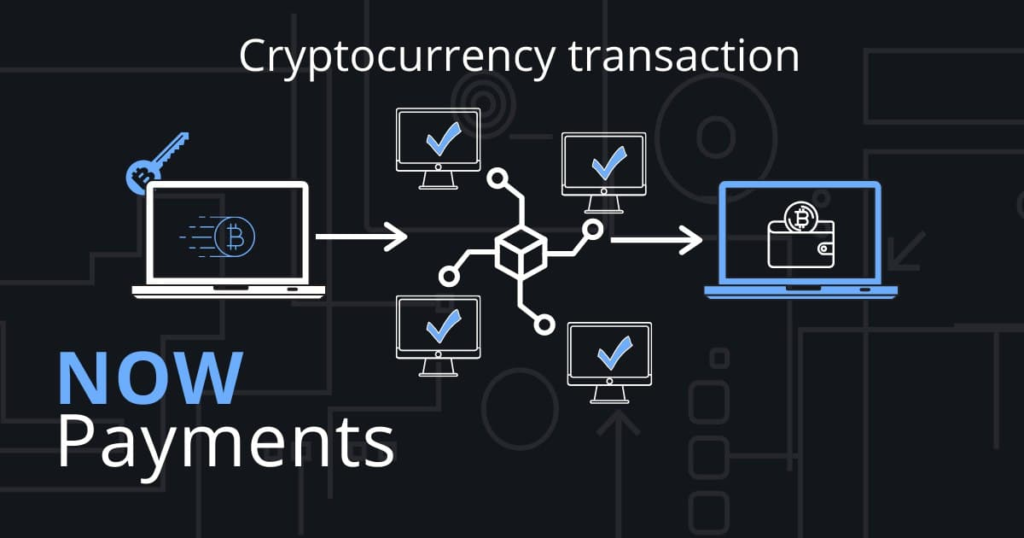

Cryptocurrency transactions are revolutionizing the way we think about finance, allowing for seamless exchanges in a digital landscape. Recently, the U.S. Office of the Comptroller of the Currency (OCC) released Interpretive Letter 1188, clarifying that national banks can now engage in banking activities related to risk-free principal cryptocurrency transactions. This pivotal decision enables banks to act as intermediaries, facilitating operations without holding substantial cryptocurrency inventories. Essentially, they deal as principals with one customer while balancing transactions with another, thereby harnessing a broker-like functionality. This emerging framework promises to reshape conventional banking practices and boost the adoption of digital assets within the financial system.

The landscape of digital asset exchanges is expanding as financial institutions begin to explore blockchain technology. With the allowance for national banks to participate in risk-free principal financing through digital currencies, there’s a significant shift in how traditional banking interacts with cryptocurrencies. These exchanges, often referred to as digital currency trades, enable banks to operate in intermediary roles, facilitating transactions for customers by using innovative financial products. This development not only enhances the efficiency of banking activities but also aligns with evolving regulatory measures governing digital currencies in accordance with OCC guidelines. As institutions embrace these changes, we can anticipate a more integrated future where digital and traditional finance converge.

Understanding OCC Interpretive Letter 1188

The U.S. Office of the Comptroller of the Currency (OCC) has issued Interpretive Letter 1188, which provides vital clarity on the role of national banks in the evolving landscape of cryptocurrency. This letter formally acknowledges that national banks have received the green light to partake in activities related to risk-free principal cryptocurrency transactions. This is a significant step for traditional financial institutions, as it delineates the boundaries of engagement, paving the way for more structured participation in cryptocurrency markets.

By permitting national banks to act as intermediaries in cryptocurrency transactions, the OCC’s Interpretive Letter 1188 sets the stage for a new era where traditional banking practices intertwine with digital finance. National banks, under this guidance, can undertake principal transactions without holding physical inventories of cryptocurrencies. This capability enables banks to facilitate customer transactions more efficiently, acting in a broker-like capacity that underscores the regulatory oversight necessary for maintaining financial stability.

The Role of National Banks in Cryptocurrency Transactions

In light of OCC Interpretive Letter 1188, national banks are positioned to harness their infrastructure in servicing cryptocurrency transactions. Acting in a broker-like manner, these banks can provide individuals and businesses with easier access to crypto assets while adhering to regulatory requirements. This new framework allows them to perform risk-free principal transactions by engaging one customer while simultaneously offsetting with another, thus mitigating their exposure to cryptocurrency volatility.

Furthermore, as intermediaries, national banks play a crucial role in establishing trust within cryptocurrency markets. Their involvement serves to bolster confidence among potential investors who may be apprehensive about the volatility and risks associated with cryptocurrencies. By leveraging established banking activities within a compliant framework, national banks can provide a more stable environment for cryptocurrency investments, thereby bridging the gap between traditional finance and the burgeoning digital asset space.

Risk-Free Principal Transactions Explained

Risk-free principal transactions represent a unique model where banks operate without exposing themselves to direct cryptocurrency ownership. Through OCC Interpretive Letter 1188, national banks are authorized to facilitate these transactions, allowing them to act on behalf of clients while reducing their own financial risks. By engaging in offsetting transactions, banks can structure operations that fulfill customer preferences without holding cryptocurrency themselves, effectively acting as facilitators in digital finance.

This model not only safeguards the banks’ financial interests but also delivers advantages to clients who wish to engage in cryptocurrency trades. As banks assume the role of intermediaries in these transactions, customers can enjoy seamless access to the cryptocurrency market while benefiting from the banking sector’s compliance and risk management systems. This structure permits banks to tap into the burgeoning cryptocurrency market without the complexities often associated with direct digital asset management.

Banking Activities and Cryptocurrency Intermediation

The integration of cryptocurrency into traditional banking practices marks a pivotal moment in the financial sector. With the endorsement of OCC Interpretive Letter 1188, banks now possess a regulatory framework to engage in banking activities that include cryptocurrency intermediation. This allows for innovative financial services that blend conventional banking expertise with the flexibility of digital assets, ultimately expanding the service offerings available to clients.

As banks diversify their activities to include cryptocurrency transactions, they are not only responding to market demand but also redefining their operations. By operating as intermediaries, these institutions maintain a necessary regulatory oversight that protects both the banks and their clients from potential risks associated with unregulated crypto markets. This careful balancing act reinforces the credibility and stability of both the banking sector and the cryptocurrency industry.

Navigating Risks in Cryptocurrency Transactions

While OCC Interpretive Letter 1188 opens up new avenues for national banks, it also emphasizes the importance of navigating risks associated with cryptocurrency transactions. Banks must ensure adherence to stringent guidelines to conduct these transactions safely and securely. This involves implementing robust compliance mechanisms while also developing risk management strategies tailored to the dynamic nature of cryptocurrency.

In order to thrive in this new environment, banks need to enhance their technological capabilities and foster a culture that embraces innovation while maintaining regulatory compliance. By doing so, they can effectively mitigate risks and leverage the opportunities presented by cryptocurrency transactions, ultimately standing out as leaders in both traditional banking and the digital finance space.

The Future of Banking and Cryptocurrency

The issuance of OCC Interpretive Letter 1188 signifies a transformative shift in the relationship between traditional banking and cryptocurrency. As national banks are equipped to navigate this new landscape, they are positioned to play a pivotal role in shaping the future of digital finance. The adoption of such forward-thinking regulations indicates that the financial sector is ready to embrace the realities of cryptocurrency.

Looking forward, we can anticipate a growing integration of banking practices and cryptocurrency markets. National banks may innovate their service offerings to include more advanced cryptocurrency products and services, catering to a wider range of consumer needs. This synergy between banks and the cryptocurrency ecosystem is crucial for fostering a more inclusive, efficient, and trustworthy financial infrastructure.

Implications for Financial Regulation and Compliance

With the advent of OCC Interpretive Letter 1188, the regulatory landscape surrounding cryptocurrency transactions is set to evolve significantly. National banks now have the authority to engage in crypto activities under a framework that aims to protect both banks and their clients. However, this shift also comes with heightened responsibilities for banks to ensure compliance with existing financial regulations.

Failure to rigorously adhere to these compliance requirements can expose banks to legal and financial consequences, underscoring the importance of strong regulatory frameworks. As cryptocurrency transactions become more commonplace, the need for clear and enforceable regulations that govern these activities will only become more pressing, creating a critical juncture for the financial services industry.

Building Consumer Trust in Cryptocurrency

One of the significant challenges facing the cryptocurrency market is the issue of consumer trust. By leveraging OCC Interpretive Letter 1188, national banks have the opportunity to enhance consumer confidence in cryptocurrency transactions through their established reputation and comprehensive regulatory compliance. As trusted financial institutions, banks can serve as a bridge, providing consumers with a secure pathway towards investing in cryptocurrencies.

National banks’ involvement in cryptocurrency transactions can dispel some of the uncertainties surrounding digital currencies. Through their intermediary role, they can educate consumers about the risks and benefits associated with cryptocurrencies while ensuring transactions are handled in a transparent and secure manner. This proactive approach can pave the way for broader adoption of cryptocurrencies by alleviating fears and building a more informed consumer base.

Opportunities for Innovation in Banking

The introduction of OCC Interpretive Letter 1188 not only legitimizes national banks’ participation in cryptocurrency transactions but also opens the door for innovative financial products. Banks can consider developing services that combine traditional banking functions with cryptocurrency offerings, which could include crypto savings accounts or interest-bearing wallets. This fusion of banking activities can create new revenue streams while meeting the demands of a tech-savvy clientele.

Additionally, the ability to engage in cryptocurrency transactions allows banks to capitalize on the growing interest in digital assets. As more customers seek access to cryptocurrencies, banks can leverage their existing customer relationships to cross-sell these new products. This innovation can lead to improved customer retention and attract new clients who are looking for a reputable institution to facilitate their cryptocurrency investments.

Frequently Asked Questions

What is OCC Interpretive Letter 1188 regarding cryptocurrency transactions?

OCC Interpretive Letter 1188 clarifies that national banks are authorized to engage in banking activities related to risk-free principal cryptocurrency transactions. This means banks can act as intermediaries in cryptocurrency transactions between clients, ensuring compliance with established regulations.

How do national banks participate in risk-free principal cryptocurrency transactions?

National banks participate in risk-free principal cryptocurrency transactions by acting as intermediaries. They engage in transactions with one customer while offsetting these with another, similar to broker activities, without holding cryptocurrency inventories.

What are the implications of banking activities associated with cryptocurrency transactions?

Banking activities associated with cryptocurrency transactions, as outlined in OCC Interpretive Letter 1188, allow banks to engage in more integrated financial services with cryptocurrencies while ensuring safe and sound operational practices in compliance with regulatory guidelines.

Can banks hold cryptocurrency inventories when conducting cryptocurrency transactions?

No, under OCC Interpretive Letter 1188, national banks cannot hold cryptocurrency inventories. Instead, they act as intermediaries in cryptocurrency transactions, facilitating trades between customers and conducting offsetting transactions.

What regulations must national banks follow when engaged in cryptocurrency transactions?

National banks must ensure that all practices associated with cryptocurrency transactions are conducted in a safe and sound manner. This includes adhering to relevant banking regulations and compliance laws to protect customers and the financial system.

Why is the OCC’s stance on national banks engaging in cryptocurrency transactions significant?

The OCC’s stance provides legal clarity for national banks regarding their capacity to engage in cryptocurrency transactions. This fosters innovation within the banking sector while ensuring adherence to safety and compliance standards.

What role do banks play as intermediaries in cryptocurrency transactions according to OCC regulations?

Banks act as intermediaries in cryptocurrency transactions by facilitating trades without taking ownership of the assets. This allows them to operate in a market-like fashion while adhering to the regulatory framework set forth by the OCC.

How can businesses benefit from national banks participating in cryptocurrency transactions?

Businesses can benefit from national banks participating in cryptocurrency transactions through improved access to financial services, enhanced transaction security, and the ability to engage in risk-free principal transactions that streamline operations and mitigate risks.

| Key Point | Explanation |

|---|---|

| OCC Interpretive Letter 1188 | Released by the U.S. Office of the Comptroller of the Currency, confirming national banks can engage in cryptocurrency transactions. |

| Risk-free Principal Transactions | Banks can act as principals in cryptocurrency transactions without holding inventory, using offsetting transactions with other customers. |

| Broker-like Role | National banks operate as intermediaries, similar to agents, rather than directly holding cryptocurrency. |

| Compliance and Safety | Banks must ensure activities are safe, sound, and comply with applicable laws. |

Summary

Cryptocurrency transactions have gained significant attention with the OCC’s recent Interpretive Letter 1188. This letter allows national banks to engage in activities related to cryptocurrency transactions, emphasizing their role in facilitating trades without the need to hold cryptocurrency inventories. By acting as intermediaries, banks can mitigate risks while adhering to compliance and safety regulations. This development marks an important step in integrating banks into the evolving cryptocurrency market.