Is Crypto Officially in a Bear Market? A Technical Analysis Perspective

Key Takeaways

The ebbs and flows of the cryptocurrency market have been a topic of intensive scrutiny and excitement over the past few years, marked by meteoric rises and precipitous drops. As of late, the digital currency landscape seems to have entered a chilly season, prompting investors and traders to ask: Is crypto officially in a bear market? Let’s delve into a technical analysis to unravel this query.

Peaks and Troughs: Understanding the Market’s Momentum

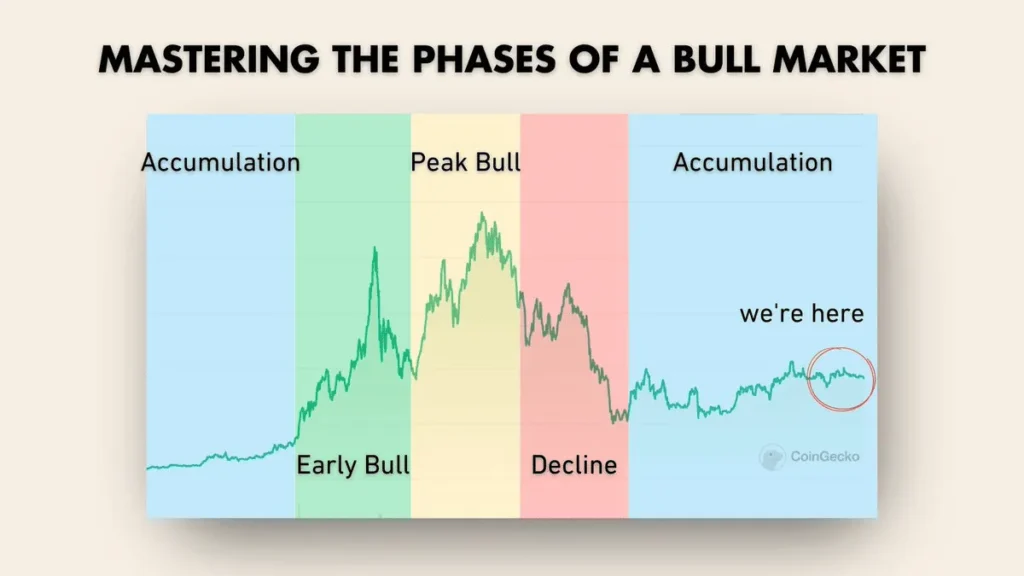

Crypto markets, much like their traditional counterparts, go through cycles of bull and bear markets. A bear market is typically characterized by a sustained period where prices fall 20% or more from recent highs, accompanied by widespread pessimism and negative investor sentiment.

Current Market Conditions

As of the latest metrics, significant cryptocurrencies like Bitcoin, Ethereum, and others have witnessed sharp declines from their all-time highs. Bitcoin, for instance, having soared above $60,000 per unit in November 2021, has seen values plummeting by more than 50% in subsequent months.

Several factors contribute to this downturn:

-

Regulatory Headwinds: Increased scrutiny and tighter regulations by governmental bodies across the globe continue to cast large shadows.

-

Macro-economic Conditions: Wider economic factors such as inflation rates, changes in monetary policy by central banks, and geopolitical tensions also play critical roles.

- Technological Setbacks and Platform Failures: Issues like the collapse of certain blockchain projects or hacking incidents have led to reduced confidence.

Technical Analysis: Indicators and Patterns

Technical Analysis (TA) involves the study of historical price and volume data to predict future market movements. Here are some key TA concepts that point towards a bear market in crypto:

-

Moving Averages: Long-term moving averages such as the 200-day moving average are crucial determinants. For many cryptos, prices have not only dropped below daily moving averages but have also struggled to rise above these levels, confirming a bearish trend.

-

Relative Strength Index (RSI): The RSI levels for many cryptocurrencies have remained below 50, often plunging into oversold territories during sell-offs, indicating a bearish momentum.

-

Market Structure: On higher time frame charts, the formation of lower highs and lower lows is a classic sign of a downtrend.

- Resistance Levels: There’s difficulty in breaking through key resistance levels during corrective rallies, implying sustained selling pressure.

Psychological and Sentimental Factors

The psychological element of market participants plays a significant role. The fear and greed index, a popular indicator, has been showing extreme fear for some time now. Historically, if this sentiment prevails, it indicates that a bottom might not be too far off—but it also emphasizes the bearish grip on the market.

Future Outlook: Is There Light at the Tunnel’s End?

While technicals are currently bearish, it’s important to recall that markets are cyclical. Factors such as the adoption of cryptocurrencies, technological advancements, and integration into the financial ecosystem could potentially lead to a reversal. However, as per strict technical analysis, the bearish trends seem to hold strong presently.

Conclusion

In conclusion, from a technical standpoint, the crypto market appears deeply entrenched in a bear phase. However, as all seasoned traders and investors know, the key is in the adaptability and vigilance. Markets inevitably rebound, but the timing is an art and science dictated by myriad external factors and intrinsic market dynamics. As always, thorough analysis and prudent decision-making are the watchwords for navigating such turbulent waters.