The **Gate reserve ratio** is an essential metric that highlights the financial health of cryptocurrency exchanges, and recent findings show that Gate has made impressive strides in this area. In Gate’s latest reserve report, the total reserve ratio has reached a solid 125%, which indicates that the platform is well-positioned to handle user assets securely. Particularly noteworthy is the BTC reserve ratio, which stands at a robust 140.69%, reflecting the increasing confidence of its users in this leading cryptocurrency. Additionally, the report reveals substantial growth in other core assets, with the ETH reserve ratio also showcasing adequate reserves. As investors seek reliable platforms, understanding the nuances of these reserve ratios, including the USDT reserve report, is pivotal for making informed decisions in the dynamic world of digital currencies.

The **reserve ratio of Gate** serves as a critical barometer for assessing the stability and reliability of cryptocurrency exchanges. Recent data demonstrates that this exchange, along with its competitors, is reinforcing its commitment to secure asset management, as evidenced in the latest reserve analyses. Users and investors alike are becoming increasingly mindful of metrics such as the BTC and ETH reserve ratios, as they seek trustworthy platforms for their transactions. Moreover, the transparency provided by detailed reports like Gate’s reserve report fosters a deeper understanding of the overall health of these digital investment ecosystems. By digging into the balance of assets held by exchanges, stakeholders can better gauge potential risks and rewards in the cryptocurrency market.

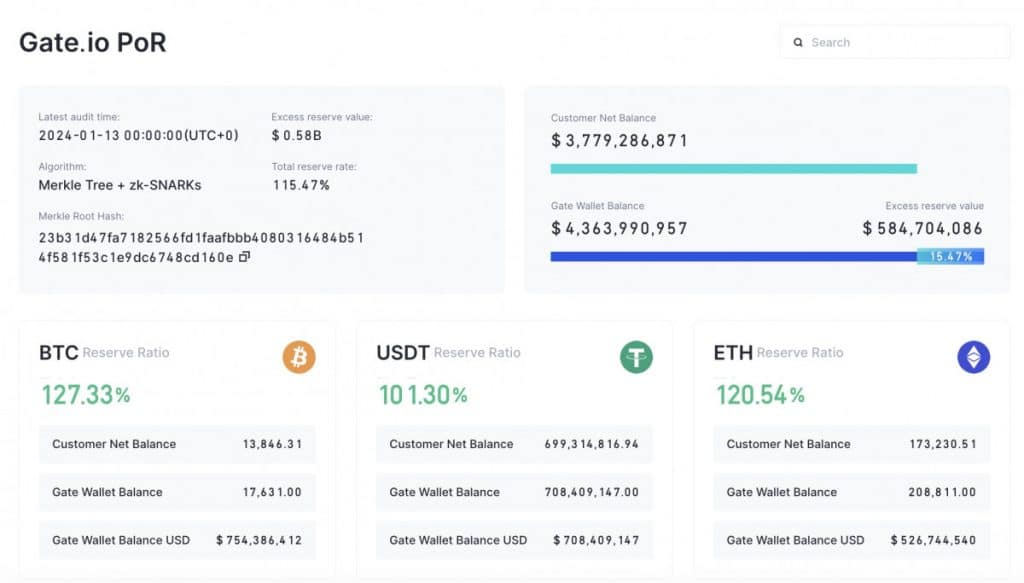

Understanding Gate’s Latest Reserve Ratio Improvement

Gate has recently announced an impressive increase in its total reserve ratio, now standing at 125%. This improvement is largely attributed to the enhancement in the core asset reserves, reflecting the exchange’s commitment to maintaining a robust framework for user assets. The total reserve value reported at $9.478 billion, coupled with coverage for nearly 500 asset types, signals a strong operational strategy that aligns well with user confidence in the platform.

This upward trend in Gate’s reserve ratio, jumping from 124% to 125%, highlights the exchange’s effective management practices and strategic allocation of resources. Especially noteworthy is the increase in Bitcoin (BTC) reserves, which has fostered a surplus reserve ratio of 40.69%. Such metrics not only showcase Gate’s fiscal health but also play a crucial role in attracting more users seeking secure environments for cryptocurrency transactions.

Analyzing BTC and ETH Reserve Ratios

The latest reserve report from Gate reveals significant insights into the reserve ratios for BTC and ETH. With a BTC reserve ratio soaring to 140.69%, this demonstrates a strong surplus that enhances trust among BTC holders. The data indicates that the growth in BTC reserves, amounting to 24,817 BTC for approximately 17,640 users, reinforces the exchange’s capability to handle fluctuations in demand and supply effectively.

In terms of Ethereum (ETH), the reserve ratio shows stability with a modest increase leading to a surplus reserve ratio of 24.22%. This marginal growth in the reserve amount to 419,320 ETH for over 337,565 users showcases Gate’s management in balancing its asset allocations. Both BTC and ETH ratios are pivotal indicators not just for investors but also for the broader cryptocurrency market landscape.

The Role of USDT in Gate’s Reserve Structure

USDT continues to play a crucial role in Gate’s reserve strategy, particularly with the number of users surging from 1.333 billion to 1.385 billion. Gate’s current reserves of 1.516 billion USDT ensure that the exchange can maintain liquidity and stability for its users. This growth signals a rising confidence in the use of stablecoins amidst market fluctuations, as USDT offers a reliable medium for trading.

Furthermore, the inclusion of USDT in Gate’s reserves enhances the overall security of the users’ assets. The reserve structure that integrates stablecoins allows for smoother transactions and easier conversions between volatile cryptocurrencies. As Gate progresses, continuing to bolster its USDT reserves will be essential for securing user transactions and sustaining trust in the platform.

Gate’s Strategic Management of Cryptocurrency Reserves

The strategic management of cryptocurrency reserves by Gate is vital for its success in the volatile digital asset market. With a total reserve value of approximately $9.478 billion and an overall reserve ratio surpassing 125%, the exchange demonstrates an adept understanding of market dynamics. Such careful management helps to safeguard user investments while ensuring that the exchange remains compliant with regulatory standards.

Moreover, the prudent increase in reserves signals to the market that Gate is not only focused on current performance but also on creating a sustainable business model for the future. Enhanced oversight and allocation in reserve management will likely fortify user loyalty, making Gate a preferred exchange in the competitive cryptocurrency landscape.

Impact of Gate’s Reserve Report on User Confidence

Gate’s latest reserve report acts as a catalyst for enhancing user confidence across its trading platform. With measurable improvements in reserve ratios and a total reserve value of $9.478 billion, users can rest assured that their assets are safeguarded. This transparency is crucial in the cryptocurrency industry, where trust often hinges on an exchange’s ability to demonstrate financial robustness.

Furthermore, as the report details the specific ratios for BTC, ETH, and USDT, it provides users with a comprehensive perspective on how their investments are secured. Confidence in an exchange directly correlates with its transparency, and Gate’s proactive approach in sharing these metrics reflects a commitment to fortifying its reputation in the competitive cryptocurrency market.

Calculating the Cryptocurrency Reserve Ratio Effectively

Understanding the calculation of cryptocurrency reserve ratios is essential for both users and exchanges. The reserve ratio indicates the extent to which an exchange holds assets compared to user liabilities, serving as a vital risk management tool. As Gate’s total reserve ratio now stands at 125%, this implies substantial backing for user deposits, instilling confidence in the way the platform operates.

For instance, the BTC reserve ratio at 140.69% is a positive indicator, suggesting that Gate is well-positioned to fulfill users’ withdrawal requests. Such effective calculations not only protect users but also enhance the dignity of the cryptocurrency exchange sector by establishing benchmarks that reflect financial integrity.

Insights from Gate’s Trending Reserve Metrics

The ongoing trends in Gate’s reserve metrics provide an insightful glance into how the exchange adapts to fluctuating market conditions. The notable increase in both BTC and ETH reserve ratios represents a proactive approach to recent market trends, ensuring that user assets remain well-covered and secure. Investors are now looking closely at these metrics to gauge Gate’s reliability as a safe trading platform.

Furthermore, the growth in USDT reserves highlights a trend towards stablecoin adoption, which is becoming increasingly important in the volatile cryptocurrency landscape. Users are finding value in exchanges that can showcase stability and reliability, which Gate promotes through enduring metrics derived from their latest reserve report.

The Future Implications of Gate’s Reserve Strategy

Looking ahead, the implications of Gate’s reserve strategy could substantially reshape the cryptocurrency trading environment. By maintaining a total reserve ratio above 125% and continually enhancing core asset reserves, Gate positions itself as a leader in providing security and assurance to its user base. The methods used in calculating and managing these reserves will likely set new industry standards.

Moreover, the strategic focus on asset reserves, especially across BTC, ETH, and USDT, will allow Gate to respond more dynamically to market pressures. As trends shift, having a solid reserve framework could allow Gate to capitalize on emerging opportunities while safeguarding its customers’ investments.

How Gate Keeps Users’ Assets Secure Through Reserves

Gate has implemented stringent measures to secure users’ assets through effective management of reserves. The total reserve ratio reaching 125% underscores the exchange’s commitment to ensuring that assets are adequately backed. With such a significant buffer, users can feel at ease knowing that their holdings are secure, minimizing concerns about asset loss.

In addition, the clarity in Gate’s reserve reporting fosters a culture of transparency, allowing users to track their assets and understand the exchange’s financial health. This proactive communication is vital in the cryptocurrency space, where trust can often be hard-earned, yet Gate continues to build confidence by demonstrating accountability in asset management.

Frequently Asked Questions

What is the current Gate reserve ratio and its significance in cryptocurrency?

As of January 12, 2026, Gate’s latest reserve ratio stands at 125%. This high reserve ratio indicates that Gate has more than enough assets to cover user deposits, enhancing trust and stability within the cryptocurrency market.

How does the BTC reserve ratio at Gate compare to that of other cryptocurrencies?

Gate’s BTC reserve ratio currently sits at 140.69%, reflecting a strong surplus in Bitcoin reserves compared to its user holdings. This ratio is a positive indicator of liquidity and financial health for Gate’s Bitcoin operations.

Why is the ETH reserve ratio important for cryptocurrency users?

The ETH reserve ratio at Gate is 24.22%, derived from a total reserve of 419,320 ETH. This ratio is essential for determining the platform’s ability to meet withdrawal demands and support its Ethereum users effectively.

How can I access Gate’s latest reserve report?

You can view Gate’s latest reserve report directly on their official website, which details the total reserve value, the breakdown of assets like BTC, ETH, and USDT, and other relevant metrics for user transparency.

What does the Gate latest reserve report indicate about user safety?

The Gate latest reserve report shows a total reserve value of $9.478 billion, which covers nearly 500 types of user assets. This substantial reserve enhances user safety by ensuring that Gate can meet withdrawal requests and maintain liquidity.

What trends are reflected in Gate’s latest reserve ratio?

Gate’s latest reserve ratio has shown a positive trend, increasing from 124% to 125%. This demonstrates a commitment to maintaining strong reserves and financial health, positioning Gate as a reliable platform in the cryptocurrency ecosystem.

How does the total number of USDT users relate to Gate’s reserve strategy?

With the total number of USDT users growing from 1.333 billion to 1.385 billion, Gate has adjusted its reserve amount to 1.516 billion USDT. This increase helps to ensure adequate liquidity for USDT transactions and reinforces user confidence in the platform.

| Metric | Value | User Base | Surplus Reserve Ratio |

|---|---|---|---|

| Total Reserve Ratio | 125% | N/A | N/A |

| Total Reserve Value | $9.478 billion | N/A | N/A |

| BTC Reserve Ratio | 140.69% | 17,640 | 40.69% |

| ETH Reserve Amount | 419,320 ETH | 337,565 | 24.22% |

| USDT Reserve Amount | 1.516 billion USDT | 1.385 billion | N/A |

Summary

The Gate reserve ratio is a critical metric that reflects the financial health of the exchange. With a total reserve ratio of 125% and a robust BTC reserve ratio reaching 140.69%, Gate demonstrates its commitment to maintaining sufficient reserves for its users. This latest report highlights the exchange’s ability to support a substantial user base with adequate asset backing, ensuring security and reliability in transactions.