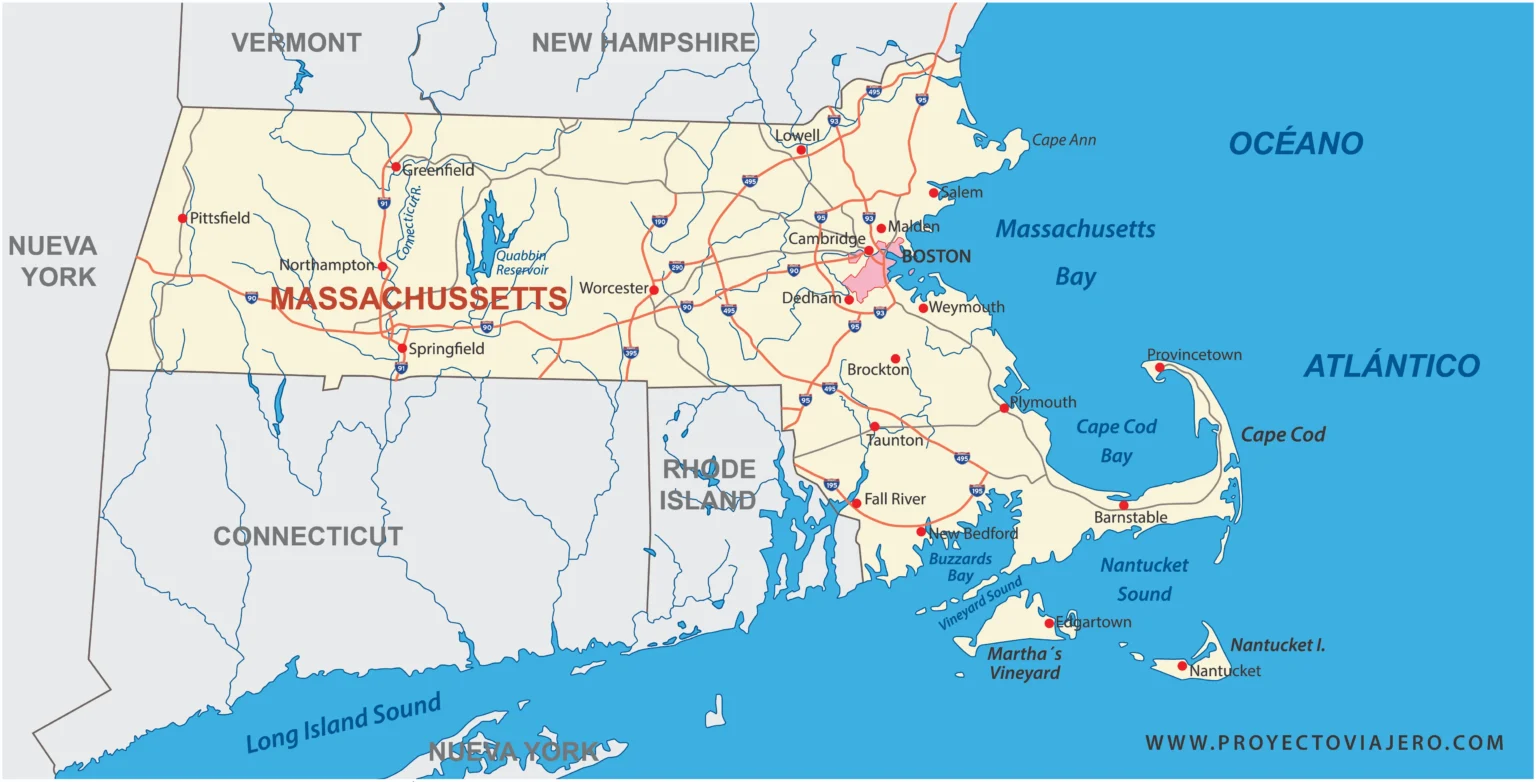

In a significant development for the financial landscape of state governance, Massachusetts lawmakers are preparing to debate a proposed bill that aims to establish a Bitcoin Reserve Fund. This initiative marks a pioneering step towards integrating cryptocurrency into state financial strategies, potentially setting a precedent for other states to follow.

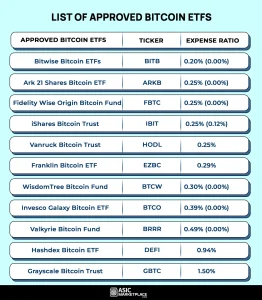

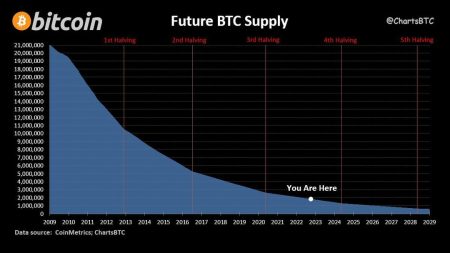

The proposal comes amid a growing recognition of Bitcoin and other cryptocurrencies as viable financial assets. Advocates argue that by creating a reserve fund, Massachusetts could leverage the volatility and potential growth of Bitcoin to enhance its financial portfolio. This move reflects a broader trend among states and institutions exploring digital currencies as a means to diversify their investments and tap into new revenue streams.

The bill outlines the framework for how the fund would operate, including guidelines for investment, management, and oversight. Proponents believe that a Bitcoin Reserve Fund could not only provide financial benefits but also position Massachusetts as a leader in the cryptocurrency space, attracting tech-savvy businesses and investors.

However, the proposal is not without its critics. Detractors raise concerns about the inherent risks associated with cryptocurrency investments, including market volatility and regulatory uncertainties. They argue that state funds should prioritize stability and security, rather than venturing into the unpredictable world of digital currencies.

As the debate unfolds, the outcome could have significant implications for Massachusetts’ financial future and its approach to emerging technologies. Lawmakers are expected to weigh the potential benefits against the risks, making this a pivotal moment in the intersection of state finance and cryptocurrency.