Binance leverage adjustment is set to impact the cryptocurrency trading landscape significantly. Beginning on December 5, 2025, Binance Futures will implement a crucial update to leverage and margin levels for several U-standard perpetual contracts, including popular trading pairs like PAXGUSDT. This adjustment is expected to take place within an hour, affecting existing positions of traders as they adapt to the new margin levels update. As one of the leading platforms for Binance futures, these changes will influence how traders manage risk and capitalize on market volatility. Understanding the implications of this adjustment is essential for anyone engaged in trading perpetual contracts on Binance.

In an important move for cryptocurrency traders, Binance is preparing to modify its leverage settings and margin requirements for various U-standard perpetual contracts. This alteration, which includes well-known pairs such as PAXGUSDT and BDXNUSDT, will be executed on December 5, 2025, at 14:30 (Beijing time). Traders relying on Binance’s futures market must be ready for this shift, as it will directly affect their positions and margin calculations. The upcoming change aims to enhance market stability and participant experience by ensuring appropriate leverage ratios. As such, this margin levels update signals a pivotal moment for those involved in the dynamic world of digital asset trading.

Understanding Binance Leverage Adjustment

In the fast-paced world of cryptocurrency trading, leverage plays a pivotal role in maximizing profit potential while also introducing significant risk. With Binance’s upcoming adjustment of leverage and margin levels for U-standard perpetual contracts, traders need to grasp what this entails. Leverage allows traders to control larger positions with a smaller amount of capital, thus affecting their margin requirements and overall trading strategies. As such, understanding how Binance adjusts its leverage is crucial for anyone participating in its futures market.

The adjustments, which will affect various contracts, including PAXGUSDT, underscore the importance of maintaining adequate margin levels. Traders must be prepared for how these changes will impact existing positions on or after December 5, 2025. Any adjustments can lead to forced liquidations if margins fall below specific thresholds, making it essential for traders to review their portfolio management strategies in light of Binance’s leverage policy changes.

Impact of Margin Levels Update on Cryptocurrency Trading

Margin levels updates are critical events in cryptocurrency trading that can significantly influence a trader’s approach to market dynamics. With Binance updating its margin requirements for several contracts, including BDXNUSDT and PAXGUSDT, traders need to examine how these changes can impact their risk management practices. Higher margin requirements may reduce the amount of leverage available, leading traders to either reevaluate their positions or implement new trading strategies to adapt to the evolving margin landscape.

Furthermore, the timing of these margin level updates on Binance could create volatility in the market, as traders react to the changes in potential leverage. As traders adjust their positions in anticipation of the upcoming updates, it may lead to increased trading volume and price fluctuations. It’s vital for traders to stay informed and utilize proper risk assessment tools so as not to overextend themselves during this transition.

The Role of Perpetual Contracts in Binance’s Offerings

Perpetual contracts are essential instruments within Binance’s trading ecosystem, providing traders with the ability to speculate on the price movements of various cryptocurrencies without an expiration date. This flexibility allows traders to maintain positions for as long as they desire, making perpetual contracts like those based on PAXGUSDT a popular choice among both novice and seasoned traders. As Binance adjusts leverage for these contracts, understanding the characteristics of perpetual contracts becomes paramount for effective trading.

Moreover, Binance’s focus on enhancing perpetual contracts through leverage adjustments indicates a desire to improve the trading experience for its users. By optimizing margin levels, Binance aims to strike a balance between maximizing trader potential and minimizing risk exposure. Traders must pay close attention to these changes when planning their investment strategies, as adjusting leverage can significantly impact potential returns and losses.

Navigating Binance Futures During Leverage Changes

Navigating the Binance Futures market can be challenging, especially during times of leverage changes. As the exchange implements its leverage adjustment for several perpetual contracts, including PAXGUSDT, traders must remain vigilant. Understanding how to manage existing positions while adjusting to new margin levels is critical. Traders may want to consider setting stop-loss orders to mitigate potential losses that could arise from sudden market movements during this transitional period.

Additionally, experienced traders often rely on historical data and market analysis to anticipate how leverage changes might influence price actions. By analyzing previous market responses to similar leverage adjustments, traders can develop strategies that promote resilience during turbulent times. Staying informed about market trends and Binance’s leverage policies will empower traders to make educated decisions, ultimately enhancing their trading proficiency and success.

The Future of Cryptocurrency Trading on Binance

As Binance continues to adapt its trading offerings, the future of cryptocurrency trading on the platform looks intriguing. The ongoing adjustments to leverage and margin levels signal a responsive approach to market conditions and trader needs. By enhancing the trading environment, Binance aims to cater to a more diverse audience, allowing both new and experienced traders to benefit from the platform’s features. As the cryptocurrency landscape evolves, Binance’s commitment to improving its operations positions it well for future challenges.

Moreover, leveraging innovative trading tools and offering buyers and sellers more control over their trades will likely shape the way traders interact within the marketplace. With the rapid growth of decentralized finance (DeFi) and the increasing adoption of cryptocurrencies like PAXG, the future of trading on Binance promises to be dynamic and full of opportunities. Traders must stay agile and adaptable, embracing the latest updates to navigate the ongoing development of cryptocurrency trading effectively.

Strategies for Effective Margin Management on Binance

Effective margin management is a cornerstone of successful trading, especially when operating on platforms like Binance. As the exchange updates leverage and margin levels, traders must develop strategies that encompass risk management, position sizing, and trade execution skills. Understanding the intricacies of how margin works within futures trading can lead to more informed decision-making. Traders should meticulously assess personal risk tolerance levels when adjusting their positions in response to Binance’s updates.

Using tools like stop-loss orders, take-profit levels, and diversification across various contracts can provide essential safeguards against market volatility. It’s also beneficial to continuously monitor margin levels to ensure compliance with Binance’s new requirements, as failing to meet these can lead to position liquidations. By integrating these strategies into their trading routine, cryptocurrency investors can actively manage their exposure while capitalizing on market movements.

Understanding Cryptocurrency Volatility and Its Effects

Cryptocurrency markets are known for their high volatility, which can be both a challenge and an opportunity for traders. As Binance prepares to adjust leverage for its perpetual contracts, such as PAXGUSDT and BDXNUSDT, understanding the inherent volatility becomes essential. Price fluctuations can occur rapidly due to market news, trader sentiment, or leverage adjustments, making timing and strategy critical components of trading success.

Traders must be prepared for the implications of volatility on their margin levels and positions. When markets swing dramatically, the margin requirements can change, potentially leading to margin calls or forced liquidations if traders are not adequately prepared. To navigate this volatility effectively, employing a robust trading plan that encompasses both technical and fundamental analysis is crucial for maintaining profitability in an ever-changing environment.

Binance Futures: Adapting to Market Changes

As the cryptocurrency market evolves, Binance Futures continues to adapt its offerings to meet the changing needs of traders. The upcoming leverage adjustment for various U-standard perpetual contracts is a direct response to current market dynamics. By adjusting these leverage levels, Binance aims to enhance risk management for traders while ensuring a fair trading environment. This proactive approach is vital in encouraging user trust and engagement on the platform.

Traders must keep abreast of these changes and understand how they will impact their trading strategies. For instance, with the adjustment of leverage affecting their positions, it is crucial to analyze potential risk scenarios in the wake of margin level updates. By being prepared and informed, traders can leverage the new conditions to their advantage, optimizing their trading experience on Binance Futures.

Preparing for Trading Changes on Binance

As December 5, 2025, approaches, traders on Binance should prepare for the anticipated leverage and margin level adjustments. These changes signal the importance of staying proactive and responsive to market conditions, especially in the realm of cryptocurrency trading. By understanding the adjustments that will occur, traders can make informed decisions about their existing positions and potential trades.

Additionally, it is advisable to conduct thorough research on the specific contracts affected by the updates, including PAXGUSDT and other U-standard perpetual contracts. This involves reviewing market conditions, historical price patterns, and implementing sound risk management practices to cushion against any adverse effects that margin level changes might generate. Preparation and market awareness can make all the difference in navigating the complexities of the cryptocurrency trading landscape.

Frequently Asked Questions

What is Binance leverage adjustment for perpetual contracts?

Binance leverage adjustment refers to the modification of margin levels and leverage ratios for perpetual contracts offered on Binance Futures. This adjustment helps manage risk and stability in cryptocurrency trading, ensuring that traders can trade effectively under varying market conditions.

When will Binance adjust leverage for PAXGUSDT?

Binance will adjust the leverage and margin levels for the PAXGUSDT perpetual contract on December 5, 2025, at 14:30 Beijing time. This adjustment is part of a broader update affecting multiple U-standard perpetual contracts on Binance Futures.

How does the leverage adjustment impact my existing positions on Binance Futures?

The leverage adjustment on Binance Futures will affect existing positions in the relevant perpetual contracts, including PAXGUSDT. Traders should review their margin levels and adjust their trading strategies accordingly to align with the new leverage settings.

Why is Binance changing the margin levels for cryptocurrency trading?

Binance changes margin levels to enhance risk management and ensure the liquidity and stability of its trading platform. Adjusting leverage on perpetual contracts allows Binance to adapt to market conditions and protect traders from excessive risk during volatile periods.

What should I do ahead of the leverage adjustment for my perpetual contracts on Binance?

Before the leverage adjustment on Binance, it is advisable to monitor your positions closely, review your margin levels, and consider rebalancing your portfolio if necessary. Keeping abreast of the changes ensures you can make informed decisions based on the new leverage settings.

Will Binance Futures inform users about leverage changes in advance?

Yes, Binance typically provides notifications about forthcoming leverage adjustments and margin level updates via official announcements and their platform. Traders are encouraged to stay updated on these changes to maintain optimal trading conditions.

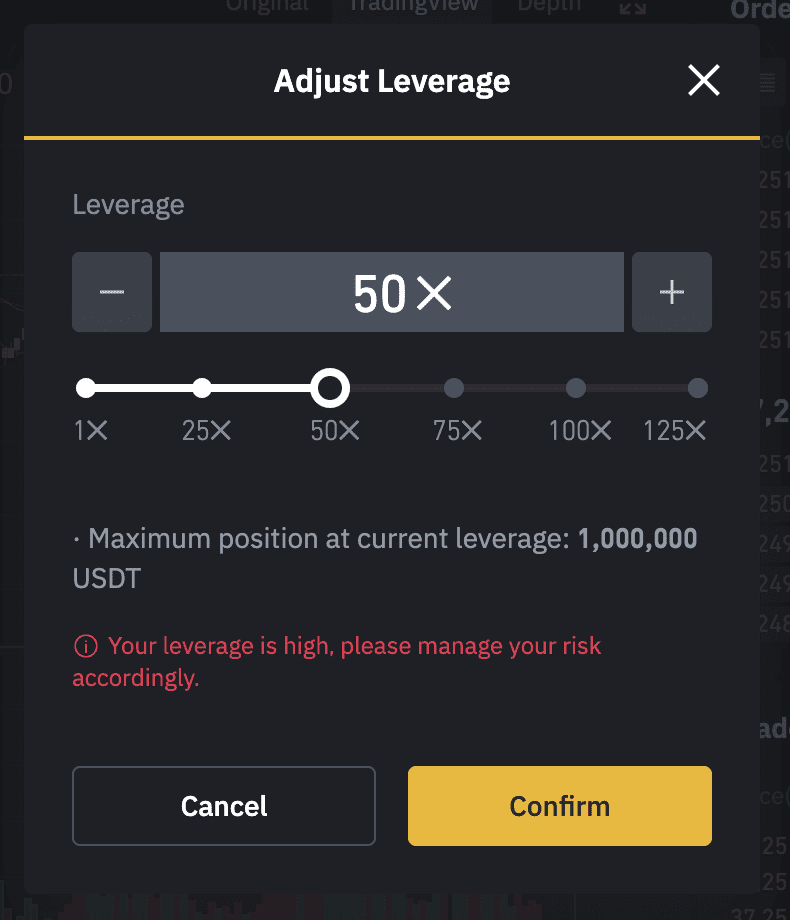

Can I adjust my own leverage settings for PAXGUSDT on Binance?

Yes, traders can manually adjust their leverage settings for the PAXGUSDT perpetual contract on Binance Futures according to their trading preferences, within the limits set by the platform. It’s important to assess the risks involved when changing leverage.

What are the implications of leverage adjustment for new traders on Binance?

For new traders, leverage adjustment on Binance can affect trade strategies and risk management. Understanding the new margin levels and their impact on potential losses and gains is crucial for making informed trading decisions.

Is there a risk associated with high leverage in Binance cryptocurrency trading?

Yes, trading with high leverage on Binance carries significant risk, as it can amplify both potential profits and losses. Traders should exercise caution and use appropriate risk management strategies when trading perpetual contracts with high leverage.

| Date | Event | Contracts Affected | Time of Adjustment (Beijing) | Expected Duration | Impact on Existing Positions |

|---|---|---|---|---|---|

| 2025-12-02 | Leverage and Margin Adjustment | PAXGUSDT, BDXNUSDT | 2025-12-05 14:30 | Within 1 hour | Yes |

Summary

Binance leverage adjustment refers to the upcoming changes in leverage and margin levels that Binance Futures will implement for several U-standard perpetual contracts. This adjustment, scheduled for December 5, 2025, affects contracts like PAXGUSDT and BDXNUSDT and aims to ensure optimal trading conditions for users. As such adjustments can significantly impact trading strategies, traders should prepare accordingly.