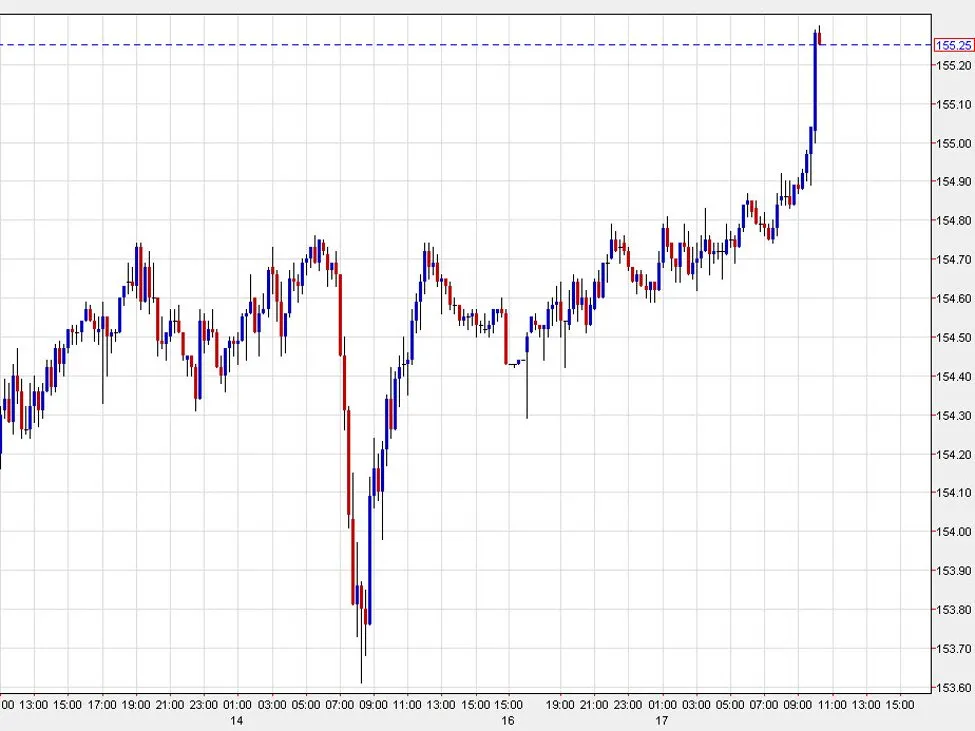

USD/JPY Breaks 155 as Yen Weakness Deepens, Intervention Chatter Builds

The Japanese yen extended its slide as the US dollar/yen pair vaulted the 155.00 threshold for the first time since February, triggering a wave of buy stops and propelling prices toward 155.25 intraday. The move revives questions about how far authorities in Tokyo will tolerate yen depreciation before stepping up verbal pushback.

Momentum gathered as risk appetite improved, with the rally in USD/JPY coinciding with a bounce in equities. That said, US stocks later faded to flat in choppy trading, underscoring a fragile risk backdrop. The pair had briefly dipped on risk aversion late last week before fully retracing the move alongside a broader rebound in markets.

Policy risks are now front of mind. While officials are unlikely to welcome further yen losses, traders largely expect jawboning before any direct market action. In the current mood, many see the bar for outright FX intervention as higher—often discussed nearer the 160.00 area—though the rhetoric could intensify after the 155 break. Technically, the daily setup leaves room toward the late-January highs around 158.00 if momentum holds, making upcoming sessions pivotal for corporate hedging plans and cross-border payment pricing.

Key Points – USD/JPY cleared 155.00 for the first time since February, reaching around 155.25 on stop-driven buying. – The move aligned with a bounce in equities, though US markets later traded flat amid volatility. – Market focus turns to potential verbal intervention from Japanese officials following the break of 155. – Many participants see actual FX intervention as less likely unless levels approach the 160 area. – Technicals indicate scope toward the January peak near 158.00 if bullish momentum persists. – Yen weakness heightens FX risk for importers, exporters, and cross-border payment flows.