The Surprising Impact of Political Events on Cryptocurrency Markets: Insights from the Epstein Files Vote Rally

In an unexpected convergence of politics and finance, the cryptocurrency markets experienced a noticeable rally following the vote to release the controversial Epstein files. This occurrence provides a fascinating case study on how seemingly unrelated political events can significantly influence the digital asset landscape.

Key Takeaways

Background on the Epstein Files Vote

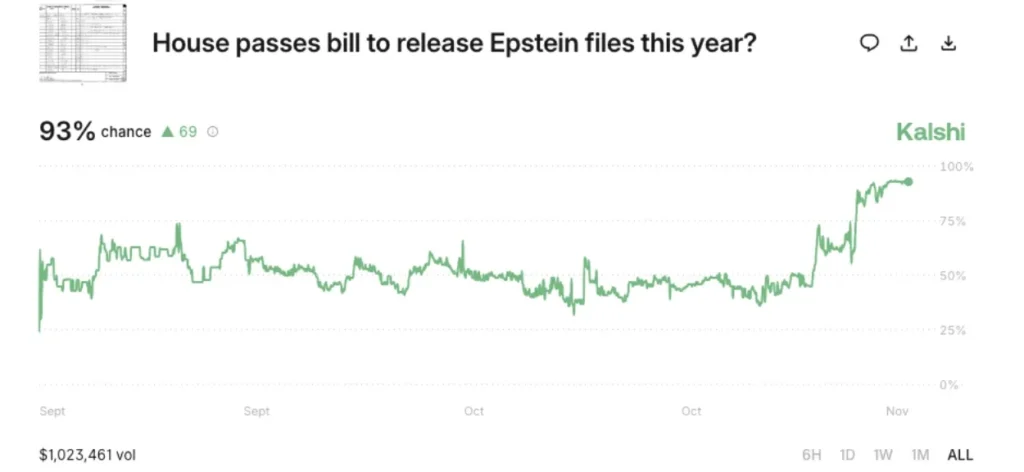

The Epstein saga, centered around the convicted financier Jeffrey Epstein, has gripped the public and the media due to its connections with numerous high-profile individuals and its unsettling revelations. The decision to release the Epstein files was anticipated by many who hoped it would bring additional transparency and shed light on the dealings and characters involved. When lawmakers finally voted in favor of making these documents public, the event caught the attention of investors and market watchers globally.

Linking the Epstein Files to Cryptocurrency Market Movements

The rally in cryptocurrency markets following the Epstein files vote might seem illogical at first glance. However, a deeper analysis reveals a complex interplay of market psychology and investor sentiment. Here are key factors that contributed to this phenomenon:

-

Uncertainty and Traditional Markets: Traditional markets often react negatively to political uncertainties. In cases where traditional assets seem risky, cryptocurrencies can appear as attractive alternatives. The Epstein files, loaded with potential political bombshells, could have shifted some investor focus towards cryptocurrencies as a hedge against traditional market instability.

-

Speculative Behavior: Cryptocurrency markets are notably influenced by speculative trading. Traders might have anticipated that the Epstein files could contain information that would be detrimental to the confidence in traditional financial systems or certain currencies, leading them to increase their positions in decentralized assets like Bitcoin.

-

Increased Media Attention: The high levels of media coverage around the Epstein files vote may have indirectly spotlighted cryptocurrency as an alternative investment class. As more investors tuned into the news, the heightened exposure potentially prompted increased buy-ins from those looking at diversifying their portfolios.

-

Public Sentiment and Trust: The Epstein case, emphasizing themes of corruption and elite manipulation, might have spurred a greater affinity towards decentralized and ostensibly more transparent systems like blockchain and cryptocurrencies. This dynamic could have encouraged more participants to move into crypto markets, seeking a refuge from traditional systems perceived as flawed or corrupt.

Implications and Future Outlook

The Epstein files vote and subsequent rally in crypto markets underscore the sensitive nature of these markets to geopolitical events, even those that are not directly related to finance or technology. This incident illustrates several critical insights:

- Cryptocurrencies as Political Havens: Just as gold has historically played the role of a “crisis commodity,” certain cryptocurrencies may increasingly serve as safe havens during political disturbances.

- Influence of Media and Public Sentiment: The role of media coverage in shaping investment behavior cannot be underestimated, especially in the fast-paced world of cryptocurrencies. Public sentiment, heavily swayed by media narratives, can precipitate sudden market shifts.

- The Need for Vigilant Market Analysis: Investors and analysts must be acutely aware of global events — even those outside the conventional economic spectrum — recognizing their potential impact on digital asset valuations.

Conclusion

While the Epstein files vote might initially appear as a minor political event in the vast landscape of global news, its impact on cryptocurrency markets highlights the complex, interconnected nature of modern finance. Investors should remain aware of the broader socio-political environment and be prepared for unexpected market movements stemming from non-financial events. As the world becomes increasingly interconnected, the boundary between political happenings and financial markets continues to blur, creating both risks and opportunities for informed investors.