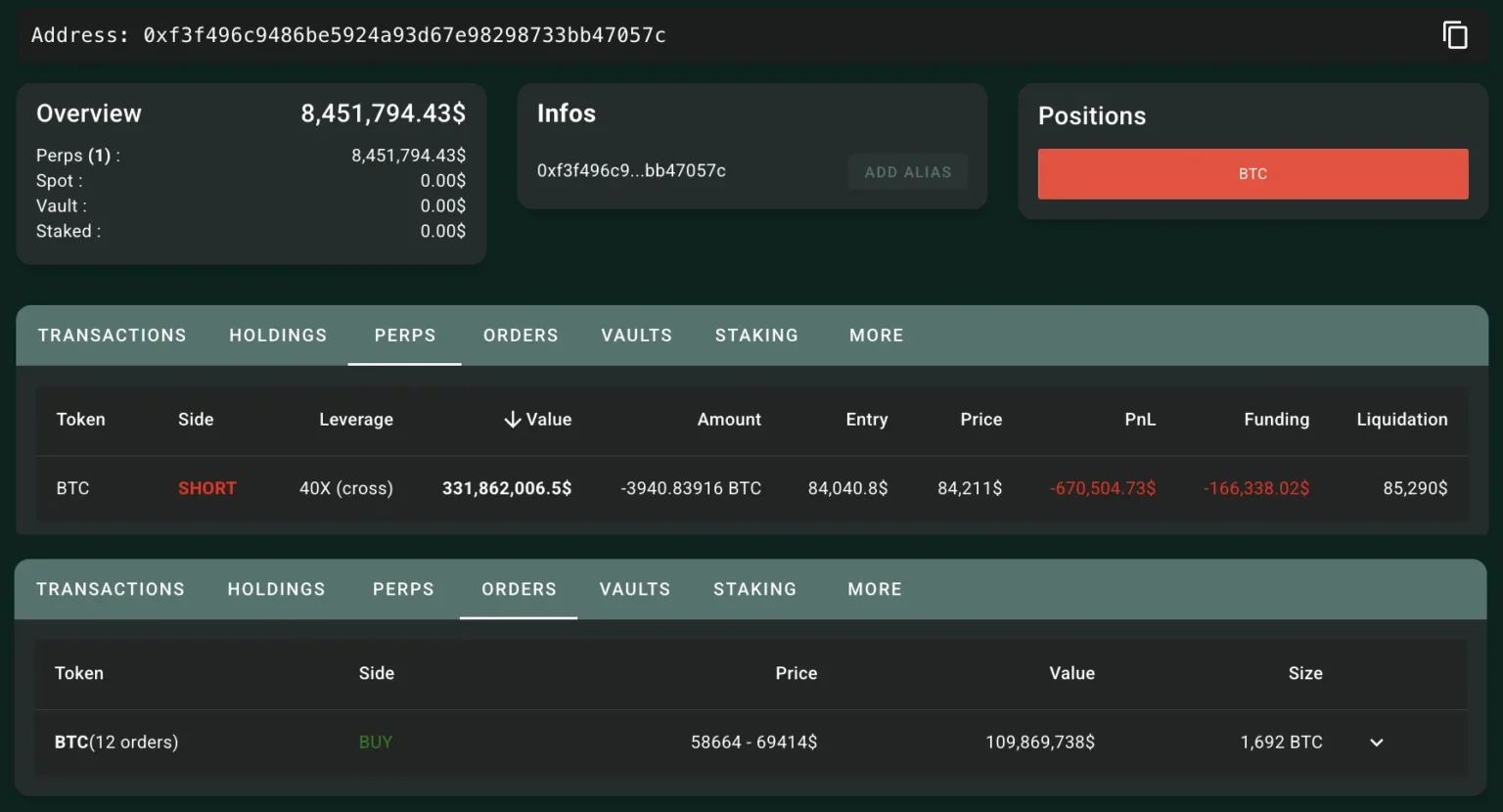

A significant development has occurred as the Triple Short ASTER whale has hedged its short position, now becoming the largest long holder of both Ethereum and XRP on Hyperliquid.

The Triple Short ASTER whale’s strategy has shifted, indicating a notable change in its investment approach. By hedging its short position, the whale aims to mitigate potential losses while capitalizing on price movements in the cryptocurrency market. This move highlights the whale’s adaptability in a volatile trading environment.

As a result of this adjustment, the whale has emerged as the largest long position holder for Ethereum, a leading cryptocurrency known for its smart contract functionality. Additionally, the whale has also taken a substantial long position in XRP, a digital asset designed for cross-border payments.

The whale’s actions on Hyperliquid, a trading platform, reflect a broader trend among institutional investors who are increasingly engaging with cryptocurrencies. This trend underscores the growing interest in digital assets as investment opportunities.

Overall, the Triple Short ASTER whale’s strategic repositioning may influence market dynamics, especially for Ethereum and XRP, as other traders observe these movements and potentially adjust their own strategies.

Previous ArticleIndicators of Stablecoin’s True Intent Amid 80% Hype

Related Posts

Add A Comment