An ETH long position can be a game changer in the world of Ethereum trading, allowing investors to capitalize on the cryptocurrency‘s upward price movement. In recent news, a notable address leveraged its ETH long position to earn a staggering profit of 1.285 million USD, demonstrating the potential rewards that come with successful blockchain investments. However, the volatility of the market was evident as this same address faced losses of 230,000 USD from two subsequent long positions. This scenario highlights the importance of a solid ETH trading strategy to manage risks effectively while seeking ETH profits and losses. Understanding these dynamics is critical for anyone looking to navigate the complexities of cryptocurrency long positions in today’s fast-paced market.

Exploring the strategies behind bullish trades in Ethereum can significantly enhance one’s understanding of crypto market dynamics. A recent case illustrates how an investor leveraged a bullish stance on ETH, achieving substantial returns before experiencing setbacks with additional trades. This narrative exemplifies the dual nature of risk and reward in cryptocurrency investments, particularly within the domain of Ethereum transactions. Whether one refers to them as optimistic positions or bullish bets, the principles of engaging with long positions apply universally across the cryptocurrency landscape. As traders navigate these waters, their ability to strategize effectively will ultimately determine their success in realizing profits and mitigating losses from their Ethereum ventures.

Understanding ETH Long Positions

Long positions in ETH, or Ethereum, represent a strategy where investors anticipate an increase in Ethereum’s market value. In trading, a long position entails purchasing Ethereum with the expectation that it will appreciate over time. This approach is particularly common in volatile markets, such as cryptocurrency trading, where investors often seek to capitalize on rapid price fluctuations. The address in question successfully closed a long position that netted an impressive profit of 1.285 million USD, highlighting the potential gains when correctly predicting price movements.

However, long positions come with inherent risks, especially in a market as unpredictable as cryptocurrencies. The same address that secured a substantial profit in its ETH long position also faced losses on two subsequent trades. Each of these long positions ended in losses totaling 230,000 USD. This illustrates the importance of having a robust risk management strategy as part of an ETH trading strategy, enabling investors to mitigate losses while seeking impressive profits.

Analyzing ETH Trading Strategies

An effective ETH trading strategy encompasses a variety of techniques designed to maximize profits while managing risks. Strategies may include fundamental analysis of market trends, technical analysis to identify patterns, and the use of stop-loss orders to limit potential losses. The scenario with the address exemplified how strategic planning can lead to significant profits, as it initially capitalized on price trajectories leading to a 1.285 million USD gain before experiencing downturns with its subsequent positions.

Moreover, successful Ethereum trading often involves a deep understanding of blockchain investments, where the intrinsic value of Ethereum and its applications can influence trading decisions. Leveraging knowledge of market sentiment, technological advancements within the Ethereum network, and overall economic conditions can provide traders with an edge. This multifaceted approach may enable traders to make informed decisions on entering or exiting long positions, refining their strategies to enhance profitability in the unpredictable world of cryptocurrency.

ETH Profits and Losses: A Reality Check

Navigating the volatile waters of Ethereum trading requires a keen awareness of the potential for both profits and losses. The address’s experience serves as a stark reminder of this duality: while it realized a significant gain from its initial long position, subsequent trades led to notable losses. This accumulation of profits and losses—totaling 1.055 million USD after factoring in losses—emphasizes the importance of maintaining accuracy in trading assessments and psychological resilience when confronting market fluctuations.

Furthermore, understanding how profits and losses influence overall trading performance is crucial for Ethereum traders. It’s important to analyze past trades to refine future strategies. This may involve evaluating the conditions under which previous long positions were successful or failed. By understanding these factors, traders can better position themselves in subsequent trades, making educated decisions that align with their long-term goals and risk profiles.

The Impact of Market Conditions on Long Positions

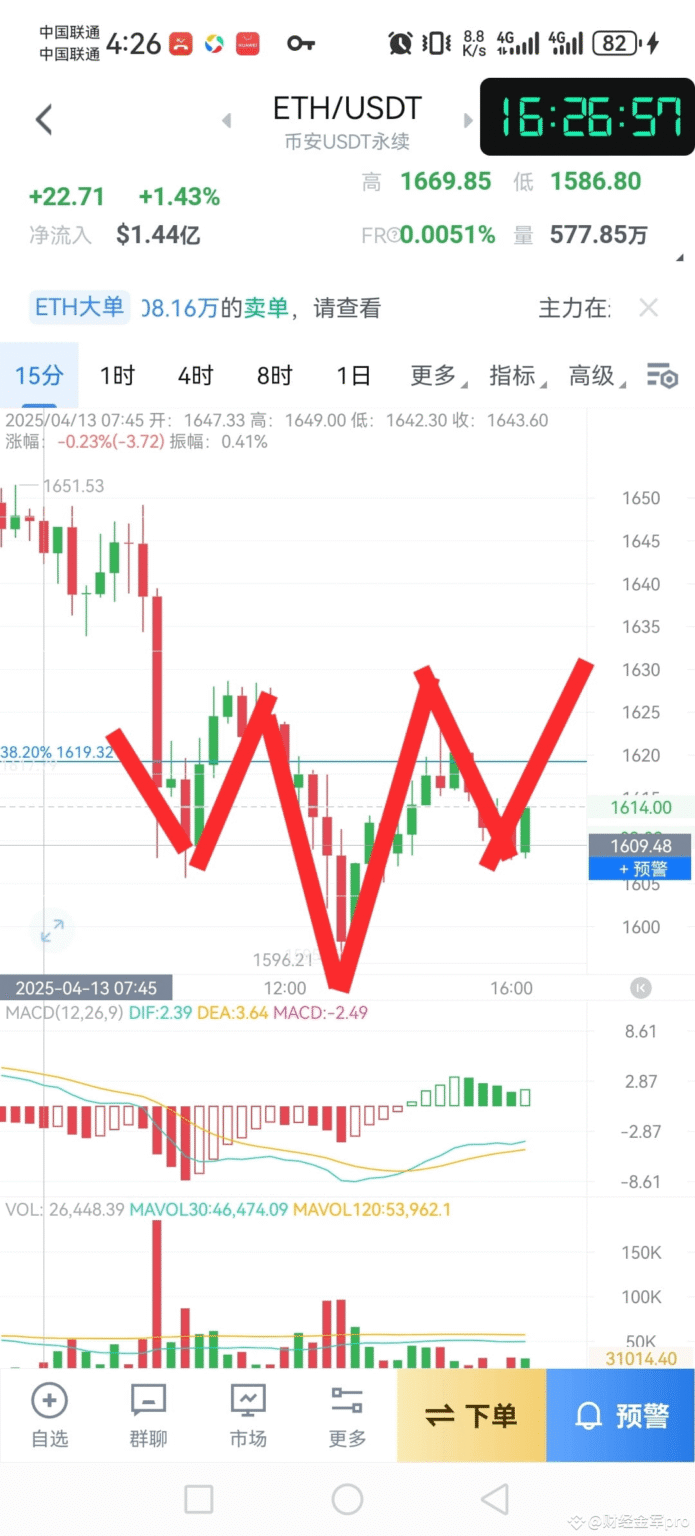

Market conditions play a pivotal role in the success of ETH long positions. The cryptocurrency market is notoriously volatile, often subject to drastic price swings driven by news, regulatory changes, and market sentiment. The address mentioned successfully capitalized on favorable market conditions, realizing a peak floating profit of 5.3 million USD. However, in contrast, when market dynamics shifted, the same address faced losses on new long positions. This illustrates how quickly the market can change, forcing traders to continuously adapt their strategies.

Understanding the intricacies of market psychology and external influences can help ETH traders make better-informed decisions regarding entering or exiting long positions. Monitoring indicators and news cycles can provide insights into potential market movements, allowing traders to optimize their positions. As demonstrated, acknowledging the impact of such factors can enhance the effectiveness of trading strategies and potentially lead to higher profits in the ever-changing landscape of cryptocurrency.

Risk Management in Cryptocurrency Long Positions

Effective risk management is essential for successful trading in cryptocurrencies, particularly for long positions in ETH. Strategies may include setting clear risk-reward ratios, using stop-loss orders, and diversifying the investment portfolio. In the case of the address in question, the realization of substantial profits followed by losses highlights the need for a disciplined approach to risk. Without appropriate measures, the high potential for loss in volatile markets can quickly outweigh the benefits of trading.

This discipline can lead to more sustainable trading practices, allowing investors to maintain their capital for longer periods. By assessing the risk-reward potential of each trade, ETH traders can better prepare for the inevitable ups and downs of their trading journey. Ultimately, managing risk effectively can safeguard against severe financial setbacks while helping traders attain their financial goals.

Lessons Learned from ETH Trading Experiences

Lessons in trading often emerge from successes and failures. The case of the address that closed a profitable ETH long position only to suffer losses on later trades serves as a significant educational point for traders. It highlights the importance of continuously learning and adapting one’s strategy based on past performances. Each trade, whether profitable or not, contributes to a trader’s overall skill set and understanding of the market.

Moreover, disclosures from such experiences can ignite discussions in trading communities, where individuals share their triumphs and challenges. Insight into how others approach their ETH trading strategies aids in refining one’s own tactics. Collectively, these shared lessons shape more informed and resilient traders, better equipped to navigate the complexities of the cryptocurrency landscape.

Navigating Ethereum’s Volatility

The volatility of Ethereum presents both challenges and opportunities for traders involved in long positions. Price fluctuations can lead to significant profits if timed correctly, but they can also result in steep losses if the market moves unfavorably. In the illustrated case, the address managed to exploit a favorable environment resulting in considerable earnings from its initial ETH long position, only to experience a downturn shortly after with its follow-up trades.

Traders need to develop strategies that incorporate volatility as a core element of their investment decisions in Ethereum. This may involve technical analysis to predict various price movements or implementing automated trading strategies that react quickly to changing market conditions. By acknowledging and planning for volatility, ETH traders can better position themselves for long-term success.

The Role of Blockchain Investments in Ethereum Trading

Understanding blockchain technology and its implications can provide Ethereum traders with critical insights when managing their long positions. Knowledge about the underlying technology that supports Ethereum can influence trading strategies, as it helps traders gauge the potential growth of the cryptocurrency market. For instance, recognizing the value of smart contracts and decentralized applications built on the Ethereum blockchain can inform traders’ decisions regarding their positions.

Moreover, blockchain investments continue to attract attention due to their transformative potential, impacting Ethereum’s price dynamics. As investors become more aware of the long-term prospects of blockchain applications, demand for ETH may rise, directly influencing the profitability of long positions. Thus, a sound understanding of blockchain technology is an integral part of a comprehensive ETH trading strategy.

Future Outlook for Ethereum Traders

As the cryptocurrency market evolves, the future outlook for Ethereum traders appears promising yet filled with uncertainties. The dramatic profits and losses highlighted in recent trading experiences exemplify the market’s volatility. However, with technological advancements and increasing institutional interest in cryptocurrencies, such as Ethereum, traders have a wealth of opportunities to explore, albeit accompanied by the need for robust strategies.

Looking ahead, traders who prioritize education, risk management, and market analysis will likely have the upper hand in navigating the challenges of Ethereum trading. As the market matures, the ability to adapt trading strategies based on real-time data and evolving trends will be pivotal. Ultimately, the future of effective ETH trading rests on a foundation of informed decisions and strategic planning.

Frequently Asked Questions

What is an ETH long position in cryptocurrency trading?

An ETH long position in cryptocurrency trading refers to a strategy where a trader buys Ether (ETH) with the expectation that its price will rise over time. This bullish approach allows traders to profit from price increases, as seen when an address realized a profit of 1.285 million USD after holding an ETH long position.

How do ETH profits and losses work in Ethereum trading?

ETH profits and losses in Ethereum trading are calculated based on the difference between the buying price and the selling price of Ether. For example, an address closed an ETH long position at a significant profit of 1.285 million USD, but also experienced losses of 230,000 USD on two subsequent long positions, demonstrating the inherent volatility in crypto markets.

What should I consider when adopting an ETH trading strategy?

When adopting an ETH trading strategy, it’s essential to analyze market trends, set clear entry and exit points, and manage risk appropriately. Successful implementation, like the example of an address accumulating a net profit of 1.055 million USD across multiple ETH long positions, involves being mindful of potential downturns and adjusting strategies accordingly.

What risks are associated with cryptocurrency long positions like ETH?

Cryptocurrency long positions, including ETH, carry risks such as market volatility and sudden price declines. For instance, the mentioned address faced a loss of 230,000 USD on two long positions after a downturn, highlighting the importance of risk management in blockchain investments.

Can you explain how the performance of an ETH long position is evaluated?

The performance of an ETH long position is evaluated by measuring the overall profit or loss incurred during the trade. This includes the highest floating profit at potential peak prices and the final closed profit. An address that saw a peak floating profit of 5.3 million USD before realizing a total profit of 1.055 million USD exemplifies this evaluation.

| Action | ETH Amount | Profit/Loss (USD) | Duration (Days) | Peak Profit (USD) | |

|---|---|---|---|---|---|

| Closed Long Position | N/A | 1,285,000 | 4 | 5,300,000 | N/A |

Summary

The recent trading activity reflects a successful ETH long position, where the address effectively closed a profitable trade for 1.285 million USD. However, their involvement in subsequent trades illustrates the risks associated with high volatility in cryptocurrency markets, resulting in additional losses of 230,000 USD. Overall, despite the losses incurred on these later positions, the address ultimately achieved a net profit of 1.055 million USD from their ETH long positions, highlighting the potential rewards and risks of engaging in long-term strategies with Ethereum.