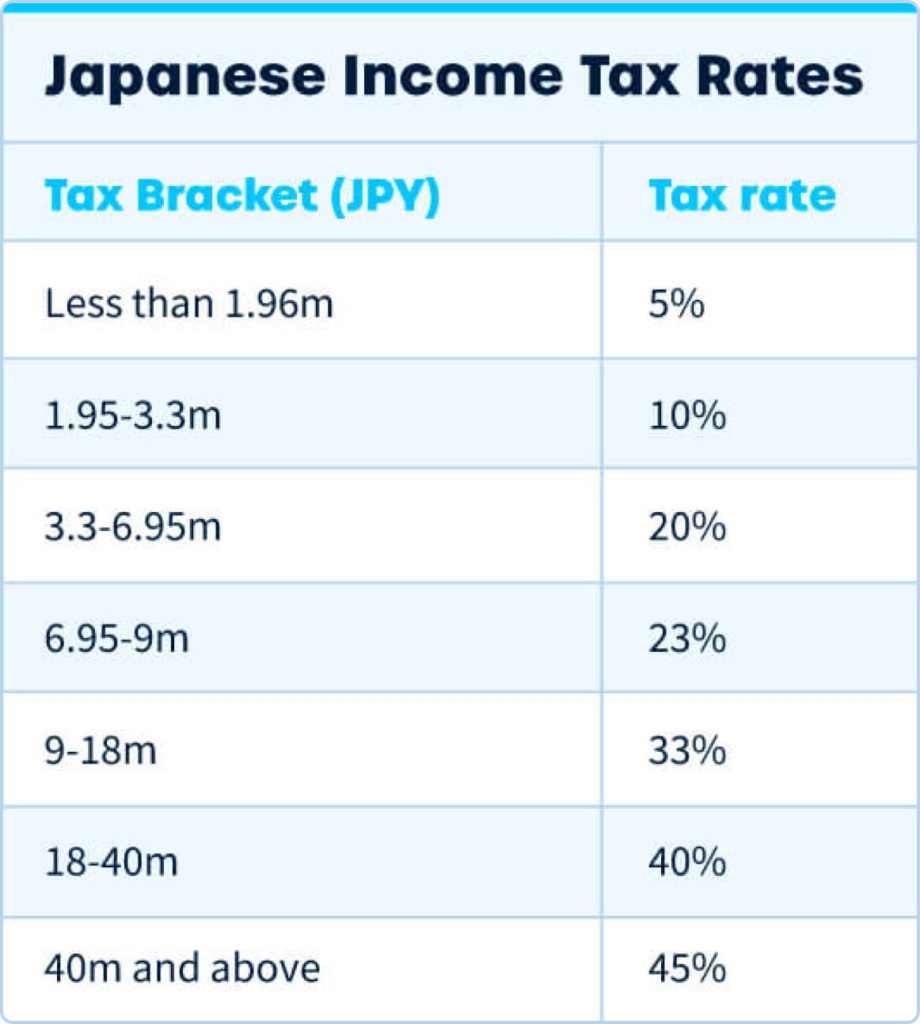

The Japanese cryptocurrency tax rate has been a contentious issue, as the government considers significant reforms to enhance the nation’s blockchain industry. Currently, cryptocurrency earnings are subject to a staggering progressive tax rate that can reach up to 55%, a figure that many believe stifles growth and innovation in the sector. The proposed changes by the Financial Services Agency Japan aim to simplify this landscape by introducing a flat tax rate of 20%, aligning crypto taxes with those on traditional financial products like stocks. This in-depth reform is expected to not only alleviate burdens on investors but also promote greater transparency and protection for participants in the cryptocurrency market. With the Diet slated to review these proposals in early 2026, the future of cryptocurrency tax Japan looks poised for transformative change, promising to attract new investment and foster a thriving economy in this emerging sector.

In recent discussions surrounding tax policies in Japan, the dialogue around cryptocurrency taxation has gained momentum. Various stakeholders are considering adjustments to how earnings from digital currencies are taxed, shifting from a complicated progressive system to a more straightforward flat rate. The anticipated tax reforms aim to balance the need for government revenue with the growth potential of the crypto market. Supporters of these changes argue that a simplified tax approach could invigorate the local blockchain ecosystem and facilitate more robust investor engagement. As Japan navigates these reforms, the implications for both individual investors and the broader cryptocurrency landscape remain a focal point of interest.

Understanding Japan’s Cryptocurrency Tax Reform

The Japanese government is poised to enact significant changes to its taxation policies regarding cryptocurrency transactions and earnings. With a proposal to unify the tax rate on crypto earnings at a flat 20%, these new policies signal a major shift in approach from the current progressive tax structure that can reach as high as 55%. This transition to a more favorable tax environment aligns Japan with other major economies where tax rates on cryptocurrencies tend to be more stable and inviting for investors. By proposing this change, the Financial Services Agency Japan is actively working towards fostering a more robust cryptocurrency market in Japan.

As part of the larger discussions around Japan’s tax reform, the proposed modifications reflect growing recognition of the importance of the blockchain industry. In particular, the Japan Blockchain Association (JBA) has been at the forefront of advocating for these reforms, highlighting how high tax burdens have stifled innovation and investment in the domestic crypto sector. The move towards a flat tax rate is expected to not only streamline compliance for individuals and businesses but also to enhance Japan’s competitiveness in the global cryptocurrency market.

The Impact of Unified Tax Rates on Crypto Earnings

Implementing a unified tax rate of 20% on cryptocurrency earnings could significantly impact how investors and businesses engage with digital currencies in Japan. By lowering the tax burden, the new policy is expected to encourage more people to invest in cryptocurrencies, fostering a vibrant and diverse blockchain ecosystem. As the tax landscape evolves, it could attract foreign investments and innovative projects into the Japanese market, ultimately supporting the growth of the local economy.

Furthermore, lowering the tax rate aligns with the global trend of regulating cryptocurrencies in a way that strikes a balance between investor protection and market growth. With Japan positioning itself as a leader in the space, upcoming policies should encompass not just tax reform but also security measures such as issuing guidelines on trading practices. This holistic approach could enhance trust in the market while simultaneously nurturing the burgeoning crypto economy.

Regulatory Measures Alongside Tax Changes

The proposed tax reform from the Japanese government won’t occur in isolation; it comes alongside the introduction of stricter regulations aimed at protecting investors. As part of the initiative to make cryptocurrency trading safer, the Financial Services Agency is set to implement comprehensive measures that include a ban on trading with non-public information and reinforced disclosure requirements for crypto exchanges. These regulatory enhancements are designed to build confidence among investors, ensuring that the crypto market develops on a solid foundation of trust.

As Japan navigates these changes, it is crucial to strike a balance between regulation and innovation. While the regulatory framework aims to mitigate risks associated with cryptocurrency trading, it must not stifle the growth of the blockchain industry Japan has been eager to cultivate. Thoughtfully tailored regulations, paired with attractive tax rates, can entice established players and new entrants alike, ultimately benefitting the economy and potentially making Japan a global hub for cryptocurrency activity.

Future Prospects of Japan’s Cryptocurrency Market

Looking ahead, Japan’s cryptocurrency market stands at a crossroads, with substantial reforms on the horizon. The move to a 20% flat tax rate and the introduction of investor protection regulations represent a turning point for the industry. These changes are likely to enhance the business environment for crypto companies and improve the attractiveness of Japan as a destination for blockchain development. With the upcoming proposals expected to be debated in the Diet, the direction taken by lawmakers will be pivotal in shaping the future landscape of cryptocurrency in Japan.

Moreover, as other nations also grapple with cryptocurrency regulation, Japan has the opportunity to set a precedent that could influence policy discussions globally. By establishing a supportive regulatory framework, Japan could lead the way in championing cryptocurrencies and blockchain technology, fostering innovation, and encouraging a new generation of tech entrepreneurs. The actions taken now will not only affect the domestic market but could also contribute to Japan’s standing on the international stage as a pioneering force in the world of digital assets.

Navigating Investor Sentiment in Cryptocurrency Tax Policy

As Japan moves closer to finalizing its new cryptocurrency tax policy, understanding investor sentiment becomes critical. Tax burdens are a significant consideration for investors when entering the cryptocurrency market, and the prospect of a lower, unified tax rate of 20% could lead to renewed interest and investment in the sector. Stakeholder feedback from the Japan Blockchain Association and other industry players emphasizes the importance of aligning tax policies with global standards to attract both domestic and international investors.

Moreover, investor sentiment is closely tied to perceptions of regulatory fairness and clarity. Clear communication and transparency from the Financial Services Agency about how the new tax rate and regulations will be implemented will play a crucial role in shaping confidence among investors. Ensuring that these changes are communicated effectively will be necessary to alleviate concerns and encourage a positive response from the market as Japan transitions to a more favorable investment environment.

Strategies for Compliance With New Tax Regulations

With Japan’s impending tax reforms, it is essential for individuals and businesses engaged in cryptocurrency to prepare for compliance with the new regulations. Understanding the details of how the 20% tax will apply to various forms of crypto income—such as trading gains, staking rewards, and other forms of revenue—is vital for informed financial planning. Investors must familiarize themselves with the reporting requirements that come with the simplified tax regime to avoid potential pitfalls.

Additionally, adopting proactive compliance strategies can help mitigate any risks associated with the transitional period of new regulations. Engaging with tax professionals who specialize in cryptocurrency will provide essential insights into navigating the complexities of reporting and compliance. As the Japanese government finalizes the details of its tax framework, developing a comprehensive understanding will be crucial for all stakeholders in the cryptocurrency market.

Global Comparisons: Cryptocurrency Tax in Other Countries

To better appreciate Japan’s cryptocurrency tax reforms, it is beneficial to look at how other countries are approaching this emerging financial domain. For instance, countries like Malta and Portugal have implemented favorable tax regulations surrounding cryptocurrency, promoting themselves as crypto-friendly jurisdictions. This creates a competitive landscape where nations vie to attract blockchain technology and investment, often adjusting their policies to cater to the evolving market.

By benchmarking against global standards, Japan can refine its regulatory approach to foster innovation while ensuring adequate revenue collection. These comparisons will help Japanese lawmakers understand best practices and pitfalls from other jurisdictions, allowing them to craft a comprehensive and competitive tax framework that supports the growth of the cryptocurrency industry in Japan.

The Role of Financial Services Agency in Crypto Taxation

As Japan contemplates its cryptocurrency tax reforms, the role of the Financial Services Agency (FSA) cannot be overstated. The FSA is not only responsible for overseeing financial markets but also plays a pivotal role in shaping the regulatory framework for the burgeoning cryptocurrency sector. By advocating for a unified 20% tax rate, the agency demonstrates its commitment to creating a more favorable environment for crypto investors and operators.

Furthermore, the FSA’s involvement extends beyond taxation to include comprehensive regulations that enhance investor protection and market integrity. As the agency prepares to introduce reforms, its leadership will be crucial in fostering cooperation between the government and the cryptocurrency industry. By engaging with stakeholders across the blockchain ecosystem, the FSA can better tailor policies that align with both regulatory objectives and market needs, ensuring sustainable growth for Japan’s crypto landscape.

Anticipating the Next Steps in Japan’s Crypto Regulation

As proposals for tax reform and regulatory changes progress, stakeholders in the Japanese cryptocurrency market eagerly anticipate the next steps. The upcoming discussions in the Diet are expected to address a variety of issues that affect the industry, from taxation to investor protections and the role of blockchain technology in the economy. As the government seeks to finalize these proposals, stakeholder engagement will be key, ensuring diverse voices are heard to shape a well-rounded policy.

Looking ahead, the successful implementation of these reforms will depend on how effectively the government communicates and enforces new regulations. It is essential to build a framework that not only provides clarity for compliance but also fosters innovation in the blockchain sector. The next steps taken will be foundational for establishing Japan as a leading player in the global cryptocurrency market, impacting how both local and international investors view opportunities within the country.

Frequently Asked Questions

What is the current cryptocurrency tax rate in Japan?

Currently, the cryptocurrency tax rate in Japan can be as high as 55% for earnings, which is part of a progressive tax system. However, the Japanese government is proposing a new unified tax rate of 20% for cryptocurrency earnings to be on par with financial products like stocks.

How will the proposed Japan tax reform affect cryptocurrency investors?

The proposed Japan tax reform aims to lower the cryptocurrency tax rate to 20%, which could significantly reduce the tax burden on investors and encourage growth in the blockchain industry in Japan. This reform is set to be discussed by the Diet in 2026.

What are the implications of the flat 20% crypto earnings tax in Japan?

Implementing a flat 20% crypto earnings tax in Japan is expected to stimulate the cryptocurrency market, attract more investors, and align Japan’s tax structure with other financial products, fostering a healthier blockchain industry.

When will the new cryptocurrency tax rate be submitted for deliberation in Japan?

The proposal for a new cryptocurrency tax rate of 20% is scheduled to be submitted to the Diet by the Financial Services Agency in early 2026, as part of an effort to reform the current taxation of crypto earnings.

How does the Financial Services Agency Japan plan to support cryptocurrency investors?

The Financial Services Agency Japan plans to support cryptocurrency investors by introducing a lower tax rate of 20% on crypto earnings and enforcing stricter investor protection measures, aimed at improving market integrity and fostering a safe trading environment.

What has the Japan Blockchain Association said about cryptocurrency taxes?

The Japan Blockchain Association has been advocating for reforms to cryptocurrency taxation, highlighting that the current high tax rates inhibit the development of the blockchain industry in Japan. They support the proposed reduction to a flat 20% rate.

What changes to investor protection will accompany the new cryptocurrency tax reforms in Japan?

Alongside the new cryptocurrency tax rate of 20%, the reforms will include enhanced investor protection measures such as a ban on trading using non-public information and stricter disclosure regulations to ensure market integrity.

| Key Points | Details |

|---|---|

| Current Tax Rate | 55% progressive rate on cryptocurrency earnings |

| Proposed Tax Rate | Flat rate of 20% for cryptocurrency earnings |

| Policy Proposal Date | Scheduled for submission to the Diet in early 2026 |

| Advocacy | Japan Blockchain Association has been advocating for tax reform to boost the cryptocurrency industry for three years |

| Additional Measures | Expected implementation of stricter investor protection measures |

Summary

The Japanese cryptocurrency tax rate is set for significant reform, as the government moves to lower the current tax rate to a flat 20%. This change aims to stimulate growth within the cryptocurrency sector while implementing investor protections. With the proposal expected to be presented to the Diet in early 2026, the new framework reflects Japan’s commitment to creating a more favorable environment for cryptocurrency investments.

Related: More from Regulation & Policy | Anthropic Founder Critiques Pentagons Choice as Unprecedented in Crypto Regulation | UK Gambling Regulator Examines Cryptocurrencies for Licensed Bettors in Crypto Regulation