XAUt withdrawal has emerged as a critical topic in the realm of cryptocurrency, especially in the context of gold-backed digital assets. Recently, a significant movement of nearly 1,500 XAUt was recorded from the Gate hot wallet, translating to an impressive valuation of approximately $7.1 million. This substantial transaction highlights the growing interest in on-chain gold assets amidst fluctuating gold prices. Moreover, the liquidity offered by platforms like Gate makes them pivotal in the landscape of crypto gold trading, enabling efficient withdrawal processes. As investors seek stable alternatives in financial markets, the significance of XAUt and its withdrawals from exchanges can’t be underestimated.

The recent movement of XAUt from exchange wallets raises intriguing questions about the future of gold-backed cryptocurrencies and their role in financial transactions. In particular, the transfer worth over $7 million underscores the heightened interest in securing on-chain gold assets amidst evolving market conditions. This scenario not only reflects the robust trading environment established by platforms like Gate but also emphasizes the increasing demand for cryptocurrency withdrawals tied to physical assets like gold. The surge in activity showcases how such digital currencies are becoming essential tools for gold price discovery, appealing to a diverse range of investors. As the integration of traditional finance and digital assets continues, the dynamics surrounding crypto gold trading are poised for significant transformation.

| Key Point | Details |

|---|---|

| XAUt Withdrawal Amount | 1,499.999307 XAUt (approximately $7.1446 million) |

| Transaction Date and Time | February 6, 2026, at 12:15 (UTC+8) |

| Transfer Addresses | From: 0x0D0…492Fe to 0x3ab9…F84f |

| Market Context | Increased trading of on-chain gold assets, with high liquidity observed on Gate platform. |

| Significance of Withdrawal | Potentially the first large single transfer of XAUt to a self-custody address. |

| Industry Rank | Gate consistently ranks among the top three for gold asset trading volumes. |

| Integration of Assets | Growing integration between traditional financial assets and crypto assets. |

Summary

XAUt withdrawal has recently gained attention following the transfer of nearly 1500 XAUt from Gate’s hot wallet, valued at approximately $7.1446 million. This significant transaction highlights the increasing activity and integration between traditional finance and the crypto market, particularly concerning gold assets. The high liquidity and ranking of Gate in gold trading further emphasize its role in on-chain capital allocation and price discovery, marking an important evolution in the landscape of digital assets.

An Overview of XAUt Withdrawal from Gate Hot Wallet

On February 6, 2026, Gate’s hot wallet recorded a significant withdrawal of 1,499.999307 XAUt, an event that highlights the growing trend of crypto investors moving their gold-backed assets into self-custody. Valued at approximately $7.1446 million, this transaction underlines the increasing confidence investors have in managing their own on-chain gold assets. As the market for gold continues to thrive amidst economic fluctuations, understanding the dynamics behind such withdrawals offers valuable insights into cryptocurrency withdrawals and asset management strategies.

The Gate hot wallet, known for its substantial trading volumes in gold assets, has been pivotal in supporting the liquidity and trading of XAUt. As the value of gold fluctuates, the withdrawal of such a significant amount indicates robust market activity. Furthermore, this action marks a trend where investors are opting for decentralized forms of asset control, moving their holdings to self-custodied wallets to protect their investments from potential risks associated with centralized exchanges.

The Impact of High Gold Prices on On-Chain Gold Trading

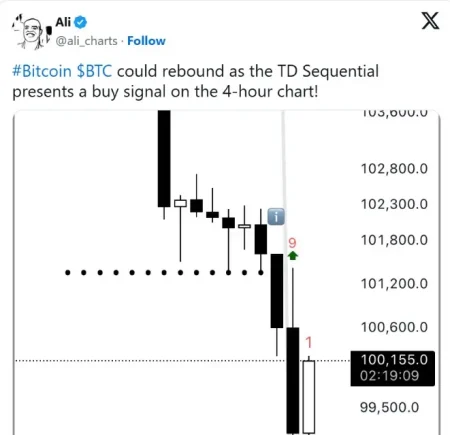

With international gold prices remaining high, there has been a marked increase in trading activity surrounding on-chain gold assets like XAUt. Gate has risen to prominence within the landscape of cryptocurrency trading, often ranking among the top exchanges for both spot and futures trading volumes. This surge in transactions demonstrates how digital assets tied to traditional commodities such as gold are becoming essential for investors seeking a hedge against inflation and market instability.

The relationship between gold price discovery and on-chain trading emphasizes the importance of platforms like Gate in the evolving financial sphere. As users engage more with on-chain gold assets, the exchange plays a crucial role in mediating these transactions, supporting liquidity, and contributing to a more transparent pricing mechanism within the gold market. In this way, Gate not only facilitates trading but also reinforces the integration of cryptocurrency into traditional asset classes, solidifying its position in crypto gold trading.

Understanding the Gate Hot Wallet’s Role in Gold Asset Management

The Gate hot wallet serves as a critical hub in the management of on-chain gold assets. By enabling quick and efficient withdrawals and deposits, this platform supports a seamless trading experience for investors dealing in XAUt. The move towards self-custody is indicative of a broader trend in the cryptocurrency landscape, where users seek greater control over their assets and the ability to respond swiftly to market changes.

Moreover, the high transaction volume and activity within the Gate hot wallet showcase its reliability and significance in the ecosystem of digital gold trading. As users increasingly turn to on-chain gold as a safe haven, the need for secure, efficient platforms that facilitate these transactions becomes paramount. Gate’s continued success in maintaining liquidity and ensuring a user-friendly interface reinforces its role as a leader in crypto gold trading.

The Future of Gold Price Discovery in a Digital Era

As cryptocurrency ecosystems evolve, the future of gold price discovery appears to be intricately linked with advancements in blockchain technologies. Gate’s significant withdrawals, such as the recent XAUt transfer, are symptomatic of larger shifts toward decentralized finance, where traditional gold trading can merge with the innovative features of the crypto market. This convergence is set to redefine how price discovery occurs, bringing unprecedented transparency and efficiency.

The implications of this shift are profound for both traders and investors alike. Engaging in cryptocurrency withdrawals and reallocating assets into gold-backed tokens allows users to navigate through volatile markets with a stable underlying asset. Consequently, as the demand for on-chain gold assets surges, trading platforms like Gate will likely continue to play a crucial role in establishing new benchmarks for gold price determination within the digital landscape.

The Importance of Liquidity in Gold Trading on Gate

Liquidity is a fundamental aspect of trading, significantly impacting the ease with which assets can be bought or sold without causing noticeable price changes. In the context of gold trading on Gate, high liquidity facilitates smoother transactions, making it an attractive platform for investors. The recent movement of nearly 1500 XAUt reflects not just investor confidence but also the strength of Gate’s liquidity to handle large trades without disruption.

For those dealing in on-chain gold assets, the ability to access liquid markets is crucial. Gate’s position among the top exchanges signifies its role in ensuring users can execute trades efficiently. As more investors recognize the advantages of integrating cryptocurrency and traditional commodities, the demand for liquidity will only escalate, solidifying Gate’s strategic importance in the landscape of gold trading.

Navigating the Challenges of Cryptocurrency Withdrawals

While platforms like Gate offer numerous advantages for gold trading, navigating the challenges associated with cryptocurrency withdrawals remains a critical concern for users. Security, transaction fees, and processing times are among the factors that can complicate the withdrawal process, especially when moving large amounts like the recent XAUt withdrawal. Ensuring that investors are aware of these considerations can help manage their expectations and safeguard their assets.

Furthermore, as the exchange experience continuously evolves, Gate must prioritize building trust among its user base. Implementing advanced security measures and transparent fee structures for cryptocurrency withdrawals can enhance user confidence. As the landscape of on-chain gold assets continues to expand, addressing these challenges will be key for Gate to maintain its reputation as a leading platform in the crypto gold trading arena.

The Shift Towards Self-Custody in Gold Investments

The shift towards self-custody among investors in gold-backed cryptocurrencies like XAUt represents a significant evolution in asset management strategies. By moving assets out of centralized exchanges into personal wallets, individuals are taking proactive steps to protect their investments from potential mismanagement or third-party risk. The recent withdrawal from Gate’s hot wallet exemplifies this trend, showcasing a growing preference for direct ownership.

As more investors adopt self-custody practices, the implications for trading platforms such as Gate will be profound. The capacity to facilitate secure and efficient transfers will be crucial to attracting users who prioritize control over their assets. Additionally, as this trend grows, exchanges may need to innovate by offering tailored services, education, and resources that empower users to manage their gold investments effectively.

Capital Allocation Strategies in the Crypto Gold Market

Successful capital allocation in the crypto gold market requires an understanding of both traditional commodities and cryptocurrency dynamics. The high liquidity seen on platforms like Gate provides investors with numerous investment avenues and strategies to maximize returns on on-chain gold assets. As investors assess market conditions, the ability to diversify holdings into gold-backed tokens offers a compelling way to hedge against risks inherent in the crypto landscape.

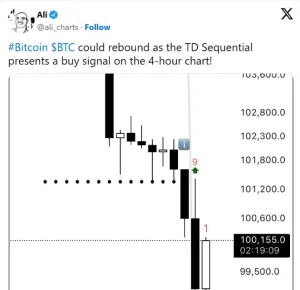

Investors must remain vigilant in monitoring gold price movements, as they directly impact the value of XAUt. By leveraging the insights from on-chain data and trading volumes, traders can make informed decisions about when to allocate or withdraw capital. This approach not only aids in effective asset management but also enhances overall participation in the increasingly intertwined markets of gold and cryptocurrency.

The Role of Gate in Shaping the Future of On-Chain Gold Trading

Gate has firmly established itself as a primary arena for on-chain gold trading, positioning itself at the forefront of integrating traditional assets with cryptocurrency. The significant XAUt withdrawal highlights the platform’s role in facilitating large transactions, reinforcing its reputation as a trusted exchange for gold-backed cryptocurrencies. With ongoing developments and regulatory changes, Gate is poised to adapt and continue shaping the cryptocurrency landscape.

As the demand for gold as a digital asset grows, Gate’s competitive edge will depend on its ability to innovate and enhance its service offerings. By focusing on user experience, security, and liquidity, Gate can ensure its place as a leader in the crypto gold trading environment. Ultimately, the interplay of traditional commodities with on-chain trading will redefine investment opportunities in the future.

Frequently Asked Questions

What is XAUt withdrawal and how does it work?

XAUt withdrawal refers to the process of transferring XAUt, a tokenized form of gold, from a crypto wallet, typically from platforms like Gate. This process allows users to access their on-chain gold assets and convert them to fiat currency or other cryptocurrencies. By maintaining high liquidity, Gate ensures seamless cryptocurrency withdrawals for its users.

How does the Gate hot wallet facilitate XAUt withdrawals?

The Gate hot wallet plays a crucial role in facilitating XAUt withdrawals by securely holding and transferring on-chain gold assets. Recent transactions, such as the withdrawal of nearly 1500 XAUt valued at approximately $7.1446 million, highlight the wallet’s capability to manage significant transactions efficiently, further supporting crypto gold trading.

What implications does the recent XAUt withdrawal from Gate have on gold price discovery?

The recent XAUt withdrawal from Gate, particularly the transfer of 1,499.999307 XAUt, underscores the active trading environment in the on-chain gold asset market. As Gate ranks among the top platforms for gold trading, such withdrawals contribute to enhanced gold price discovery through increased market participation and liquidity.

Can I withdraw XAUt directly to a self-custody address?

Yes, you can withdraw XAUt directly to a self-custody address. The significant withdrawal of XAUt from the Gate hot wallet indicates that users are choosing to secure their on-chain gold assets in personal wallets, allowing for greater control over their cryptocurrency withdrawals.

How does Gate maintain liquidity for XAUt and other on-chain gold assets?

Gate maintains liquidity for XAUt and other on-chain gold assets by consistently ranking in the top three exchanges for spot and futures trading volumes. The exchange’s large user base and active participation in gold trading ensure that users can efficiently execute XAUt withdrawals and transactions.

What are the benefits of using Gate for crypto gold trading and XAUt withdrawals?

Using Gate for crypto gold trading and XAUt withdrawals provides several benefits, including high liquidity, competitive trading volumes, and a user-friendly interface. These features make it easier for users to trade on-chain gold assets and manage their withdrawals effectively.

Is XAUt a secure asset for cryptocurrency withdrawals?

XAUt, backed by actual gold reserves, is considered a secure asset for cryptocurrency withdrawals. The backing ensures that users have a stable value holding while participating in the growing market for on-chain gold assets, such as XAUt transactions through Gate.

What trends are influencing XAUt withdrawal activity on trading platforms like Gate?

Current trends such as rising international gold prices and increasing integration of traditional and crypto assets are influencing XAUt withdrawal activity on platforms like Gate. These factors drive user engagement and the frequency of withdrawals related to on-chain gold assets.