Average stock trading volume is a critical metric for gauging the health and liquidity in stocks of any publicly traded company. Recently, Strategy’s 30-day average stock trading volume to market capitalization ratio impressively reached 7.2%, outshining major players like Tesla and Nvidia. This striking figure not only emphasizes the robust trading dynamics of the firm but also highlights the importance of stock trading metrics in evaluating market performance. As noted by Michael Saylor, the increased activity reflects enhanced liquidity that offers potential stakeholders a clearer insight into the company’s market value. Understanding such average stock trading volume can be invaluable for investors seeking to navigate complex market landscapes and identify promising opportunities.

The evaluation of stock activity often involves analyzing the typical amount of shares being traded over a specific period, commonly referred to as the average trading volume. This essential trading indicator can significantly influence investors’ decisions, especially when assessing a company’s market position in relation to its peers. A high average trading volume suggests a strong interest in a stock, which can translate into better liquidity, similar to what has been observed with Strategy’s notable trading figures against competitors like Tesla and Nvidia. Furthermore, leaders in the industry, such as Michael Saylor, underscore the importance of these trading metrics in making informed investment decisions. By examining companies’ trading volumes and market capitalization ratios, investors can obtain a clearer perspective on potential trading strategies.

Understanding Stock Trading Volume Metrics

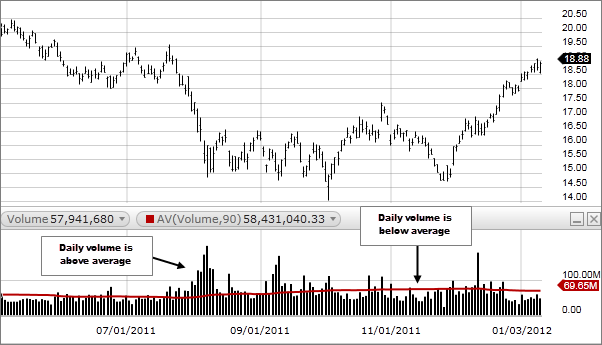

The average stock trading volume serves as a crucial indicator of a company’s market activity. It informs investors about how actively a stock is bought and sold over a specified period, typically 30 days. This metric is particularly significant for traders looking to gauge liquidity in stocks, as higher volumes often indicate that a stock can be traded with greater ease. For instance, Strategy’s impressive 30-day average stock trading volume to market capitalization ratio, which stands at 7.2%, is indicative of robust trading activity. In contrast, stocks like Tesla exhibit much lower ratios, emphasizing the differences in trading dynamics among tech giants.

Such stock trading metrics allow investors to assess not just the value of a company, but how frequently its shares are being exchanged. With Strategy outperforming competitors like Tesla and Nvidia in this regard, it highlights its potential as a liquid asset in the stock market. By understanding these variables, traders can make more informed decisions, tailoring their strategies based on stock performance relative to market capitalization.

Michael Saylor’s Advocacy for Stock Liquidity

Michael Saylor, renowned for his bullish stance on Bitcoin, has also emphasized the importance of liquidity in stocks, particularly for his company Strategy. By sharing the news of Strategy’s market capitalization ratio and trading volume, Saylor underlines how Bitcoin has enhanced his company’s financial fluidity. This strategic communication not only elevates investor confidence but also positions Strategy as a formidable player in the stock market landscape. Saylor’s insights are particularly valuable as he bridges the gap between cryptocurrency and traditional equity trading.

Saylor’s approach reflects a larger trend among investors who are increasingly looking at liquidity as a critical factor in their trading strategies. With Strategy’s high trading volume ratio relative to its market cap, it evokes interest from both crypto enthusiasts and traditional investors. The ability to swiftly enter and exit positions in stocks, as demonstrated by Strategy, can spell the difference between profit and loss, making Saylor’s advocacy for liquidity vital for contemporary trading.

Comparing Market Capitalization Ratios Among Tech Giants

The market capitalization ratio serves as an essential metric for comparing stocks across the industry, revealing insights beyond mere price tags. By evaluating the trading volume to market capitalization ratios of prominent companies, it’s evident that Strategy’s 7.2% stands in stark contrast to Tesla’s 2.3%, Nvidia’s 0.7%, and other major players. This considerable difference indicates that investors may perceive Strategy as a more dynamic investment opportunity, which could influence trading habits and stock performance moving forward.

When analyzing such metrics, it’s important to consider why certain companies like Nvidia and Tesla lag in trading volume. Factors may include volatility, market sentiment, or a shift in investor focus towards emerging technologies like blockchain. Strategy’s current trajectory showcases the advantages it has in attracting traders who prioritize liquidity and stock trading metrics. These dynamics can ultimately redefine how investors approach established tech firms versus new market entrants.

Stock Trading and Its Impact on Investment Decisions

Understanding stock trading volume is vital for making informed investment decisions. With Strategy’s remarkable average stock trading volume ratio, investors might be drawn to this company due to its demonstrated liquidity characteristics. High trading volume can provide confidence that there will be buyers or sellers available when one wants to execute a trade, which is crucial for maximizing returns. In contrast, tech stocks with lower trading metrics can pose risks for investors looking to pivot quickly.

Investors must weigh the implications of trading volume against other metrics like market capitalization, indicating a stock’s valuation. As markets fluctuate, companies like Strategy are attracting attention, particularly among those observing the interplay between tech innovation and trading liquidity. Hence, stock trading decisions should consider a holistic view of metrics to identify the most promising investment avenues.

The Role of Liquidity in Modern Trading Strategies

Liquidity is an essential aspect of trading strategies in today’s fast-paced stock market. A high average stock trading volume indicates that a stock can be easily bought or sold, which is particularly attractive to active traders. In the case of Strategy, the 7.2% trading volume to market cap ratio signifies that it is a stock of significant interest, allowing traders to execute orders without causing hefty price movements. This liquidity fosters a competitive environment, encouraging traders to engage more with stocks that exhibit such vigorous trading metrics.

Moreover, liquidity impacts how investors perceive risks associated with an asset. With a liquid stock, investors can feel secure knowing they can enter or exit positions effortlessly, reducing anxiety in volatile market conditions. Strategy’s performance in trading metrics not only encapsulates its current market posture but also projects confidence to potential investors who value liquidity in stocks as a key determinant for their trading strategies.

Analyzing Tesla’s Stock Trading Performance

Tesla, despite being one of the world’s leading companies, showcases a lower average stock trading volume to market capitalization ratio at 2.3%. This surprising statistic might indicate that, while Tesla has a robust brand and market influence, it does not attract as much frequent trading activity relative to its size. Investors might find this concerning, particularly when comparing it to Strategy’s more vigorous trading dynamics. Understanding these metrics is essential for those considering investing in Tesla versus exploring opportunities like Strategy.

The lower trading ratio may be connected to multiple factors, such as investor sentiment, market cycles, and Tesla’s own volatility. As the tech landscape evolves, Tesla must adapt to varying market conditions, or face the risk of knowing that its current trading performance may deter some potential investors. In contrast, the high trading volume ratio of companies like Strategy could entice those looking for more accessible investment options in tech.

Future Outlook for Strategy and Its Competitors

As the stock market constantly evolves, Strategy’s impressive trading volume and liquidity metrics position it favorably against some of the largest companies. With the ever-increasing focus on tech innovation and assets like Bitcoin, companies that demonstrate strong trading performance, reflected in high trading volume to market capitalization ratios, are likely to gain investor attention. Investors are increasingly drawn to emerging players, especially those showing resilience and agility in their trading patterns.

The future outlook for companies like Strategy suggests potential growth, especially as it adapts to market fluctuations and endorses liquidity as a core component of its strategy. Investors analyzing market capitalization ratios and stock trading metrics will increasingly factor these elements into their decision-making processes, thereby influencing the competitive landscape. In the long run, the capacity for high liquidity and trading volume could establish Strategy as not just a participant, but a leader within its sector.

Significance of Stock Metrics in Investment Planning

Stock metrics like average trading volume and market capitalization ratios play a fundamental role in forming investment strategies. They guide investors in selecting stocks that not only show promise but also offer a stability that allows for confident trading decisions. The respective ratios of companies, such as Strategy’s 7.2% against competitors like Tesla, enable investors to compare performance effectively and strategize accordingly. The nuances of trading metrics pivot Stock investors’ focus towards opportunities that promise not just growth but sustained engagement.

Moreover, integrating these stock trading metrics into financial planning can optimize an investor’s portfolio. Savvy investors look for opportunities that extend beyond growth potential, seeking robust liquidity characteristics that ensure flexibility in trading strategies. As the battle for investor capital intensifies, companies that prioritize effective stock trading metrics will likely position themselves favorably, cementing their status in an increasingly discerning market.

How Market Sentiment Influences Stock Trading Volumes

Market sentiment is a powerful force that can dramatically influence stock trading volumes. When investors’ perceptions are positive, stocks often witness increased trading activity, reflecting a collective demand for the asset. Strategies that align with current market sentiments can lead to elevated average stock trading volumes. Factors such as news cycles, economic forecasts, and even social media trends can contribute to this sentiment, ultimately impacting trading metrics like Strategy’s assertive 7.2% ratio.

Conversely, bearish sentiment can diminish trading volume and liquidity, as investors become more hesitant to buy into stocks they perceive as volatile or risky. Thus, understanding the psychological elements of trading alongside quantitative metrics is essential for traders looking to capitalize on market behaviors. Strategy’s current performance could be indicative of a favorable sentiment toward tech and crypto innovation, which may sustain its valuation and trading dynamics moving forward.

Frequently Asked Questions

What is the average stock trading volume, and why is it important?

The average stock trading volume refers to the average number of shares traded in a given time period, typically calculated over 30 days. It is a crucial stock trading metric as it reflects the liquidity in stocks; higher trading volumes often indicate greater investor interest and can lead to more stable price movements.

How does the average stock trading volume relate to market capitalization ratio?

The average stock trading volume to market capitalization ratio provides insights into a company’s liquidity in stocks. A higher ratio, like Strategy’s 7.2%, suggests that a significant portion of the company’s market value is actively traded, making it more accessible for investors compared to companies like Tesla or Nvidia with lower ratios.

What can investors learn from comparing average stock trading volumes of companies like Tesla and Nvidia?

Comparing average stock trading volumes helps investors gauge the liquidity and trading activity of different stocks. For example, Tesla’s 2.3% trading volume to market capitalization ratio indicates that its shares are actively traded, but it lags behind Strategy’s 7.2%, which may suggest better liquidity.

Why is Michael Saylor’s statement about Strategy’s liquidity significant?

Michael Saylor’s statement highlights the importance of the average stock trading volume in assessing company liquidity. By boasting a 7.2% trading volume to market capitalization ratio, Strategy is positioned as a more liquid investment compared to major players like Tesla, which can attract more investors looking for active and liquid stocks.

What factors can affect a company’s average stock trading volume?

Several factors can influence a company’s average stock trading volume, including market trends, company news, earnings reports, investor sentiment, and overall economic conditions. High-profile endorsements or comments from figures like Michael Saylor can also impact trading dynamics significantly.

How can investors use average stock trading volume to make better investment decisions?

Investors can analyze average stock trading volume to assess the liquidity and volatility of stocks. A higher average trading volume typically signifies that the stock can be bought or sold with minimal price impacts, allowing investors to execute trades efficiently, as seen with Strategy’s strong performance in comparison to Tesla’s lower volume.

| Company | Average Stock Trading Volume to Market Capitalization Ratio (%) |

|---|---|

| Strategy | 7.2 |

| Tesla | 2.3 |

| Nvidia | 0.7 |

| Meta | 0.8 |

| Amazon | 0.3 |

| Microsoft | 0.3 |

| Apple | 0.3 |

| 0.2 |

Summary

The average stock trading volume is a critical indicator of liquidity, and Strategy’s recent achievement of a 30-day average stock trading volume to market capitalization ratio of 7.2% highlights its strong market presence. This ratio not only surpasses major players like Tesla and Nvidia but also reflects how the adoption of Bitcoin has enhanced Strategy’s liquidity, positioning it favorably against other tech giants.