As we look ahead, Bank of America rate cut predictions are beginning to shape the conversation around the Federal Reserve’s upcoming monetary policy decisions. The bank’s analysts foresee a series of adjustments starting with a 25 basis point cut at the December meeting, influenced by labor market conditions and evolving economic indicators. With further predictions pointing to additional cuts in June and July 2026, the anticipated interest rate forecast has captured the attention of investors and economists alike. This potential shift underscores the significance of economic policy changes and their impact on financial markets, prompting many to consider how these developments may affect their investment strategies. As the landscape evolves, understanding Bank of America predictions will be crucial for navigating the future of interest rates and economic stability.

In the current economic climate, projections surrounding potential reductions in interest rates are pivotal for market participants. Major financial institutions, particularly Bank of America, have begun to outline an outlook for monetary policy adjustments, suggesting that the Federal Reserve may soon implement rate cuts. This anticipated trajectory reflects a nuanced response to fluctuating labor market dynamics and investor sentiment, ultimately pointing towards a possible easing in credit conditions over the next few years. As we analyze this rate cut outlook for 2026, it becomes evident that the convergence of fiscal stimulus and changing leadership at the Fed could significantly influence broader economic performance. Therefore, staying informed about these monetary trends is essential for anyone looking to position themselves wisely in the investment landscape.

Understanding Bank of America’s Rate Cut Predictions

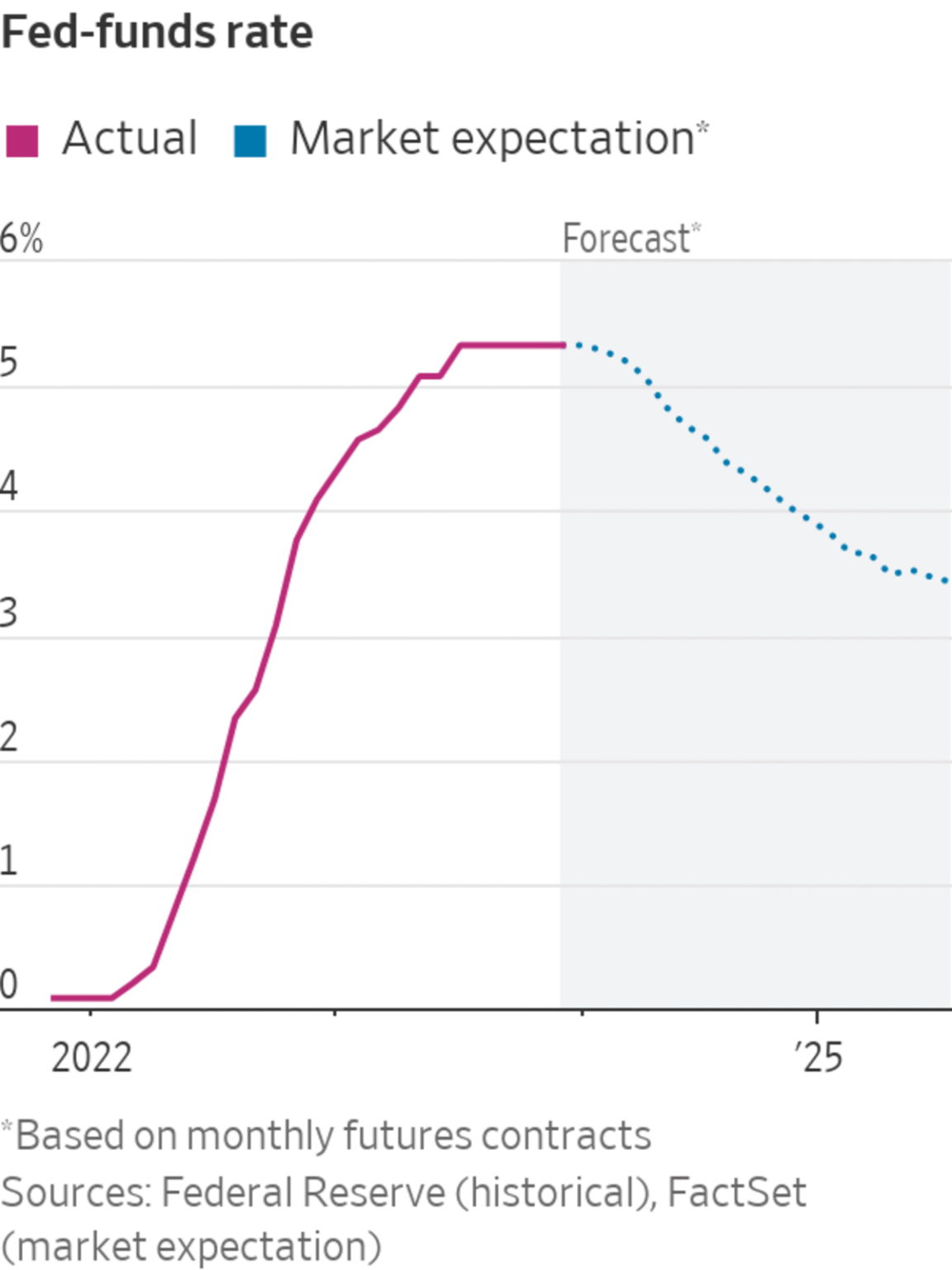

Bank of America’s recent predictions on the Federal Reserve’s interest rate cuts highlight a significant shift in the outlook for monetary policy. Their Global Research Department has revised its expectations, indicating that the Fed is likely to cut rates by 25 basis points at the upcoming December meeting. This marks a departure from earlier predictions that leaned towards maintaining the current rates. With the labor market showing signs of weakness and policymakers signaling a readiness for a shift in economic policy, the potential for rate cuts has increased.

As we look further into Bank of America’s rate cut outlook for 2026, they predict not just one, but two additional rate cuts in June and July, aiming to bring the overall rates to a range of 3.00% to 3.25%. This forecast is heavily influenced by expected leadership changes within the Federal Reserve, rather than purely economic data. The bank’s analysts suggest that these changes in leadership could herald a new approach to monetary policy, particularly if fiscal stimulus measures are enacted rapidly post-cut.

Frequently Asked Questions

What are Bank of America rate cut predictions for 2026?

According to Bank of America’s Global Research Department, the bank anticipates two rate cuts in 2026, specifically projecting a decrease of 25 basis points in June and July, leading to a target range of 3.00%-3.25% for interest rates.

How does the Federal Reserve rate cuts relate to Bank of America’s predictions?

Bank of America’s predictions regarding Federal Reserve rate cuts are based on weak labor market conditions and anticipated leadership changes within the Fed, indicating the likelihood of an accommodative monetary policy moving forward.

What is the interest rate forecast from Bank of America for December 2025?

In December 2025, Bank of America predicts that the Federal Reserve will cut rates by 25 basis points due to evolving economic conditions, shifting their prior stance which expected rates to remain unchanged.

What economic policy changes are influencing Bank of America rate cut outlook?

Economic policy changes, particularly those related to fiscal stimulus measures and leadership dynamics within the Federal Reserve, are influencing Bank of America’s outlook on rate cuts, predicting a more accommodative stance in the near future.

What recent indicators suggest Bank of America’s rate cut outlook?

Recent indicators cited by Bank of America include weak labor market conditions and signals from policymakers, which suggest that the Federal Reserve may implement rate cuts sooner rather than later.

| Date | Key Points |

|---|---|

| 2025-12-01 | Bank of America predicts two rate cuts in 2026 due to weak labor market conditions. |

| The first anticipated cut is of 25 basis points at the December meeting, followed by another in June and July of 2026. | |

| The bank’s forecast is influenced by leadership changes, especially with Kevin Hassett as a potential next Fed chair. | |

| A rate cut next week could signal a move towards a more accommodative monetary policy. | |

| Most major banks expect the Fed to cut rates, while a few think they will remain unchanged. |

Summary

Bank of America rate cut predictions indicate a significant shift towards monetary easing, with expectations of two rate cuts in 2026 driven by labor market weaknesses and changes in Fed leadership. As the market evolves, analysts are closely watching for Federal Reserve decisions that could influence economic conditions and investor sentiment.

Related: More from Market Analysis | Related Box Test | Crypto Worries Over Iranian Oil Supply: Is It Overhyped? in Crypto Market