Will Trump’s $400 Billion Tariff Dividend Trigger a Crypto Bull Run?

In the fast-evolving economic and digital landscape, the stir caused by President Donald Trump’s imposition of a $400 billion tariff on Chinese goods has sparked a vibrant debate. While many sectors brace for impact, a curious question arises: could these tariffs inadvertently set the stage for a cryptocurrency bull run?

Understanding the Tariff’s Broad Impact

To contextualize, back in 2018, the U.S. administration led by President Trump initiated a series of aggressive trade policies against China. Central to these policies were tariffs on a vast array of Chinese products, ostensibly to punish what Trump frequently described as unfair trading practices and intellectual property theft by China. The resulting $400 billion in tariffs affected goods spanning various sectors — from tech components to consumer goods.

Such a large-scale economic maneuver doesn’t come without its repercussions. Economists argue that while aimed at boosting domestic manufacturing, tariffs can also lead to inflationary pressures, increased production costs, and disrupted supply chains. For consumers, it often means higher prices at the cash register.

Link between Tariffs and Cryptocurrency Market

The imposition of hefty tariffs led to market uncertainties. Traditional markets saw fluctuation amid fears of a full-blown trade war. It is here that cryptocurrencies come into play as potential beneficiaries.

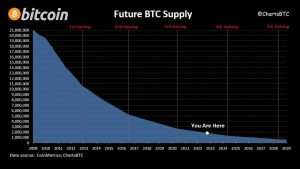

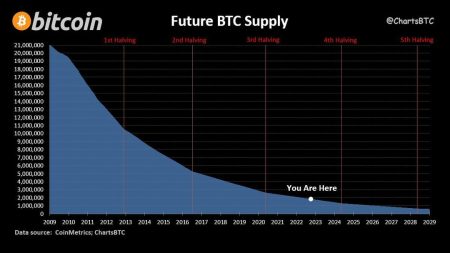

Cryptocurrencies, particularly Bitcoin, have often been referred to as “digital gold” due to their proposed qualities as safe havens during economic turmoil. Like gold, Bitcoin is seen by some investors as a hedge against inflation and currency devaluation — common consequences feared from prolonged trade wars.

Crypto Market’s Response to Economic Policies

Following the announcement and implementation of tariffs, the cryptocurrency market has shown some intriguing trends. Historically, socio-economic uncertainties have correlated with upticks in cryptocurrency valuations. For instance, amid the 2020 global pandemic and resulting financial instability, Bitcoin and other major cryptocurrencies experienced significant surges.

Investors might increasingly view cryptocurrencies not just as speculative investments but as genuine alternatives to safeguard value. This is particularly compelling in scenarios where confidence in traditional markets and currencies wavers due to policy decisions like imposing heavy tariffs.

Potential Roadblocks

However, suggesting a direct causal relation between the tariffs and a potential crypto bull run is complex. The crypto market is influenced by a myriad of factors, including but not limited to regulatory news, technological advancements, market sentiment, and macroeconomic indicators.

Moreover, cryptocurrencies remain highly volatile and speculative, deterring some investors. Regulatory crackdowns, such as those in China against cryptocurrency trading and mining, also inject a degree of uncertainty and risk that could counteract other positive signals.

Conclusion

While it’s tempting to draw a neat connection between Trump’s $400 billion tariffs and a consequent crypto bull run, the scenario invites more nuanced consideration. Yes, economic policies inducing market uncertainty could push more investors towards cryptocurrencies. Yet, this transition remains speculative, influenced by varied and unpredictable market dynamics.

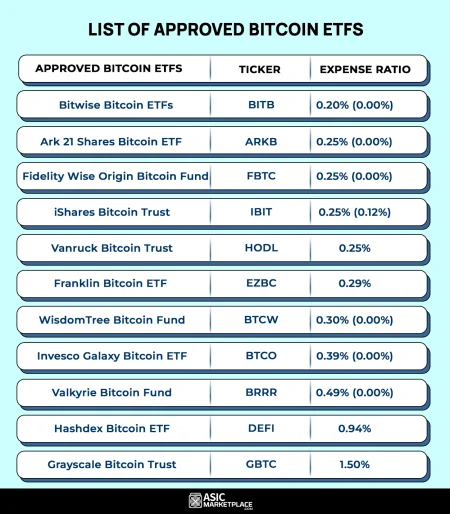

Investors should remain agile, well-informed, and cautious, weighing the potential risks and returns in light of global economic trends and their personal investment thresholds. As with any investment, the key lies in diversification and a keen understanding of the factors at play. If the tariffs do lead to marked inflation or currency devaluation, then holding some assets in cryptocurrencies might be a prudent part of a broader investment strategy to hedge against those risks.