BTC rebounds impressively, breaking through the $66,000 mark, signaling a positive shift in the cryptocurrency landscape. Recent market analysis shows a narrowing 24H decline of only 6.72%, highlighting the resilience of Bitcoin despite recent fluctuations. In this BTC price update, investors are keenly watching how the market reacts to this rebound, and many are optimistic about the potential recovery ahead. As Bitcoin trading news unfolds, traders are analyzing trends and movements that could impact future valuations. Stay tuned for deeper insights into how this BTC rebound could influence the broader Bitcoin market and overall investment strategies.

In the ever-evolving world of digital currencies, Bitcoin is once again making headlines with its notable resurgence. With its latest rally moving past the $66,000 threshold, Bitcoin is sparking interest among investors and traders alike. The analysis of the previous day’s price action shows a modest decline, yet the recent recovery indicates strong market support. Cryptocurrency enthusiasts are eagerly consuming trading updates and speculating on the factors driving this bullish trend. Understanding these dynamics is crucial as the market adjusts to the changing tides of Bitcoin’s performance.

| Date | Price (USDT) | 24H Decline (%) | Market Analysis |

|---|---|---|---|

| 2026-02-06 | 66,020.4 | 6.72% | BTC rebounds above 66,000 USDT level, indicating potential market recovery. |

Summary

BTC rebounds successfully above the 66,000 USDT mark, demonstrating signs of market recovery despite a recent decline. As the 24-hour decline narrows to 6.72%, this could signify a positive shift in sentiment among investors, indicating that BTC may continue to stabilize and even rise further in the upcoming days.

BTC Rebounds Beyond 66,000 USDT

On February 6, 2026, Bitcoin (BTC) demonstrated significant resilience by rebounding and crossing the crucial level of 66,000 USDT. This recovery marks a pivotal moment for investors who have closely monitored the volatile nature of the cryptocurrency market. As the BTC price update indicates, the current valuation stands at 66,020.4 USDT, reflecting a robust comeback amid challenging market conditions. The rebound is particularly notable given the broader economic landscape, where fluctuations in trading volumes and regulatory actions continue to impact digital asset prices.

The BTC rebound signals not only a recovery in price but also renewed confidence among traders and investors alike. Recent Bitcoin market analysis suggests that the narrowing of the 24H decline, which is now at 6.72%, may indicate a stabilizing phase for Bitcoin. For many market participants, the price movement can be interpreted as a buying opportunity, particularly as analysts predict potential upward trends should the support level hold. Keeping a keen eye on BTC trading news in the upcoming days will be essential for those looking to capitalize on this volatile yet lucrative market.

Understanding the 24H Decline in BTC Value

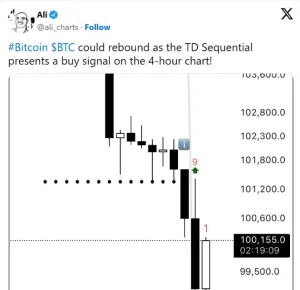

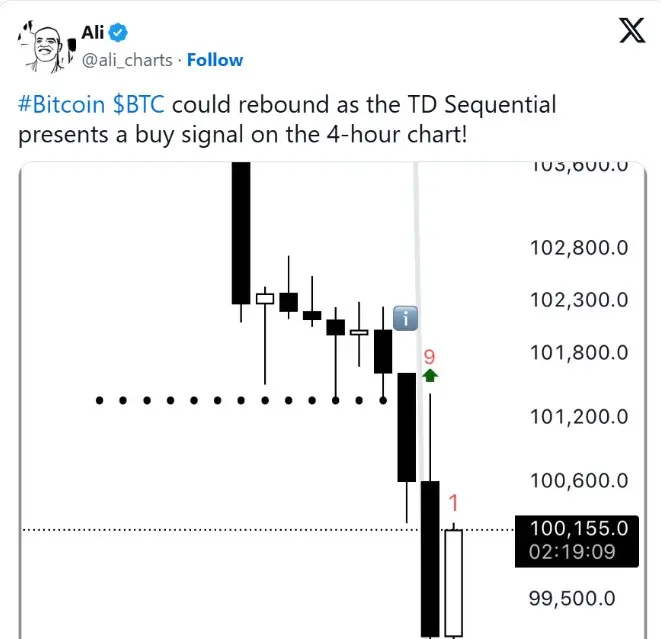

The recent decline of 6.72% in BTC’s value over the past 24 hours has raised concerns among investors regarding the cryptocurrency’s short-term outlook. Analyzing this decline through the lens of previous BTC price updates reveals patterns that traders must consider when making decisions. Factors contributing to these fluctuations include market sentiment, regulatory news, and external economic indicators, which collectively influence BTC’s trading dynamics. A thorough examination of these elements can provide insights into whether this is a mere correction or part of a broader bearish sentiment in the market.

In examining the reasons behind the 24H decline, it’s crucial to consider the role of market volatility that has characterized Bitcoin’s trading history. The recent trends in Bitcoin market analysis highlight both bullish and bearish sentiments, suggesting that traders remain divided on Bitcoin’s future trajectory. Understanding the nuances behind BTC’s price movements, especially after a rebound, can be pivotal for gauging the timing of buys and sells. The ongoing analysis of BTC trading news will provide essential intelligence for navigating potential market shifts successfully.

Bitcoin Market Analysis: Current Trends and Predictions

Current trends in Bitcoin trading reveal a complex landscape as the cryptocurrency adapts to various market pressures. The latest Bitcoin market analysis has pointed to a growing number of institutional investors entering the space, which could explain some of the recent volatility. Analysts predict that as institutional involvement increases, Bitcoin may see more substantial price corrections, followed by rebounds. Understanding these dynamics is crucial for making informed decisions in the crypto sphere, as large players can significantly sway market movements, further complicating BTC’s price path.

Furthermore, ongoing advancements in blockchain technology and wider acceptance of Bitcoin as a payment method are contributing factors in this evolving scenario. Stakeholders are cautiously optimistic, eyeing the potential for BTC to establish new support levels following its rebound past 66,000 USDT. Predictions within the Bitcoin trading news realm suggest that sustained upward momentum could encourage a revival in investor interest. Keeping tabs on market shifts and technological innovations will be critical for anyone looking to navigate the upcoming Bitcoin landscape.

The Role of Institutional Investors in Bitcoin Trading

Institutional investors are increasingly becoming major players in the Bitcoin market, wielding considerable influence on price movements. Their entry into Bitcoin trading marks a significant shift from retail-focused trades to a more diversified investment landscape. This change helps in stabilizing Bitcoin’s price direction, especially following the recent rebound. The confidence displayed by these entities has the potential to attract further investments, pushing BTC towards new all-time highs, if market conditions remain favorable.

Additionally, the presence of institutional investors typically promotes a more structured trading environment, reducing the severity of price fluctuations commonly seen with retail trading alone. Such dynamics are essential when analyzing Bitcoin’s market trends post-rebound. Many believe that as more hedge funds and traditional financial institutions adopt Bitcoin into their portfolios, the previous volatility will diminish over time, leading to a more mature and balanced market. Observations of institutional buying patterns in current BTC trading news can further elucidate potential future movements for the cryptocurrency.

Bitcoin’s Resilience Amidst Market Volatility

Bitcoin has consistently demonstrated resilience even in the face of significant market volatility. The recent rebound beyond the 66,000 USDT mark exemplifies this characteristic clearly. Despite the 24-hour decline of 6.72%, BTC’s ability to recover indicates that many investors remain committed to its long-term potential. This is particularly important as the cryptocurrency market often faces unpredictable price swings that can shake investor confidence.

Such resilience is not only pivotal for Bitcoin’s price performance but also serves as a psychological boost for both current and prospective investors. Engaging in comprehensive Bitcoin market analysis provides insights into how BTC navigates these turbulent waters, highlighting the factors that contribute to its sustained appeal. News regarding potential regulatory changes or macroeconomic factors tends to shape trader sentiment, influencing the next steps in Bitcoin’s journey toward price stability.

Adapting to Bitcoin Market Changes

For many investors, adapting to the ongoing changes in the Bitcoin market is essential for maximizing potential gains. The recent BTC rebound serves as a reminder that timing and market awareness can heavily influence investment outcomes. Investors need to stay informed on the latest Bitcoin trading news to understand how external factors might trigger shifts in market dynamics. Additionally, utilizing advanced trading techniques and tools can help investors navigate the complexities of the crypto landscape more effectively.

As BTC experiences both ups and downs, employing strategies that account for its inherent volatility becomes crucial. This includes setting stop-loss orders to mitigate risks when declines occur. The latest Bitcoin market analysis offers valuable indicators and forecasts that can guide traders in making sound decisions. By enhancing their knowledge and adaptability, investors can better position themselves to seize opportunities arising from BTC’s price fluctuations, especially after significant rebounds.

The Importance of Market Sentiment in Bitcoin Trading

Understanding market sentiment is a key component of effective Bitcoin trading. The impact of investor psychology on Bitcoin’s price movements means that interpreting sentiment can often lead to smarter trading decisions. The recent drop in value, followed by a rebound beyond 66,000 USDT, reflects fluctuating emotions within the trading community. Positive sentiment following the rebound may encourage increased buying pressure, while negative sentiment could lead to profit-taking, illustrating the direct relationship between sentiment and BTC’s pricing.

Furthermore, analyzing Bitcoin trading news can help investors gauge market sentiment, offering insights into how different factors influence trader behavior. Social media trends, news headlines, and market commentary all contribute to shaping perceptions around Bitcoin’s value. By sensitively observing and interpreting these sentiments, traders can adapt their strategies to align with market movements, hopefully optimizing their entry and exit points. This level of awareness is vital for navigating a landscape characterized by volatility and rapid price changes.

Future Predictions for Bitcoin Post-Rebound

Looking ahead, the future of Bitcoin post-rebound appears promising, contingent upon various factors such as market demand and investor sentiment. The recent breakthrough over 66,000 USDT signifies more than just a price increase; it suggests a potential return of bullish momentum. Should trading conditions remain favorable, analysts predict that BTC could test new price ceilings, fueled by both retail and institutional investments. The ongoing Bitcoin market analysis emphasizes the importance of closely monitoring future price movements to gauge potential recovery paths.

Moreover, upcoming technological advances, such as improvements in transaction processing and scalability, could further enhance Bitcoin’s appeal. Such developments are likely to play a key role in driving demand, especially as Bitcoin garners more mainstream acceptance. Keeping abreast of columnists and analysts providing insights into future BTC price updates will aid investors in preparing for what lies ahead. As always, informed decision-making will be instrumental in navigating Bitcoin’s uncertain yet exciting journey in the cryptocurrency landscape.

Navigating Risks in Bitcoin Investments

Investing in Bitcoin comes with inherent risks that demand careful navigation from potential traders. The recent 24H decline of 6.72% is a stark reminder of Bitcoin’s volatility, prompting investors to exercise caution when entering or exiting positions. Effective risk management strategies, such as setting stop-loss orders and diversifying investments, are essential to mitigate losses. In the face of risky market behavior, investor education becomes a critical tool for understanding how both macroeconomic and market-specific factors influence BTC’s trading dynamics.

Additionally, continuous analysis of Bitcoin trading news can provide crucial information about market trends and potential red flags. Tools such as technical analysis charts and sentiment indicators can lend valuable insights into Bitcoin’s trading patterns and anticipated movements. Ultimately, successful investors tend to blend both research and hands-on experience, taking proactive steps to manage risks while capitalizing on Bitcoin’s market opportunities.

Frequently Asked Questions

What does it mean when BTC rebounds and breaks through 66,000 USDT?

When BTC rebounds and breaks through 66,000 USDT, it indicates a recovery from previous declines, signaling positive market sentiment. As the price stabilizes above this threshold, it may attract more investors and influence future price movements in the Bitcoin market.

How significant is the 6.72% 24H decline in relation to BTC rebounds?

The 6.72% 24H decline, in context with BTC rebounds, suggests that while there was a drop, the narrowing of the decline indicates a potential stabilization and recovery phase. This can be interpreted as a sign of resilience in Bitcoin’s price action after recent fluctuations.

What should traders consider after BTC rebounds above 66,000 USDT?

Traders should monitor the Bitcoin market analysis for trends and resistance levels after BTC rebounds above 66,000 USDT. It’s crucial to assess trading volumes and market sentiment to make informed decisions, especially when analyzing potential support or resistance points.

What impact does BTC’s recent price changes have on Bitcoin trading news?

Recent price changes, including BTC rebounds, significantly influence Bitcoin trading news by attracting attention from investors. Market analyses focusing on this rebound can lead to increased trading activity and discussions around Bitcoin’s future price trajectory.

What are the implications of BTC rebounds on future Bitcoin price updates?

BTC rebounds are often predictive of bullish trends in Bitcoin price updates. A rebound above key levels like 66,000 USDT may lead analysts to forecast more sustained price growth, making subsequent updates crucial for understanding potential market shifts.