ZEC Valuation Decline Forms Bullish Pattern: Potential for Further Gains?

In the volatile world of cryptocurrencies, Zcash (ZEC) has recently caught the eye of investors as its market value depicted interesting patterns that may outline potential gains. Despite a recent dip in its valuation, Zcash appears to be forming a bullish technical pattern, suggesting that there might be room for optimistic outlooks in the near future.

The Rise and Dip of ZEC

Zcash, known for its high privacy features that offer users the ability to transact without exposing their address or the amount transferred, had witnessed significant fluctuations in price over the past months. Originally deriving value from its commitment to privacy, ZEC has been favored by a niche but active community. However, similar to many cryptocurrencies, it has faced its share of market volatilities influenced by broader economic signals and internal cryptocurrency market dynamics.

Potential Bullish Pattern Emergence

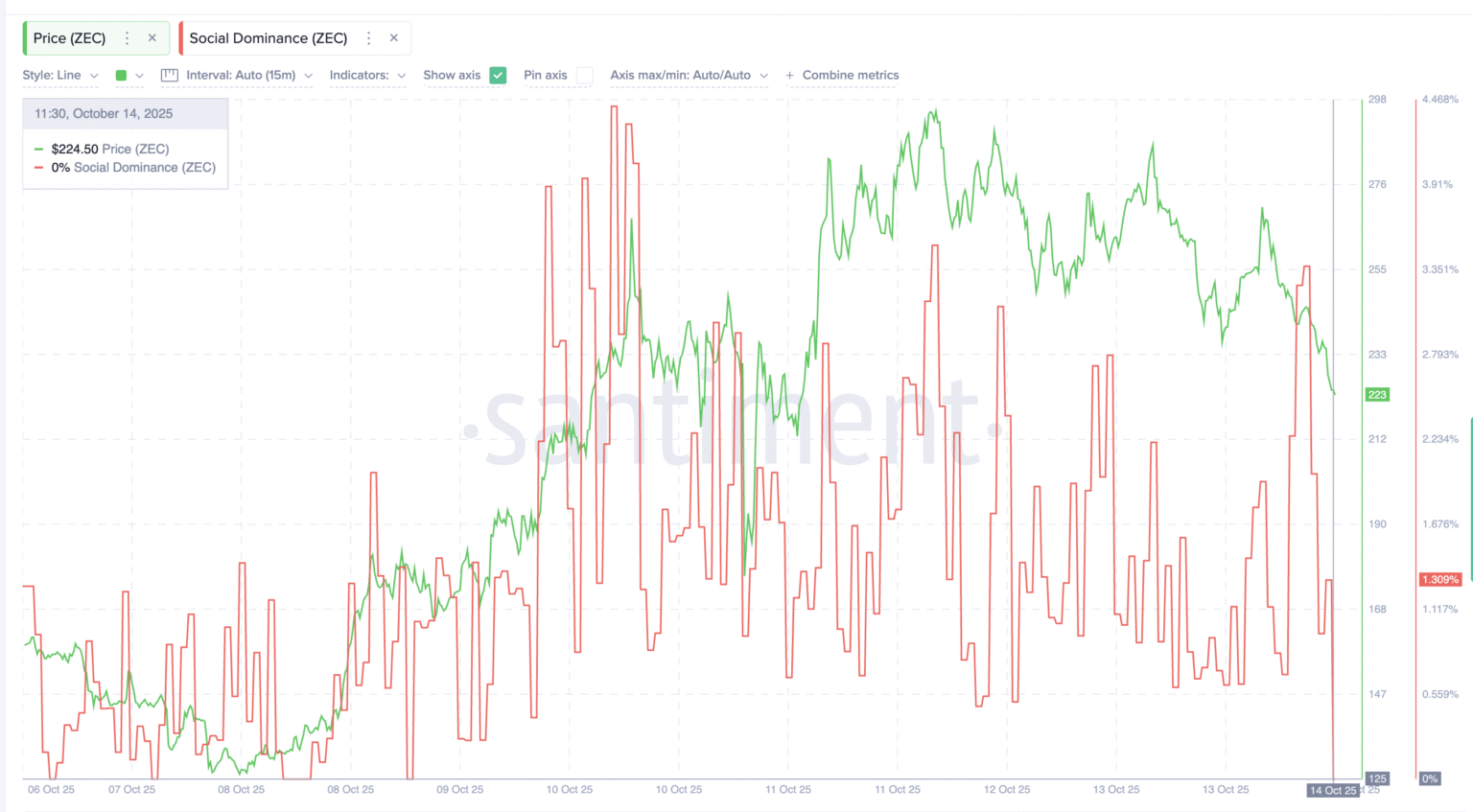

A potential bullish pattern is seemingly forming despite the recent downtrends, which might indicate a turning point for ZEC. Technical analysts following the cryptocurrency have noted the formation of what appears to be a “cup and handle” pattern on the price charts. This pattern generally suggests a pause or a slight decline after a notable uptrend, followed by a stable recovery.

The “cup” portion of this pattern represents a period where prices initially drop but then gradually start to pull back to its original position. Following the cup, a “handle” forms with a smaller downward drift, presenting a considerable buying signal before a probable price rise. Typically, for traders, this pattern suggests that buying momentum might exceed selling pressure, potentially escalating the prices.

Market Sentiments and External Influences

Several market sentiments and external influences could play critical roles in determining whether Zcash can leverage this bullish pattern into substantial gains. One of the crucial factors includes the overall health of the cryptocurrency market, which often experiences contagion effects from giants like Bitcoin and Ethereum. Additionally, Zcash could potentially benefit from increased adoption or regulatory news that favors privacy coins.

Regulatory Hurdles

Speaking of adoption and regulation, ZEC faces significant scrutiny, like many privacy-focused cryptocurrencies. Governments and financial watchdogs often criticize privacy coins because they can potentially obscure financial transactions from regulatory oversight. Any positive news in regulatory frameworks that do not stigmatize the use of privacy features could contribute positively to ZEC’s valuation.

Zcash’s Roadmap and Developments

Investors and potential users should also consider recent developments and updates from the Zcash team. Enhanced security features, scalability improvements, and partnerships can serve as pivotal factors in the coin’s adoption rates and its perceived utility. Detailed insights into Zcash’s roadmap could offer investors clues about the anticipated developmental trajectory and its alignment with broader market needs.

Conclusion

While the formation of a bullish pattern provides a hopeful perspective, the true test for ZEC will be its ability to capitalize on these technical indicators amidst shifting market conditions and regulatory landscapes. Investors considering ZEC as part of their portfolio should maintain a cautious approach, conducting thorough research and staying abreast of market trends. As with any investment, especially in the volatile cryptocurrency market, potential gains come with potential risks. However, for those who align with the technical analysis, the current patterns might spell a beneficial setup in the trading charts of Zcash.

As always, whether this potential is realized remains to be seen, but the current technical formations and surrounding interests certainly make ZEC a token to watch in the coming months.