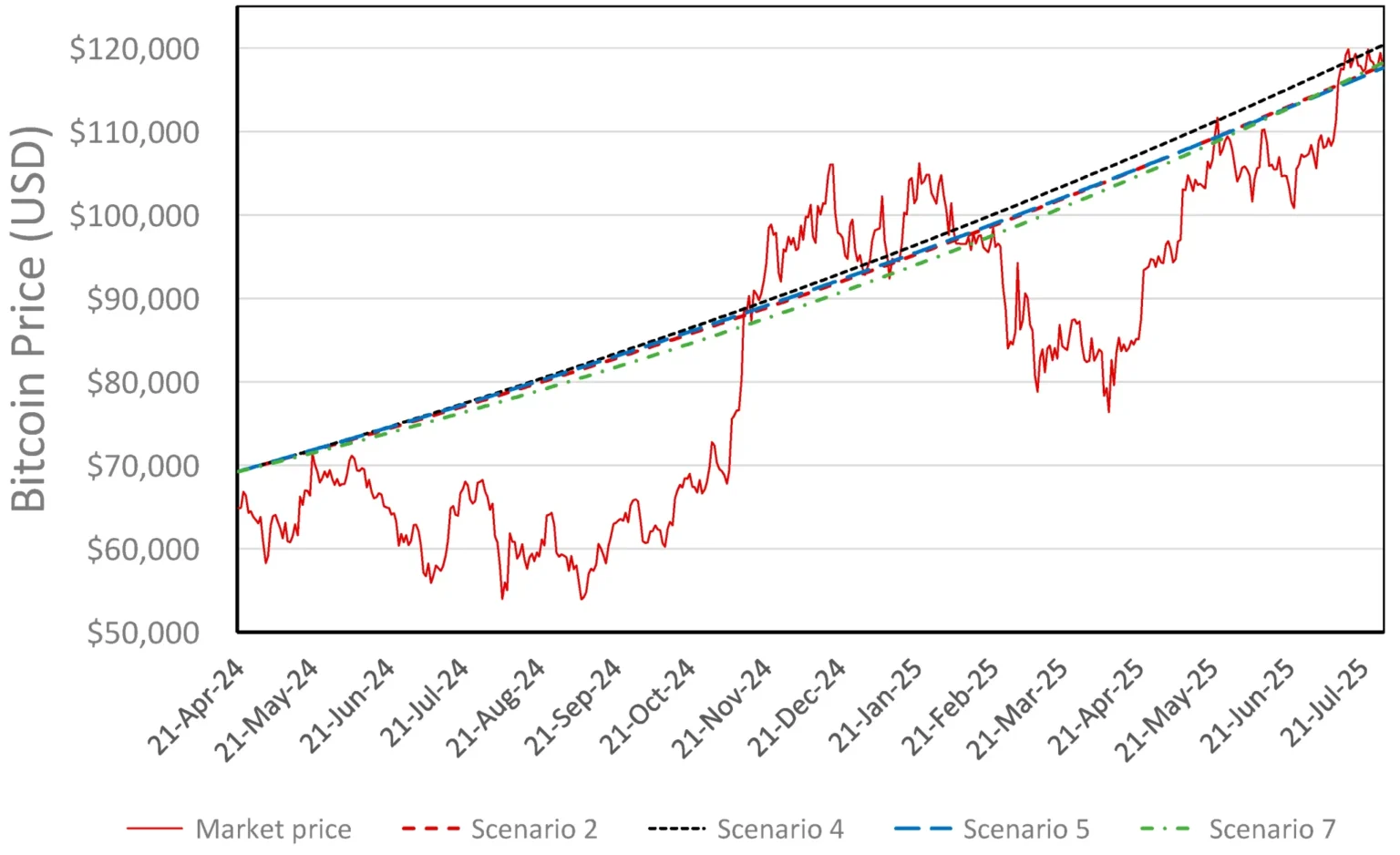

Bitcoin price analysis

An analysis indicates that Bitcoin’s current price features “almost no bubble,” with nearly 40% of chips recorded in unrealized losses. The report highlights the present market conditions surrounding cryptocurrency, emphasizing the limited signs of a speculative bubble in Bitcoin’s valuation. Analysts are observing various factors, including trading volumes and investor behavior, which reflect a more stable market climate than previously observed. The data suggests that despite fluctuations, the sentiment among investors appears grounded, contrasting with periods of speculative exuberance seen in the past. Furthermore, the significant percentage of unrealized losses among holders points to a cautious market approach, with many investors refraining from selling at present levels. Overall, this analysis underscores prevailing investor sentiments and market dynamics, indicating that while Bitcoin remains volatile, its recent pricing trends do not align with characteristics typically associated with a market bubble.