The latest Bitcoin rebound analysis reveals a concerning trend: the current upturn appears quite weak, raising the possibility of further declines in the price of the leading cryptocurrency. As analysts closely monitor Bitcoin’s price prediction, many are keenly aware of the implications of these movements within broader cryptocurrency market trends. Experts suggest that strategic Bitcoin investment strategies are essential for navigating this tumultuous bear market, particularly as uncertainty looms over future forecasts. For investors looking for long-term gains, positions around $85,000 may present a compelling opportunity despite the prevailing market volatility. With the next few months promising complex fluctuations, understanding these dynamics will be crucial for successfully capitalizing on any potential Bitcoin rallies or downturns.

In examining the landscape of digital currencies, one cannot overlook the significance of Bitcoin’s recent price movements. This cryptocurrency’s performance is a testament to its ongoing volatility, often mirrored by the fluctuating sentiments in the cryptocurrency market at large. An insightful exploration into Bitcoin’s rebound dynamics not only highlights current investment strategies but also illustrates the broader implications for crypto enthusiasts and traders alike. As we analyze market behaviors, terms such as ‘bear market’ and ‘long-term Bitcoin forecast’ become essential for grasping potential shifts and preparing strategic responses. Engaging with alternative perspectives on Bitcoin’s recovery can offer deeper insights into the realities faced by investors today.

Bitcoin Rebound Analysis: Current Trends and Future Implications

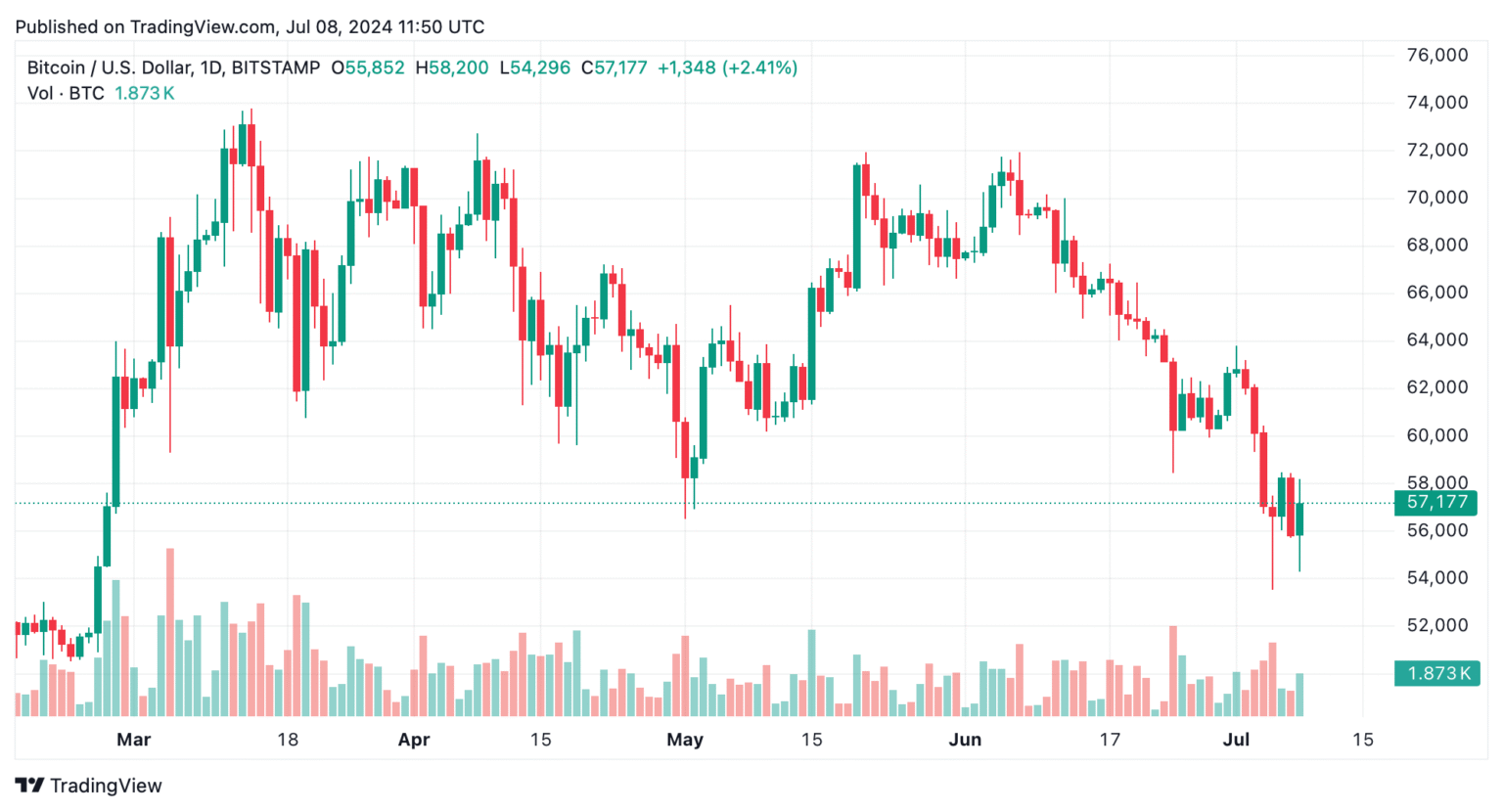

Recent insights from crypto analyst 半木夏 indicate that Bitcoin’s current rebound is considerably weak, which raises concerns over the potential for further declines in its price. While the cryptocurrency market often experiences volatility, the current sentiment suggests that investors may need to prepare for the likelihood of hitting new lows. This analysis feeds into broader Bitcoin price predictions, where many analysts express caution amidst the complex dynamics currently reshaping the market.

A weak rebound typically signals underlying issues that could affect investor confidence. Therefore, it is crucial for traders to understand that the present bear market may endure longer than anticipated. According to 半木夏, engaging in spot trading might be a prudent strategy during this volatile period. Doing so allows investors to capitalize on movements while mitigating risks associated with erratic market behavior.

Understanding Bitcoin Price Prediction Amidst Weak Rebounds

The predictions surrounding Bitcoin’s price trajectory often hinge on key market indicators, especially during periods marked by weak rebounds. Analysts maintain that despite the current downtrend, an entry point around $85,000 might be viable for long-term investors, signaling a potential recovery phase. This perspective ties into broader cryptocurrency market trends, where patience and strategic positioning are deemed essential for success.

Investing in Bitcoin during such uncertain times requires a keen understanding of both the historical performance and future potential of cryptocurrencies. Thus, forecasts must take into account not only technical analysis but also external factors impacting the market. As we observe shifts in investor sentiment and market forces, the focus for many lies not just in immediate trading opportunities but in crafting sustainable Bitcoin investment strategies.

Navigating the Bear Market: Strategies for Bitcoin Investors

In the current bear market, characterized by volatility and uncertainty, Bitcoin investors are searching for effective strategies to preserve their capital and identify profitable opportunities. With analysts warning that a rebound may not be robust, the emphasis on cautious trading practices has never been more relevant. Spot trading is highlighted as a key method to navigate this tumultuous environment effectively.

To thrive amidst the bear market challenges, investors should consider diversifying their portfolios. By spreading investments across different assets within the cryptocurrency realm, they can mitigate risks associated with Bitcoin’s fluctuating price. Furthermore, understanding long-term trends can help investors remain focused on potential gains rather than immediate losses, aligning with the principles of strategic investment management.

Long-Term Bitcoin Forecast: What Investors Should Know

As the cryptocurrency market grapples with volatility, long-term Bitcoin forecasts remain a topic of extensive analysis. Despite the weak rebound noted by several experts, many believe in the potential for growth over the coming years. Analysts suggest that Bitcoin could eventually reclaim its value, making early investment during this downturn influential for future gains.

Investors looking at Bitcoin’s long-term prospects should be aware of macroeconomic indicators, regulatory developments, and overall market sentiment. A comprehensive understanding of these factors will contribute to informed decision-making, ensuring that investment strategies are resilient against the shifts typical of the cryptocurrency landscape.

Trading Opportunities in a Volatile Cryptocurrency Climate

The cryptocurrency market is notorious for its high volatility, presenting both risks and opportunities for traders. Current analysis indicates that the weak Bitcoin rebound could be an opportune moment for savvy investors to engage in trading. Identifying and executing trades based on market reactions can yield significant profits, especially when utilizing spot trading techniques to minimize potential losses.

Moreover, keeping abreast of market trends and external economic factors could enhance trading strategies. Cryptocurrency investing demands agility and the ability to make quick decisions, emphasizing the importance of continuous market analysis. By adopting a proactive trading mindset, investors can leverage volatile conditions to their advantage.

The Role of Market Sentiment in Bitcoin Price Fluctuations

Market sentiment plays a crucial role in determining Bitcoin’s price movements, particularly during times of heightened uncertainty like the current bear market. The prevailing cautious attitude among investors can lead to decreased buying activity, further exacerbating price declines. Understanding the psychological factors that influence investor behavior is essential for anyone looking to navigate the cryptocurrency markets effectively.

As the market sentiment shifts, so too do the opportunities for trading and investment. Those who can accurately interpret sentiment changes are often better positioned to make informed decisions, whether it be to enter or exit positions in Bitcoin. Recognizing the role of emotional and social factors in trading can help mitigate risks associated with potential losses.

Analyzing Historical Patterns to Predict Bitcoin’s Future

To forecast Bitcoin’s future movements, examining historical patterns can offer valuable insights. Past bull and bear cycles typically provide clues about how Bitcoin may react in similar circumstances. By analyzing previous trends during periods of market downturns, investors can make educated predictions concerning potential recovery phases.

Investors who leverage historical data significantly enhance their ability to craft long-term strategies within the cryptocurrency realm. This methodical approach facilitates better risk management practices and identifies optimal entry points for investing. Historical analysis combined with current market insights can sharpen one’s perspective on Bitcoin’s long-term viability.

Spot Trading: A Strategic Approach for Current Market Conditions

Spot trading is emerging as a vital strategy for investors navigating the current turbulent cryptocurrency landscape. Given the mixed signals surrounding Bitcoin’s market performance, utilizing spot trading allows traders to quickly respond to price changes, ensuring they do not miss fleeting opportunities. This method helps in maintaining liquidity while capitalizing on price fluctuations.

Furthermore, spot trading can reduce exposure to unnecessary risks tied to derivative trading. Investors often find that engaging in direct transactions provides a clearer picture of market dynamics. Understanding when and how to execute spot trades is crucial for maximizing gains, especially in a bear market where timing can significantly affect outcomes.

The Future of Bitcoin: Predictions for 2025 and Beyond

Looking ahead to 2025, Bitcoin’s trajectory remains uncertain yet filled with potential. While current analyses highlight a weak rebound, the long-term outlook suggests that substantial growth could be on the horizon as market conditions stabilize. Investors are urged to remain optimistic while also preparing for the inevitable fluctuations that come with cryptocurrency investment.

Strategically positioning oneself in the market today could lead to substantial returns in the future. As Bitcoin continues to be a focal point of interest within the financial landscape, understanding future market dynamics will be paramount for informed investing decisions. Investors should consider both historical patterns and emerging trends as they formulate their long-term strategies.

Frequently Asked Questions

What does Bitcoin rebound analysis suggest about the current market trend?

Bitcoin rebound analysis indicates that the current rebound in prices is relatively weak, suggesting a potential for further declines in the cryptocurrency market. Analysts predict that the situation may lead to new lows if market conditions do not improve significantly.

How can Bitcoin price prediction be affected by weak rebounds?

Weak rebounds in Bitcoin’s price can lead to more speculative forecasts about future price movements. Analysts often take these weak recoveries as signals that the price may continue to fall, affecting the overall Bitcoin price prediction and investment strategies.

What are common Bitcoin investment strategies during a bear market?

During a bear market, Bitcoin investment strategies often include dollar-cost averaging, focusing on long-term accumulation, and prioritizing spot trading. This approach helps mitigate risks associated with volatility while positioning investors for potential gains when the market stabilizes.

What should investors consider regarding long-term Bitcoin forecast amid weak rebounds?

Investors should remain cautious with their long-term Bitcoin forecast, especially given the current weak rebound. It’s advisable to identify strong entry points, such as the indicated $85,000, while keeping an eye on market trends and technical indicators to make informed decisions.

How do cryptocurrency market trends influence Bitcoin rebound analysis?

Cryptocurrency market trends play a crucial role in Bitcoin rebound analysis, as they reflect investor sentiment, trading volumes, and external economic factors. Analyzing these trends helps predict potential rebounds or declines in Bitcoin’s price, guiding investment decisions.

What indicators suggest that a Bitcoin rebound might fail?

Indicators of a failing Bitcoin rebound may include low trading volumes, bearish market sentiment, and failure to break key resistance levels. Analysts often look for these signs to gauge the likelihood of further price declines.

Are there specific signals to watch for Bitcoin investment strategies post-rebound?

Post-rebound, investors should look for signals like increased trading activity, positive news developments in the cryptocurrency market, and confirmation of price movements above resistance levels as part of their Bitcoin investment strategies.

What role does spot trading play in Bitcoin’s currently weak rebound?

Spot trading is critical during Bitcoin’s currently weak rebound as it allows traders to avoid the risks of leverage and manage their positions effectively. Spot trading can help capture short-term opportunities without facing excess losses in volatile markets.

| Key Points | Details |

|---|---|

| Bitcoin Rebound | Analyst 半木夏 indicates that Bitcoin’s rebound is weak. |

| Likelihood of New Lows | Increased probability of Bitcoin hitting new lows again. |

| Long-Term Entry Position | $85,000 is suggested as a good long-term entry point. |

| Market Complexity | The next 3-4 months will be complex for the market. |

| Trading Strategy | Spot trading is recommended to avoid losses. |

| Future Bullish Opportunity | Bullish opportunities may arise only after the bear market ends. |

Summary

The Bitcoin rebound analysis points out that the current recovery for Bitcoin is fragile, indicating a higher likelihood of further declines. Despite this, analyst 半木夏 suggests a long-term entry at $85,000 remains attractive. The upcoming months present a complicated landscape for traders, where strategic spot trading may safeguard against common pitfalls, ultimately setting the stage for a resurgence only after this prolonged bear market concludes.

Related: More from Bitcoin News | Bitcoin Surges Above $68K After Iran Confirms Khamenei Death | Shift in demand Bitcoin’s future in an artificial intelligence-driven world may depend