Bitcoin in a Death Cross: How Low Will We Go? – Decrypt

In the ever-turbulent world of cryptocurrencies, Bitcoin has recently entered a phase that could stir anxiety even among its most steadfast holders: the dreaded death cross. This technical chart pattern has historically been a harbinger of potential extended bearish downturns. In this critical juncture, both seasoned investors and newcomers are keenly watching the markets to decipher just how low Bitcoin might go.

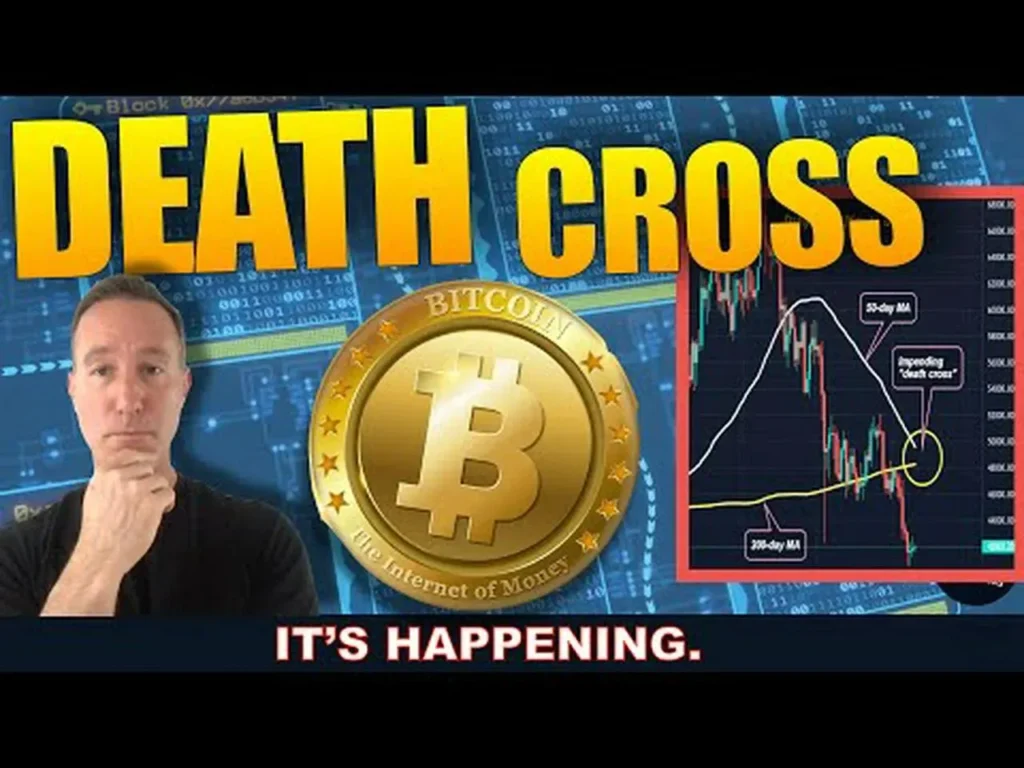

What is a Death Cross?

A death cross occurs on a price chart when a shorter-term moving average, typically the 50-day moving average, crosses below a longer-term moving average, such as the 200-day moving average. This pattern is widely recognized in the financial world as a bearish signal that could indicate the potential for a significant sell-off. The death cross contrasts with the golden cross, which signals a potential bullish market upward turn.

Historical Context of the Death Cross in Bitcoin

Historically, Bitcoin has faced several death crosses. Each occurrence brings with it a storm of media attention and speculative analysis. For instance, previous death crosses were observed in March 2020 during the onset of the COVID-19 pandemic, and later in 2021 following high benchmark peaks. Typically, these events have been followed by a drop in Bitcoin prices, contributing to bearish market sentiments.

However, it is crucial to note that while the death cross is a strongly bearish indicator, it is not always a definitive forecast of prolonged price declines. Bitcoin, with its volatile market nature, has sometimes rebounded relatively quickly after past death crosses, confounding those expecting extended bear phases.

Analysis: Causes and Potential Impacts

The recent transition into a death cross may be attributed to several combined factors. These include macroeconomic conditions such as high inflation rates, increasing interest rates by central banks, regulatory news affecting crypto, or broader economic uncertainties. Moreover, specifics such as changes in network activity, adoption rates, and technological advancements in the blockchain sector play significant roles.

Investors and analysts closely monitor these indicators to gauge the potential depth and duration of the price decline associated with this death cross. Speculations abound, but predictions remain uncertain due to Bitcoin’s historical resilience and capacity to defy expectations.

Market Sentiment and Investor Strategies

The initiation of a death cross markedly affects market sentiment, typically swinging towards pessimism. Crypto forums and social media are abuzz with discussions on strategy adjustments and the appropriate responses to this bearish signal. Some investors consider it a time to sell off, aiming to cut potential losses, while others view it as a buying opportunity, speculating that the market might soon bottom out and offer a chance for significant returns on investments during a future recovery.

Prudent investors might adopt more conservative strategies, broadening their portfolios or shifting to assets perceived as safer during potentially turbulent times. Others might double down, trusting in the cryptocurrency’s ability to navigate through its cycles with an eye for long-term gains.

Looking Ahead

As Bitcoin grapples with its latest death cross, the crypto community remains on edge. How low Bitcoin will go and how long the bearish phase will last are questions that no one can answer with absolute certainty. Historical patterns, economic indicators, and global financial trends will provide some clues, but in the world of Bitcoin, surprises are always just around the corner.

Navigating this death cross will require a blend of strategic foresight, nerves of steel, and, perhaps most importantly, an in-depth understanding of both the technical and fundamental factors that drive cryptocurrency markets. Will this be another quick dip or a protracted slide? Only time will tell. Meanwhile, the resilience of Bitcoin will be tested once again, as stakeholders watch and wait, poised for any eventuality.

Related: More from Bitcoin News | Altcoins Fall as Trump Confirms Iran Attacks, BTC Below $63K in Bitcoin | Bitcoin Surges Above $68K After Iran Confirms Khamenei Death