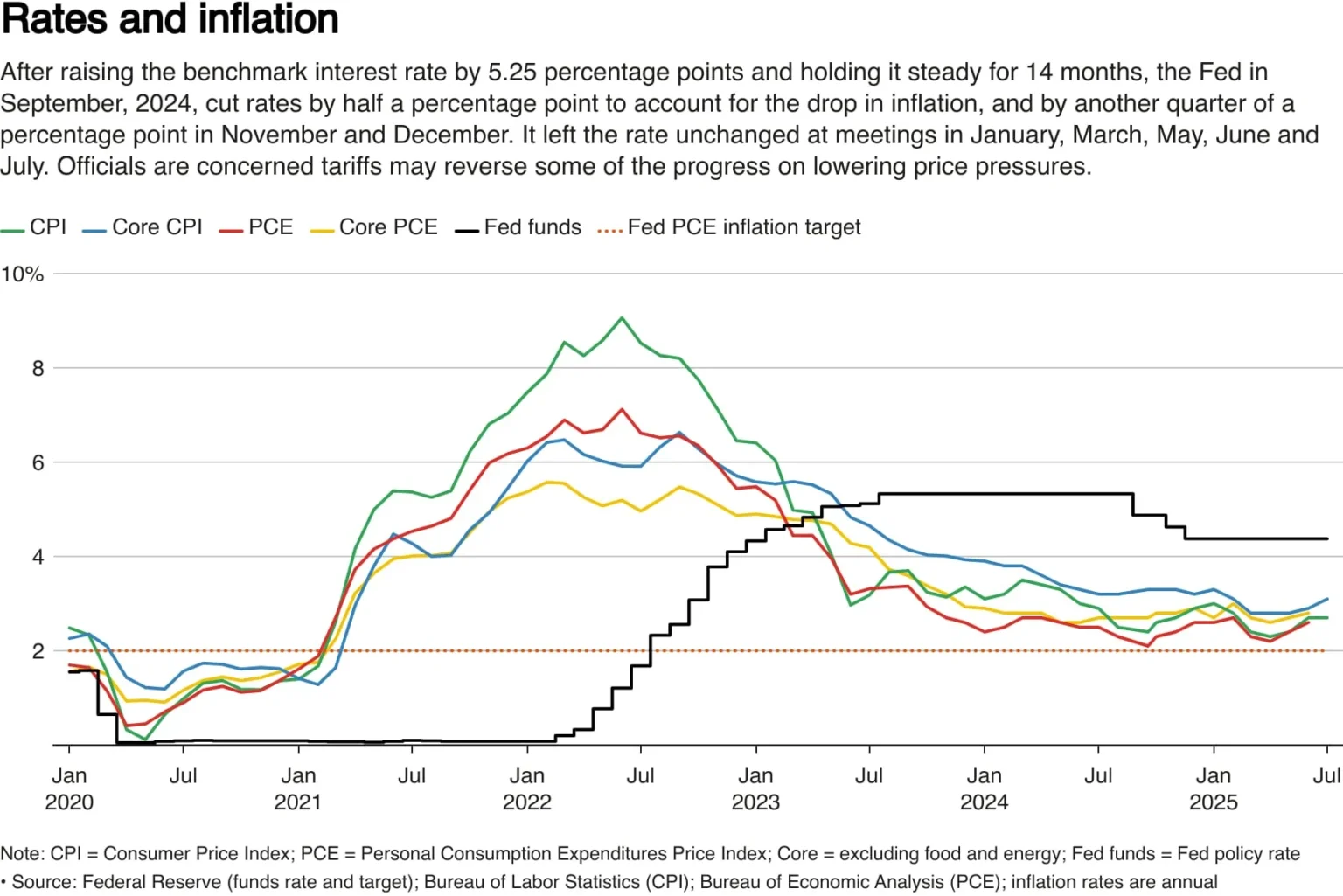

The likelihood of a 25 basis point interest rate cut by the Federal Reserve in December has increased to 71.3%, leading to a resurgence in rate cut expectations. This shift suggests that market participants are now placing greater weight on the possibility of a monetary policy adjustment during the upcoming meeting. The response from investors indicates a renewed interest in the potential impacts of financial easing on the economy. Analysts speculate that this realignment in expectations could influence various market dynamics as the date approaches. The current probability reflects growing sentiment that the Federal Reserve may take action to support economic growth.

This update was auto-syndicated to Bpaynews from real-time sources. It was normalized for clarity, SEO and Google News compatibility.

Related: More from Market Analysis | BANK LATEST QUARTER REPORT OUT NOW in Crypto Market | Tokenized Gold Surpasses CME Futures Prices This Weekend in Crypto Market