BTC rebound is making headlines as the cryptocurrency surges past the 65,000 USDT mark, showcasing a significant recovery that has caught the attention of investors. Recent Bitcoin price news indicates that this rebound comes as the market adjusts to ongoing fluctuations, with the latest statistics showing a narrowed 24-hour decline of just 8.7%. In an ever-evolving landscape of cryptocurrency market trends, many traders are closely monitoring BTC analysis to gauge the potential for further gains. The latest OKX market update highlights this upward movement, offering crucial crypto trading insights for those looking to capitalize on this trend. As Bitcoin continues to stabilize, the excitement surrounding its resurgence is palpable among enthusiasts and investors alike.

In recent developments, Bitcoin has experienced a remarkable upswing, breaking the significant threshold of 65,000 USDT. This surge in value indicates a reversal of the previous downward trend, drawing in attention from the crypto community. Analysts are now closely examining the latest movements within the cryptocurrency ecosystem to provide vital insights on potential future performance. The recent fluctuations and trends in the digital currency market have many traders on edge, looking for signs of sustained momentum. As discussions around cryptocurrency strategies grow more intricate, this rebound offers crucial learning opportunities for both new and seasoned participants.

| Key Points |

|---|

| BTC rebounds and breaks through 65,000 USDT |

| Current BTC Price: 65,004.5 USDT |

| 24-Hour Decline: 8.7% |

Summary

The recent BTC rebound is significant as it not only breaches the 65,000 USDT mark but also indicates a recovery trend after a recent decline. Investors should monitor these developments closely as they may suggest a positive shift in the market.

Bitcoin Price News: BTC Rebounds to 65,000 USDT

Recent reports indicate that Bitcoin (BTC) has successfully rebounded, soaring past the critical resistance level of 65,000 USDT. This notable uptrend signifies a potential shift in momentum for investors. As BTC achieves this milestone, it reflects a growing confidence in the cryptocurrency market, especially after experiencing volatility and declines in previous weeks. The recorded rebound brings the cryptocurrency’s price to approximately 65,004.5 USDT, only 8.7% lower than its previous peak.

Traders and analysts are closely observing this rally, as it could impact broader cryptocurrency market trends. Historical data suggests that such rebounds following substantial corrections often lead to further gains. Investors are looking for indicators of sustained growth; thus, BTC’s rebound may provide a crucial signal to prospective buyers. Continuous monitoring of Bitcoin price news will be essential for those involved in cryptocurrency trading, as they seek to optimize their strategies.

Understanding Cryptocurrency Market Trends

The cryptocurrency market is known for its rapid shifts and dynamic trends. The recent rebound in BTC prices is no exception, demonstrating how quickly investor sentiment can change. Analysts observing market dynamics suggest that spikes like this can trigger increased trading activity across various crypto assets. The rise of Bitcoin often correlates with a positive impact on other major cryptocurrencies, leading to a surge in overall market capitalization.

Moreover, understanding the factors that contribute to these market movements is crucial for cryptocurrency enthusiasts. Macro-economic factors, regulatory developments, and innovations in blockchain technology all play significant roles in influencing market trends. Keeping abreast of these elements will enable traders to make informed decisions and may help anticipate future BTC movements.

BTC Analysis: Key Indicators to Watch Out For

Frequently Asked Questions

What caused the recent BTC rebound above 65,000 USDT?

The recent BTC rebound above 65,000 USDT can be attributed to investor optimism and bullish market sentiment following positive cryptocurrency market trends. Factors such as strong trading volumes on platforms like OKX and favorable BTC analysis have contributed to regaining confidence in Bitcoin’s price performance.

How does the 24H decline of 8.7% affect BTC analysis?

A 24H decline of 8.7% indicates the recent volatility in the cryptocurrency market. However, this narrowing decline amid a BTC rebound suggests potential stabilization. BTC analysis must account for these fluctuations, focusing on key support levels and market sentiment indicators to predict future movements.

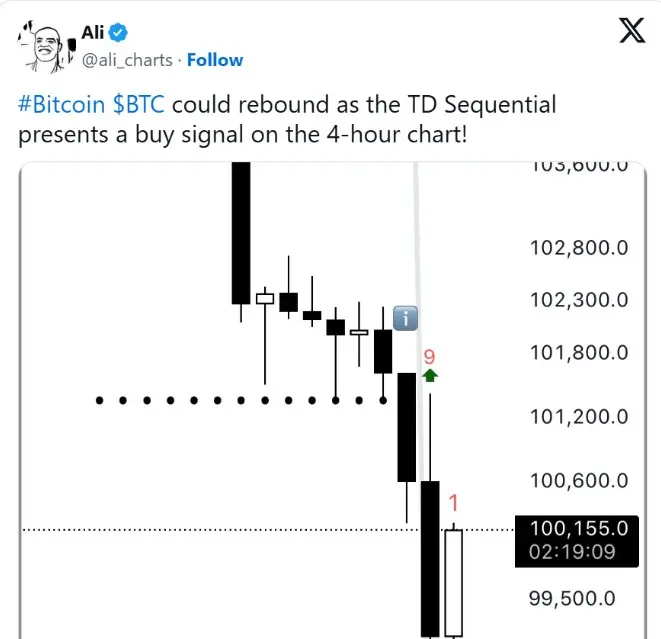

Are there specific market indicators to watch during a BTC rebound?

During a BTC rebound, it’s important to monitor key market indicators such as trading volumes, market sentiment, and resistance levels. Insights from crypto trading can provide valuable context, helping traders assess whether the rebound is temporary or indicative of a longer-term trend.

What are the implications of BTC breaking through 65,000 USDT for traders?

BTC breaking through 65,000 USDT signals bullish momentum, which might present trading opportunities. Traders should look for patterns in cryptocurrency market trends and leverage this rebound in their crypto trading strategies, while remaining aware of potential corrections.

How might the BTC rebound influence future Bitcoin price news?

A significant BTC rebound not only influences current Bitcoin price news but also sets the stage for future trends. Positive developments, like breaking past key resistance levels, could attract more investors, shifting the narrative in the cryptocurrency market and affecting public sentiment towards Bitcoin.