U.S. EIA Weekly Crude Oil Inventories Surpass Expectations, Highlighting Market Volatility

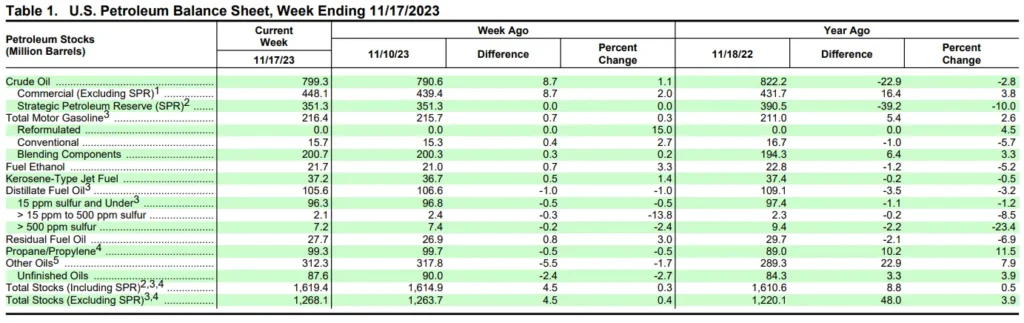

In a recent release, the U.S. Energy Information Administration (EIA) reported a substantial increase in crude oil inventories, registering a rise of 5.202 million barrels. This figure significantly exceeded the market expectations, which were set around a modest increase of 603K barrels. This report, pivotal for energy market players and investors, has triggered discussions about the underlying causes of this surplus and its potential impact on crude oil prices and broader economic indicators.

Examining the Factors Behind the Surge in Inventories

Several factors might have contributed to the unexpected rise in crude oil inventories:

-

Increased Production: The U.S. has been ramping up oil production, responding to previous price incentives. Regions like the Permian Basin have seen accelerated drilling and completion activities, which could have contributed to the surplus in inventory levels.

-

Fluctuations in Import and Export Rates: Changes in the U.S. import and export dynamics could also be key to understanding the buildup. If imports have increased without a corresponding rise in exports, this could contribute to growing inventories.

-

Refinery Demand: Potential slowdowns in refinery output, whether for maintenance or as a reaction to market conditions, can lead to an accumulation of crude stockpiles if crude production remains constant or increases.

- Economic Factors: Broader economic conditions, including slower growth forecasts or trade tensions, could reduce the expected demand for petroleum products, leading to higher crude storage levels.

Implications for Oil Prices and Markets

The unexpected jump in crude oil inventories often exerts downward pressure on oil prices. The basic economic principle of supply exceeding demand can lead to lower prices unless other market factors intervene. Following the report, the immediate response was a dip in oil prices, reflecting investor concerns about potential oversupply conditions.

However, the full impact on the market depends on various factors, including future production decisions by major oil-producing countries, geopolitical developments, and further economic indicators that may suggest an increase or decrease in global energy demand.

Investor and Industry Reactions

Investors and industry stakeholders are closely monitoring these developments. For energy companies, particularly those involved in production and exploration, fluctuating oil prices can significantly impact profitability. Investors, on the other hand, are assessing the volatility as a factor in portfolio management, balancing energy stocks, and commodities based on anticipated market trajectories.

Looking Forward

As the market digests the implications of the EIA’s report, all eyes will be on the forthcoming data and trends. Key aspects to watch include OPEC’s production decisions, further economic indicators from major economies, particularly those indicating a rebound or further slowdown, and technological or policy changes affecting energy consumption patterns.

Market participants and analysts will also be keen on observing the pattern of inventory changes in the coming weeks to determine if this rise was a one-off occurrence or part of a broader trend in global oil markets.

Conclusion

The latest data from the U.S. EIA has certainly provided some unexpected news to the oil market, underscoring the intrinsic volatility and complex interdependence of global supply chains and economic forces. As stakeholders ponder their next moves, the dynamic nature of the market continues to offer both risks and opportunities, emphasizing the need for meticulous analysis and strategic planning in navigating the energy sector.