Author: Bpay News

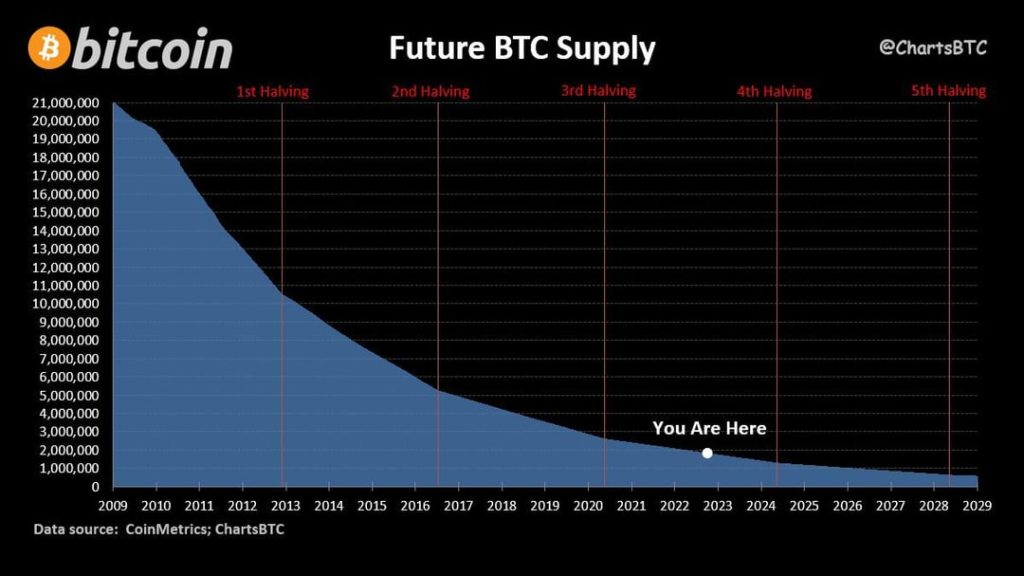

Bitcoin supply is a critical concept that influences the dynamics of the cryptocurrency market.Recent reports indicate that bitcoin whales, or large holders, are significantly impacting the overall distribution of BTC, with addresses holding between 10 and 10,000 bitcoins constituting 68.04% of the total supply, a record low in nine months.

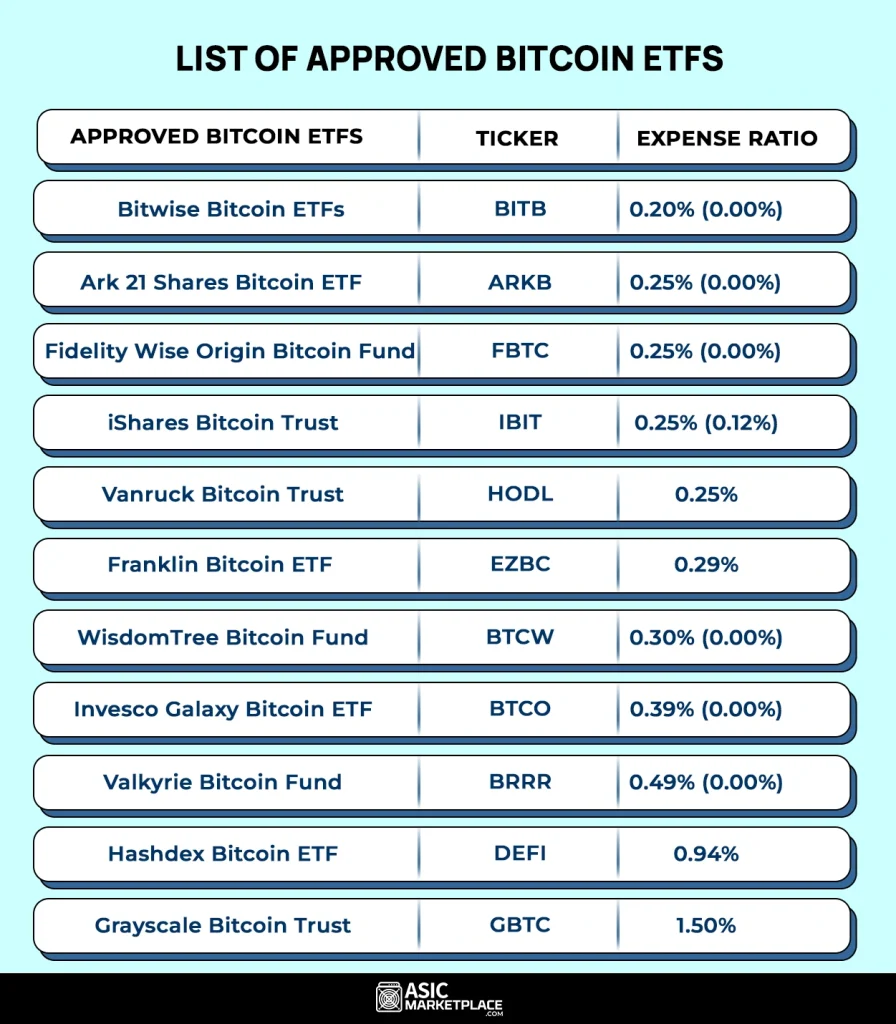

Bitcoin ETFs are currently at the forefront of financial discussions, especially as they face substantial outflows—totaling nearly $1 billion in just two days.This surge in withdrawals has raised concerns among investors about the impact of ETFs on Bitcoin’s volatility and its price trends, particularly as the price of Bitcoin recently dipped following high inflows earlier in the week.

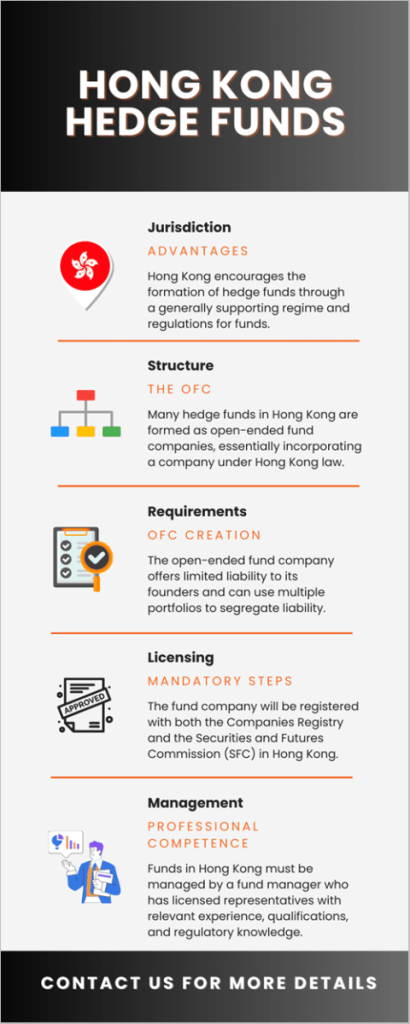

Hong Kong non-crypto hedge funds are increasingly making headlines as they navigate turbulent waters in the financial markets.Recent events suggest that these traditional investment vehicles might have an unexpected impact on market dynamics, particularly through their activities in IBIT leveraged options trading.

The Bitcoin accumulation strategy has become increasingly prominent as investors seek stability amidst the volatile crypto market downturn.Even in these turbulent times, Metaplanet CEO Simon Gerovich remains unwavering in the company’s commitment to this strategy, emphasizing its importance for long-term growth.

The BTC-USDT leverage ratio has emerged as a crucial metric in understanding current market dynamics as traders navigate the volatile waters of cryptocurrency.Recent discussions from CryptoQuant CEO Ki Young Ju indicate that this ratio is experiencing a cooling trend, suggesting a shift in trading behaviors.

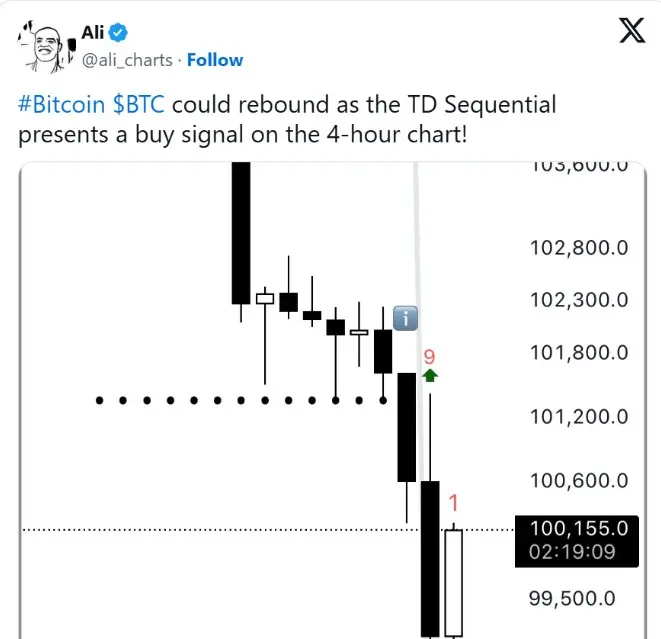

BTC rebound is making headlines as the cryptocurrency surges past the 65,000 USDT mark, showcasing a significant recovery that has caught the attention of investors.Recent Bitcoin price news indicates that this rebound comes as the market adjusts to ongoing fluctuations, with the latest statistics showing a narrowed 24-hour decline of just 8.7%.

Silver Thursday marks a pivotal moment in the history of the silver commodity market, occurring on March 27, 1980.On this day, the COMEX implemented critical regulatory measures that altered the landscape of silver trading, particularly in response to the dramatic actions of the Hunt brothers who attempted to corner the market.

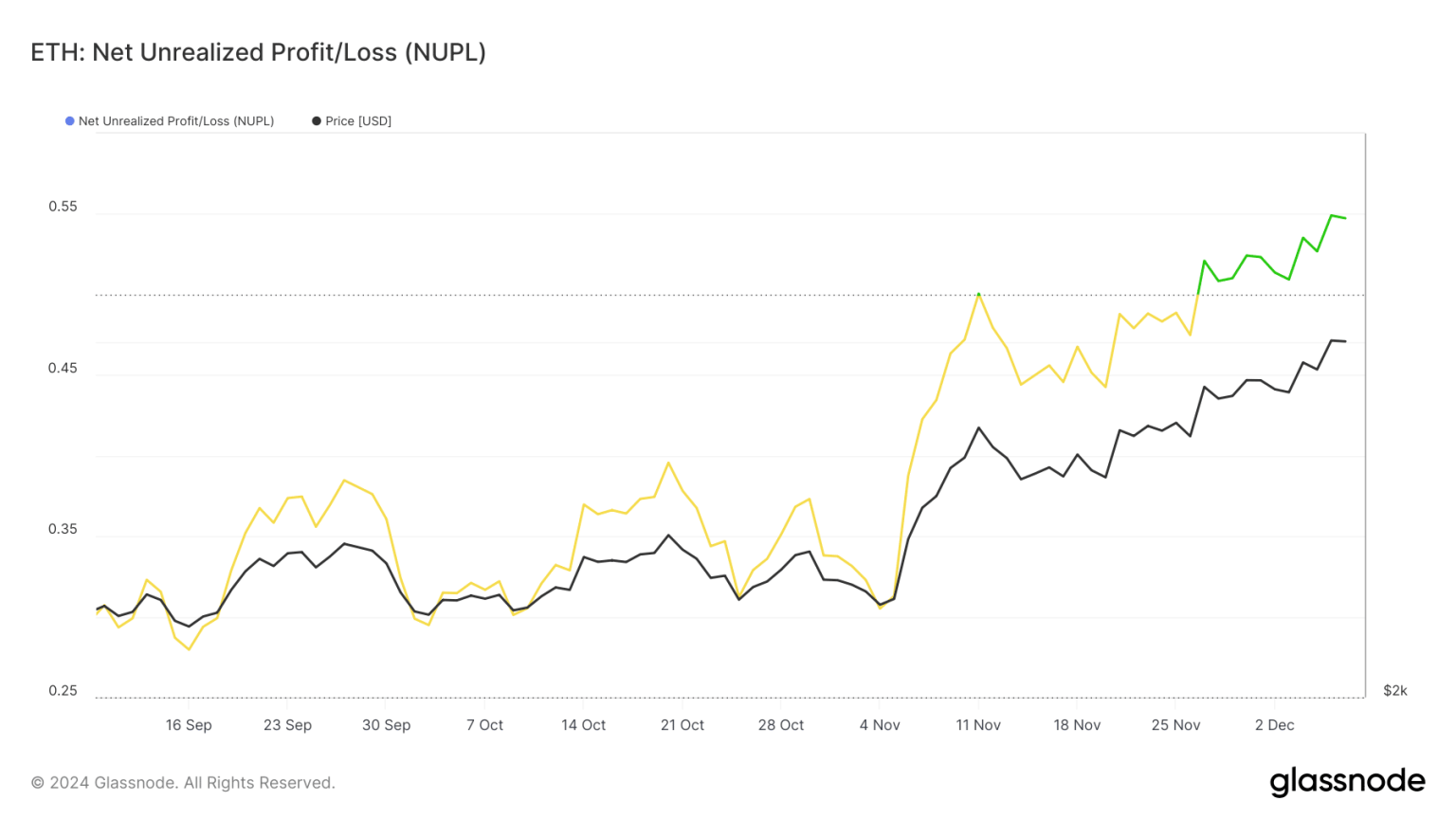

Recent reports highlight a staggering ETH loss of $763 million endured by Trend Research as the firm navigates the volatile waters of cryptocurrency trading.This unfortunate turn of events follows a previous successful bet on Ethereum, where the firm profited $315 million before facing this significant downturn.

Today marks a significant event in the cryptocurrency market as $2.1 billion in BTC options and $420 million in ETH options reach their expiry.With approximately 33,000 BTC options set to expire, traders are closely monitoring the dynamics, especially with a Put Call Ratio resting at 0.54.

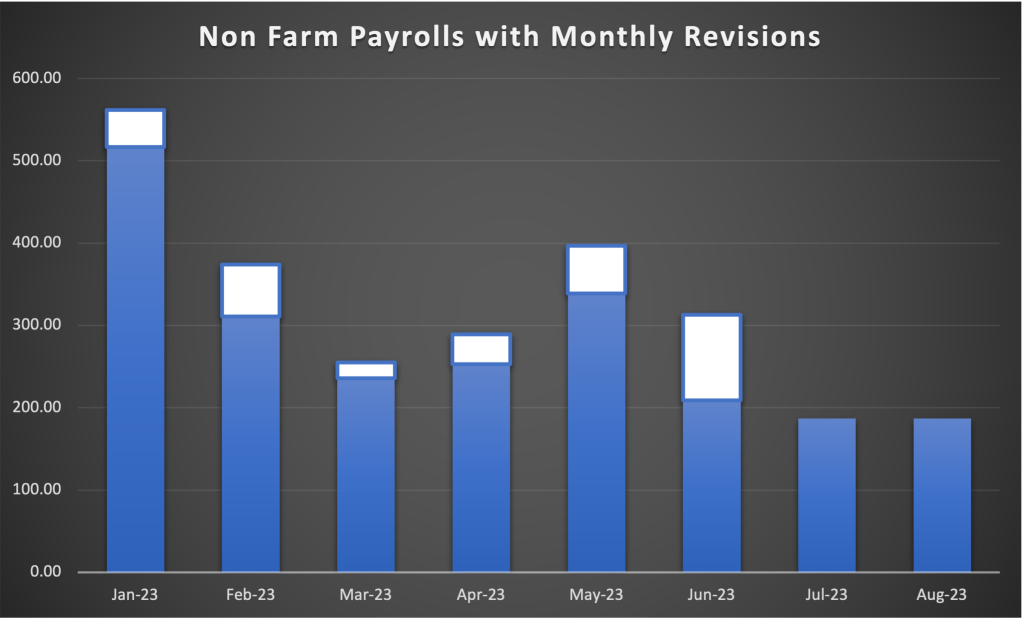

The U.S.non-farm payroll data is a crucial indicator of economic health, reflecting the number of jobs added or lost in the economy, excluding farm workers and certain other job categories.