As discussions around Bitcoin price forecasts heat up, traders are eyeing significant fluctuations driven by geopolitical tensions, particularly the volatility from Venezuela. Recent market analysis shows that Bitcoin has surged to $93,000 for the first time in nearly a month, a 6.6% increase in just five days. However, crypto price predictions hint at a possible retreat back to $80,000, raising cautious sentiments among investors. Bitcoin trading trends indicate a vital correlation with significant market events, which can heavily influence its price movement. Thus, understanding the underlying factors affecting Bitcoin’s trajectory is crucial for anyone looking to navigate this dynamic cryptocurrency landscape.

The ongoing discussions about Bitcoin’s future value are increasingly pertinent in the ever-evolving crypto landscape. Many investors are closely monitoring Bitcoin price movements, as regulatory shifts and external events shape trading strategies. This fluctuating environment creates a fertile ground for crypto predictions, particularly regarding how external factors like Venezuela’s market challenges are impacting Bitcoin adoption. Analysts are employing various approaches to Bitcoin market analysis, leveraging both historical data and current trends to offer insights into potential outcomes. With the stakes high, understanding these dimensions can empower traders and enthusiasts alike in making informed decisions in the digital currency arena.

Bitcoin Price Forecast and Market Analysis

The Bitcoin price forecast is pivotal in understanding the future direction of the cryptocurrency market. Recent dynamics have indicated a possible retreat to lows around $80,000, despite a recent surge to $93,000. Analysts are closely monitoring the price movement, as it could reflect broader trends in Bitcoin trading. The market is buzzing with activity, and investors are weighing their options carefully while considering the unique economic variables associated with Bitcoin, particularly how they intertwine with the volatility of countries like Venezuela.

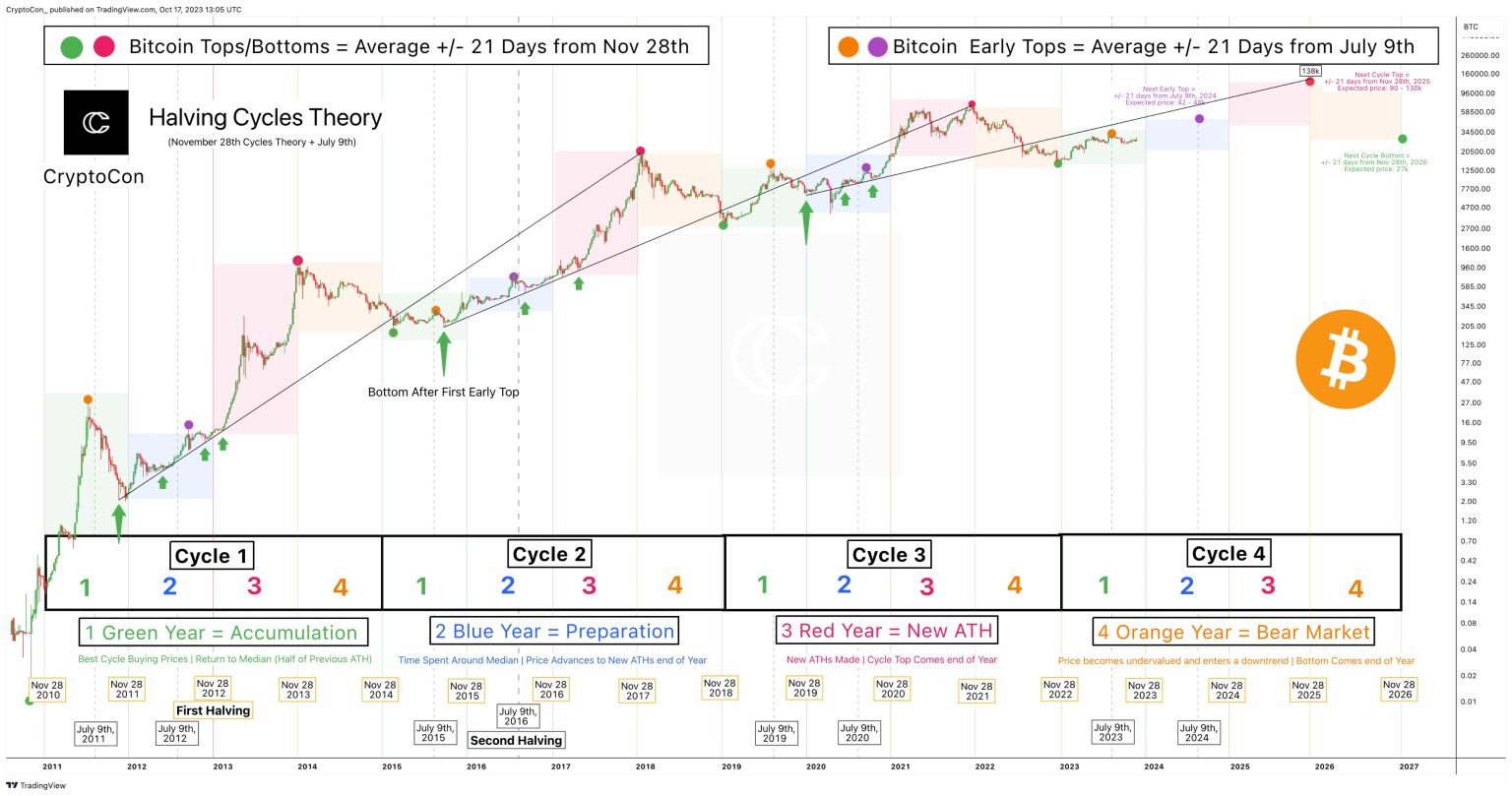

Bitcoin’s movement is influenced by various factors, including trading volume, geopolitical events, and macroeconomic trends. As the price fluctuates, traders are looking for signs that could indicate bullish or bearish trends. Technical analysis shows similarities to past patterns, notably in late 2019, when Bitcoin temporarily dipped before experiencing a substantial rally. This historical context is crucial for current investors, who are trying to gauge whether now is the right time to invest or if waiting for a dip would yield better results.

Impact of Venezuela’s Volatility on Bitcoin Trading Trends

The ongoing economic crisis in Venezuela has significantly impacted Bitcoin trading trends. As the country’s fiat currency depreciates, more Venezuelans are turning to cryptocurrencies as a safe haven, driving the demand for Bitcoin. This increased activity has repercussions on global Bitcoin prices, pushing them higher amid intense local trading. Cryptocurrency markets are closely scrutinizing these patterns, as they highlight how national economic instability can influence Bitcoin’s value. Traders need to consider these factors when evaluating potential investments or strategies.

Furthermore, the Venezuelan situation has drawn the attention of global investors looking for alternatives amid inflation and economic distress. The rising correlation between Bitcoin prices and the financial conditions in Venezuela could suggest that Bitcoin might serve as a bellwether for other troubled economies. As such, Bitcoin trading strategies now often include a careful analysis of such geopolitical events, demonstrating how interconnected the global cryptocurrency market has become. This trend indicates the importance of remaining informed about international news impacts on crypto price predictions.

Analyzing Crypto Price Predictions Amid Market Fluctuations

In the current climate of Bitcoin price movements, many experts are developing innovative crypto price predictions based on historical trends and current data. As Bitcoin recently surged, predictions started to circulate about a potential correction back to the $80,000 level due to increasing sell-off pressures from large-volume traders. The volatility in the market creates a challenging environment for both novices and seasoned traders, where shifts in price can occur rapidly and without substantial notice. Evaluating these predictions involves analyzing market sentiments, trading volumes, and external factors.

Market analysts advocate a thorough examination of past performance and current trading behaviors to make informed decisions. As Bitcoin reflects the characteristics of both a trading asset and a utility currency, the predictive models used by analysts increasingly incorporate both technical and fundamental analyses. The ability to decode these patterns becomes vital for traders as they navigate the uncertain waters of the cryptocurrency market. Crypto price predictions are shaping trading strategies, allowing investors to position themselves advantageously against looming market corrections.

The Role of Bitcoin in Safe-Haven Asset Conversations

Bitcoin is increasingly being discussed in the context of safe-haven assets, alongside gold and silver. As geopolitical tensions rise, investors often seek refuge in these stable stores of value to hedge against market volatility. The recent correlations observed between Bitcoin and traditional safe-haven assets suggest that Bitcoin might not only serve as a speculative vehicle but also as a reliable asset during economic downturns. This shift in perception is essential for traders assessing the cryptocurrency’s role in their portfolios.

The ongoing volatility in Bitcoin’s price influenced by global events reinforces its dual nature—acting as both an investment asset and a hedge. For instance, amidst turbulence in the Venezuelan economy, Bitcoin saw heightened interest, mirroring the behavior generally reserved for traditional safe havens. Market participants are now weighing the benefits of incorporating Bitcoin into a diversified investment strategy, contemplating whether it will establish itself firmly as a credible alternative to gold and other fiat currencies in turbulent times.

Historical Trends and Their Impact on Future Bitcoin Movements

Analyzing historical trends is crucial for understanding potential future movements in Bitcoin prices. Traders frequently refer back to critical price points and patterns observed in previous years to gauge where Bitcoin might head next. For example, comparing current trends to those observed in 2019 provides insight into market behavior. Analysts emphasize the importance of such historical comparisons, as they can inform trading decisions and strategy adjustments that can capitalize on predicted movements.

Moreover, recognizing the cyclical nature of Bitcoin price volatility aids traders in preparing for both upward and downward shifts. Historical price movements and trading volumes can offer clues about potential resistance and support levels, helping investors strategize accordingly. As the cryptocurrency market continues to evolve, incorporating historical trends into market analyses becomes imperative, allowing for data-driven decision-making that can enhance trading effectiveness.

The Interplay Between Large-Trader Movements and Bitcoin Prices

Large traders, commonly referred to as ‘whales’, wield significant influence over Bitcoin prices due to the sheer volume of assets they control. Their buying and selling patterns can create substantial price fluctuations, leading to increased volatility that affects the broader market. Observing the transactions of these large-volume traders often offers insights into impending market movements, as their actions may indicate market confidence or impending corrections. Traders should monitor these activities closely, especially during uncertain periods.

The current market is witnessing notable volumes being transferred across exchanges, indicating potential for future sell-offs. This interplay between large trader behaviors and Bitcoin prices emphasizes the need for market participants to remain vigilant about where large holders are putting their capital. With many traders watching for signs of bearish sentiment among whales, the possible cascade of sell-offs could further influence the market dynamic, making it critical for smaller investors to adapt quickly to the shifting environment.

Understanding Bitcoin’s Moving Averages and Market Sentiment

Bitcoin’s moving averages serve as essential tools in gauging market sentiment and predicting future price movements. By analyzing the patterns formed by moving averages over time, traders can identify potential entry and exit points that align with broader market signals. Currently, the moving averages indicate a potential rebound, suggesting that market confidence could rally if certain thresholds are met. Monitoring these averages is a fundamental aspect of cryptocurrency trading strategies.

Moreover, traders should pay attention to how external factors, such as interest rates and labor market outcomes, intersect with moving averages. Recent speculation regarding the Federal Reserve’s potential interest rate cut could positively affect Bitcoin and similar risk assets. Such correlations lead traders to analyze both technical and fundamental data, striving to predict how market sentiment may shift in response to macroeconomic changes. This diligence in understanding moving averages becomes invaluable for those looking to navigate the intricate world of cryptocurrency investment.

Cautious Optimism in Bitcoin amid Market Corrections and Pressures

Despite the pressures stemming from large-volume trades and potential market corrections, there exists a sense of cautious optimism among Bitcoin traders. The recent uptick in Bitcoin prices, alongside favorable moving averages, has inspired many to maintain or increase their positions. Historical patterns of recovery following dips encourage traders to view current market vulnerabilities as temporary, framing their strategies with a long-term perspective.

However, it is crucial for investors to remain realistic about the inherent volatility in Bitcoin trading. As the marketplace fluctuates, it is essential for traders to have contingency plans to protect their investments. The balance of hope for a price rebound against the risks associated with sell-off behaviors among significant traders serves as a reminder that while optimism is key, critical thinking and adaptive strategies are equally vital for navigating the crypto landscape.

Frequently Asked Questions

What is the current Bitcoin price forecast amidst the Venezuelan market volatility?

The current Bitcoin price forecast suggests that while Bitcoin reached $93,000 recently, there is a possibility of a dip to lows around $80,000. The forecast reflects recent market trends influenced by Venezuela’s geopolitical situation.

How do Bitcoin trading trends affect the price forecast in the current market?

Bitcoin trading trends indicate a 6.6% increase over recent days; however, traders are alert to patterns that mirror those of October 2019, suggesting potential price corrections. Analysts caution that these trends must be analyzed to gauge future movements accurately.

What impact does Venezuela have on the Bitcoin price forecast?

Venezuela’s economic turbulence plays a significant role in shaping the Bitcoin price forecast, attracting traders looking for alternative investments. The forecasts reflect a keen sensitivity to geopolitical events, potentially leading to price fluctuations.

What key factors influence crypto price predictions for Bitcoin?

Crypto price predictions for Bitcoin are influenced by market dynamics, geopolitical events, trader behaviors, and moving averages. Recent patterns indicate a mix of optimism for rebounds and caution towards potential corrections.

Are historical patterns of Bitcoin price movement indicative of future forecasts?

Yes, historical patterns of Bitcoin price movement can offer insights into future forecasts. Analysts draw comparisons to past trends, like the price behavior in October 2019, to help predict upcoming price changes amid current market volatility.

What should traders consider about Bitcoin price forecasts during economic uncertainty?

Traders should consider the volatility of Bitcoin price forecasts during economic uncertainty, such as geopolitical tensions and potential market corrections. Observing large-volume trader behaviors can provide insight into market direction and necessary caution.

| Key Point | Details |

|---|---|

| Current BTC Price | Bitcoin reached $93,000 for the first time in nearly a month. |

| Recent Price Movement | Bitcoin has gained about 6.6% over the past five days. |

| Market Sentiment | Traders are skeptical about the sustainability of the recent gains. |

| Historical Patterns | Current patterns mimic the behavior observed in October 2019. |

| Possible Price Dip | Predictions indicate a potential drop below $80,000. |

| Geopolitical Influence | Venezuela’s situation is impacting Bitcoin’s trading narrative. |

| Market Activity Increase | Overall market activity has increased by 5%. |

| Correlation with Safe-Haven Assets | Bitcoin is mirroring the performance of gold and silver. |

| Interest Rate Predictions | A potential Federal Reserve rate cut may positively influence risk assets. |

| Trader Behavior | Large-volume traders may exert pressure on Bitcoin prices. |

Summary

The Bitcoin price forecast indicates a complex but intriguing landscape ahead. With Bitcoin reaching $93,000 and experiencing a recent uptick of 6.6%, the market remains under scrutiny for its volatility influenced by geopolitical events, particularly in Venezuela. While there are bullish sentiments stemming from favorable moving averages and historical patterns, predictions warn of a potential dip to $80,000. As traders navigate these shifting dynamics, the outlook remains one of caution, driven by the actions of large traders and evolving market conditions. Overall, Bitcoin continues to be a compelling asset for investors seeking long-term opportunities amidst short-term uncertainties.