Title: Zcash Price Holds Firm, but One Breakout Level Still Matters

Key Takeaways

As the cryptocurrency market continues to exhibit volatility, one privacy-focused coin, Zcash (ZEC), has notably sustained a firm price level. Despite the broader market’s ups and downs, Zcash seems resilient, maintaining stable support levels. However, for those watching the digital currency markets, there is a critical breakout point to keep an eye on, which could signal future trends for this popular privacy coin.

Understanding Zcash’s Value Proposition

Before delving into specific price points and what they mean for investors, it is essential to understand why Zcash has held unique appeal. Launched in 2016, Zcash is built on robust zk-SNARK technology, offering users the ability to transact with enhanced privacy. This ability is a distinguishing feature in a space where transparency often takes precedence, attracting users who prioritize confidentiality in their transactions.

The value proposition of Zcash lies in its dual-address system. Users can choose between transparent addresses (t-addresses) and shielded addresses (z-addresses), thus balancing transparency with privacy. This flexibility can capture a broader audience base—those inclined towards financial privacy without completely forsaking the benefits of a transparent blockchain.

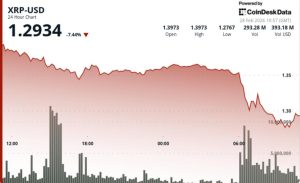

Current Market Trends for Zcash

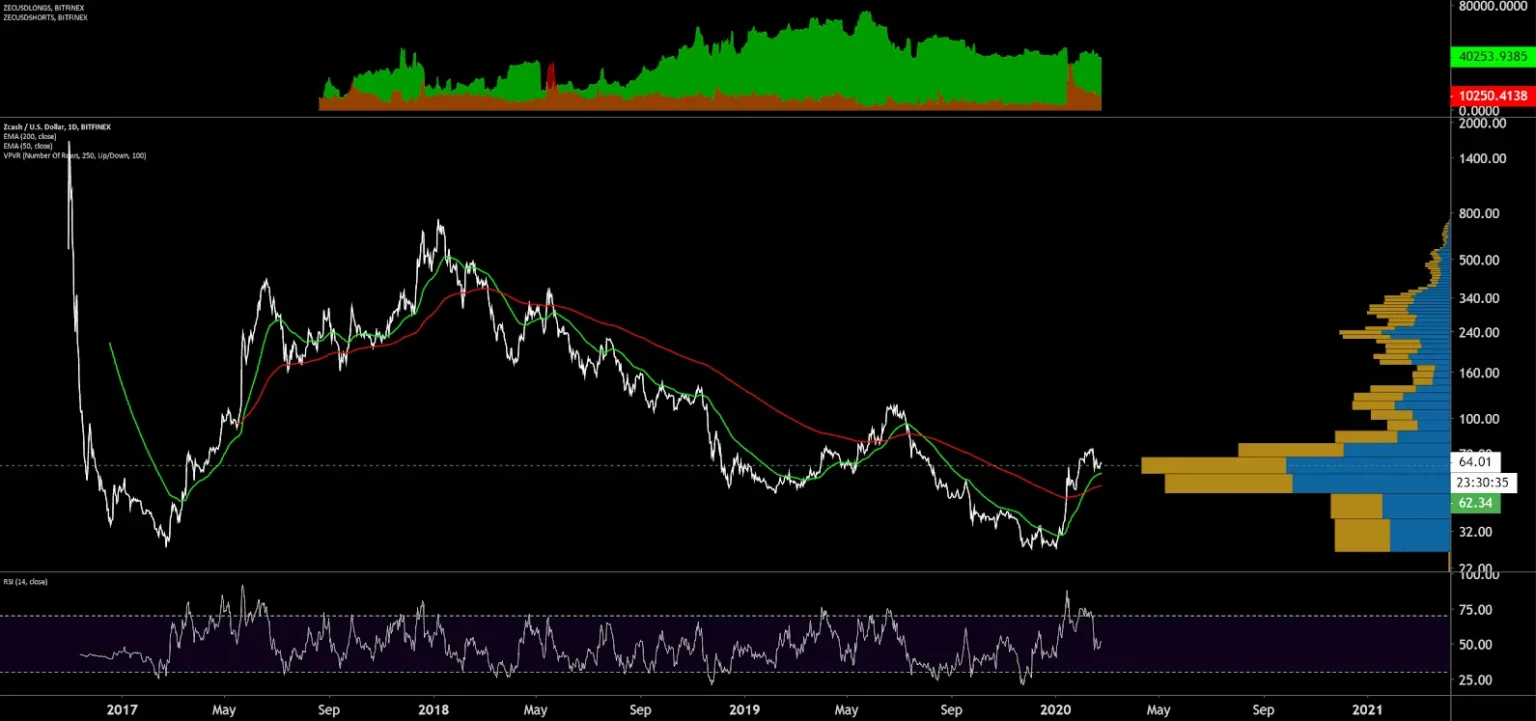

Examining the recent market trends, Zcash has shown considerable resilience. Amidst the tumultuous shifts that have often rocked the crypto landscape, ZEC has managed to hold a consistent price range, finding solid support at its current levels. This stability is noteworthy, particularly when contrasted with more volatile counterparts.

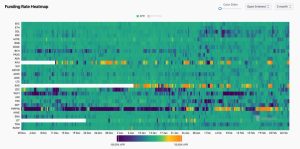

The Critical Breakout Level

Despite the stable foothold, there’s a critical breakout level that continues to hold significant relevance. This level, determined by the intersection of multiple technical indicators such as moving averages, volume, and historical resistance zones, sits slightly above the current trading range. For Zcash, surpassing this level could attract renewed interest and potentially lead to price appreciations, as it could signify to the broader market and investors that Zcash remains a strong contender in the privacy coin segment.

What It Means for Investors

Investors and those considering Zcash should watch this breakout level closely. A robust move above this point could not only confirm the strength of the current support levels but may also suggest a potential for higher valuations moving forward. Moreover, for technical traders, such breakout would be an indicator to reassess portfolios, considering the implications of enhanced market confidence in the sustainability and demand for privacy-centric solutions provided by Zcash.

Conversely, failure to break past this critical point could lead to a reassessment of the near-term price expectations. Investors might need to brace for continued consolidation. Nevertheless, the inherent value of Zcash, driven by its privacy features, remains a central attractive point that might buffer against severe downturns.

In Summary

As Zcash continues to trade within a relatively stable range, the focus shifts to a specific breakout level that holds the potential to define its short to medium-term market dynamics. Both seasoned investors and casual observers should monitor this level, as it could very well dictate the trajectory of this unique privacy-centric digital currency in an increasingly competitive space. Whether looking to invest or simply keeping an eye on privacy technologies in the cryptosphere, Zcash offers an interesting study case in balancing stability and potential growth in an unpredictable market.