ETH liquidation has recently taken center stage in the cryptocurrency landscape, particularly highlighted by the staggering 27.88 million dollars that were liquidated in the past hour alone. As the crypto market experiences volatile shifts, reports from January 2026 reveal that the total network liquidations reached over 70 million dollars, stirring significant interest among investors and analysts alike. This surge in liquidation events in crypto has raised questions about market trends and the stability of major assets, including BTC, which also faced substantial liquidation totaling 26.29 million dollars. With ongoing cryptocurrency liquidation news presenting a mix of opportunities and risks, understanding these fluctuations is crucial for both traders and enthusiasts. Keeping an eye on ETH liquidations in January 2026 is essential for anyone looking to navigate this ever-evolving market environment.

The recent phenomenon of liquidations in the crypto space has garnered attention, particularly focusing on Ethereum’s sharp downturn known as ETH liquidation. This term encapsulates the liquidation of assets when positions are forcibly closed due to adverse market movements, which has become increasingly relevant as liquidation events in the cryptocurrency sphere unfold. The latest updates show a substantial pullback in prices, as evidenced by the total of 70 million dollars liquidated in a short period. Examining these dynamics provides insight not only into ETH and BTC liquidation but also into broader market trends that can affect investors’ strategies. As we delve deeper into the intricacies of the cryptocurrency market liquidation in January 2026, the implications for both long and short-term traders become increasingly clear.

| Description | Amount Liquidated (in USD) |

|---|---|

| Total Liquidation Across Network | 70.02 million |

| ETH Liquidation | 27.88 million |

| BTC Liquidation | 26.29 million |

Summary

ETH liquidation has been a significant factor in the recent market movements, with a total of 27.88 million dollars liquidated in just one hour. This activity reflects the volatility in the cryptocurrency market, highlighting the risks involved in trading ETH. Investors should be cautious and stay informed to navigate the ever-changing landscape.

Understanding ETH Liquidation Events

ETH liquidation events can cause significant market shifts, especially during periods of high volatility. As observed recently, liquidations can exceed millions of dollars almost instantaneously, indicating high leverage positions that have been closed out as prices drop. For instance, on January 21, 2026, ETH saw liquidations of approximately 27.88 million dollars, showcasing how swiftly the cryptocurrency landscape can change, driven largely by trader sentiment and market dynamics.

These sudden liquidation events reflect the underlying volatility in the cryptocurrency market. Investors must stay informed about liquidation trends, especially with ETH liquidations, as they can provide insights into overall market sentiment. Understanding how much ETH is being liquidated during these events helps traders anticipate future market movements and adjust their strategies accordingly.

The Current Crypto Market Landscape

As of January 2026, the cryptocurrency market is experiencing notable fluctuations, with substantial liquidation events affecting both ETH and BTC. The combined total of 70.02 million dollars in liquidations within a brief period underscores the intensity of trading activity. Such market movements are often influenced by external factors, including regulatory news, macroeconomic trends, and emerging technologies within the blockchain space.

Staying updated with cryptocurrency liquidation news is crucial for traders engaged in the market. Knowing when and how much ETH and BTC are being liquidated offers a clearer picture of trading strategies that may need to be adjusted. In a market where decisions are made rapidly, being equipped with the latest information on liquidation events can be the difference between capitalizing on opportunities and suffering significant losses.

The Impact of Liquidations on ETH and BTC Prices

The impact of liquidation events on ETH and BTC prices can be profound, as seen in recent statistics from January 2026. With ETH liquidations totaling 27.88 million dollars and BTC closely following with 26.29 million dollars, the pressure created can lead to cascading sell-offs, further driving prices down. Understanding these dynamics helps traders anticipate potential price movements and strategize their entry and exit points.

Liquidation pressures from high leverage trades can exacerbate price volatility, resulting in rapid declines or spikes in cryptocurrency values. Investors need to monitor not only ETH liquidation levels but also trends concerning BTC and other cryptocurrencies, as these events create interconnected market reactions that can lead to broader repercussions in the cryptocurrency ecosystem.

Monitoring Cryptocurrency Liquidation Trends

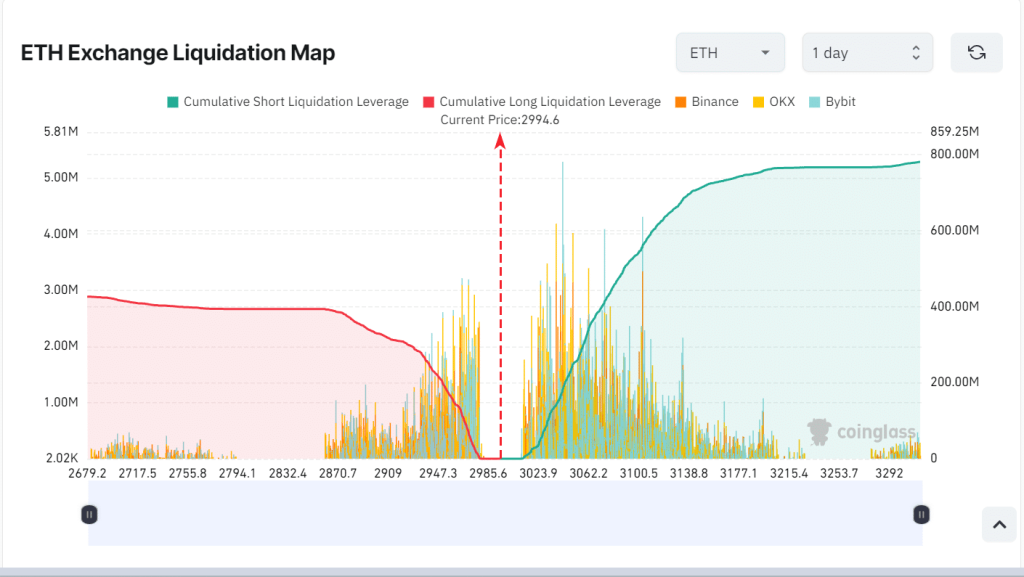

Keeping an eye on cryptocurrency liquidation trends is vital for anyone involved in trading. Platforms that report on liquidation statistics, such as Coinglass, provide insights into how much ETH and BTC are being liquidated across the market. For instance, the recent report of over 70 million dollars in liquidations highlights a significant trend that could indicate a more cautious trading environment.

Traders should utilize this data to reformulate their strategies, especially in times of increased volatility. Being aware of potential liquidation triggers, such as market announcements or price thresholds, can help mitigate losses. As the cryptocurrency market continues to evolve, understanding liquidation trends will be key to making informed trading decisions in 2026 and beyond.

Recent Cryptocurrency Market Events in January 2026

January 2026 has proven to be a tumultuous month for the cryptocurrency markets, characterized by significant liquidation events. With ETH and BTC both experiencing millions in liquidations, traders are on high alert for further changes. Such events often coincide with broader market trends and investor actions as traders react to fear and uncertainty within the market.

Moreover, these events serve as wake-up calls for risk management strategies. Traders who leverage positions frequently find themselves exposed to liquidation events, which can result in complete losses if market movement is not in their favor. This highlights the need for vigilance and strategic balanced trading practices, ensuring provisions for potential downturns in the fast-paced cryptocurrency market.

Liquidation Events: A Double-Edged Sword

Liquidation events serve as a double-edged sword within the cryptocurrency landscape. On one hand, they can provide opportunities for savvy traders to capitalize on price discrepancies following a liquidation shock. On the other hand, they pose severe risks to those who are over-leveraged and cannot react quickly enough to market shifts. With January 2026 showcasing significant liquidations across ETH and BTC, the implications are far-reaching.

Traders must recognize the dual nature of liquidations, understanding both the potential upside in terms of profit opportunities and the downside risks associated with quick market moves. Creating contingency plans and diversification within their portfolio can help mitigate risks related to liquidation events, ensuring better long-term viability in an unpredictable market.

Analyzing Liquidation Causes and Effects

Analyzing the causes and effects of cryptocurrency liquidations reveals a complex interplay of market psychology and financial mechanics. Factors such as sharp price declines, changes in investor sentiment, and external market influences can all trigger significant ETH liquidations. As witnessed on January 21, 2026, where 27.88 million dollars were liquidated due to rapid price movements, understanding these triggers is essential for traders.

The aftermath of such liquidations can induce further volatility, potentially creating a domino effect as other traders react to market reactions. By analyzing past liquidation events, traders can better predict future movements and prepare their trading strategies accordingly. A comprehensive understanding of the causes behind liquidation events can empower traders to navigate the volatile landscape of cryptocurrencies more effectively.

The Role of High-Leverage Trading in Liquidation Events

High-leverage trading is a significant contributor to the frequency and scale of liquidation events in the cryptocurrency space. With traders able to amplify their positions, even minor price fluctuations can lead to substantial liquidations. The recent ETH liquidations highlight this risky trading behavior, demonstrating how quickly a trader’s position can turn from profitable to liquidated.

Understanding the risks associated with high-leverage trading is crucial for both novice and experienced investors. To navigate such a volatile environment, traders need to be informed about their leverage and the potential consequences of market movements. Knowledge about liquidation thresholds, especially amidst extreme market conditions, will aid investors in making more rational decisions and protecting their capital in times of uncertainty.

Capitalizing on Liquidation Opportunities in the Crypto Market

Despite the risks, liquidation events can present unique opportunities for astute investors looking to capitalize on price drops. During the recent ETH liquidation of 27.88 million dollars, savvy traders could find entry points at discounted prices. These moments can often be the perfect time to buy into a cryptocurrency before a potential rebound, making thorough analysis and readiness key to maximizing profits.

Identifying and acting quickly on liquidation opportunities requires not only market knowledge but also a strong grasp of technical analysis. Traders who stay updated with potential liquidation news and market sentiment are in a better position to make strategic investments that could yield significant returns when the market stabilizes. This proactive approach often differentiates successful traders from those who succumb to market panic.

Frequently Asked Questions

What were the ETH liquidations on January 21, 2026?

On January 21, 2026, ETH liquidations amounted to approximately 27.88 million dollars as reported by Coinglass. This figure was part of a larger network total of 70 million dollars liquidated within the hour.

How do ETH liquidations affect the cryptocurrency market?

ETH liquidations can significantly impact the cryptocurrency market by increasing volatility. Events like the recent ETH and BTC liquidation on January 21, 2026, where ETH saw liquidations of 27.88 million dollars, can lead to rapid price movements and investor reactions.

Where can I find cryptocurrency liquidation news about ETH?

Cryptocurrency liquidation news, including details on ETH liquidations, can be found on financial news platforms and dedicated crypto market analysis websites like Coinglass. They provide real-time updates on liquidation events including ETH and BTC.

What are common causes of liquidation events in crypto like ETH?

Liquidation events in crypto, such as ETH liquidation, often occur due to sudden market downturns, high leverage positions, or significant sell-offs. For example, the ETH liquidations seen on January 21, 2026, were reflective of broader market movements impacting both ETH and BTC.

How do ETH and BTC liquidations typically compare?

ETH liquidations typically occur alongside BTC liquidations, as seen on January 21, 2026, where ETH liquidated 27.88 million dollars compared to BTC’s 26.29 million dollars. Such parallel liquidations demonstrate the intertwined nature of these major cryptocurrencies in the market.