XRP Nears Overvaluation, Sparking Fresh Price Concerns

In the world of cryptocurrencies, few topics generate as much interest and debate as the valuation of assets like XRP, the cryptocurrency used by the digital payment platform Ripple. Recent trends in the market have suggested that XRP may be approaching a state of overvaluation, causing investors and analysts alike to voice concerns over potential price corrections.

Understanding XRP’s Recent Surge

XRP has experienced a notable surge in value over recent months. This increase can be partially attributed to several positive developments within Ripple Labs, including successful partnerships with major financial institutions and updates in their blockchain technology. Moreover, the optimistic sentiment across the broader cryptocurrency market has also played a role in buoying XRP’s price.

However, alongside the genuine progress and achievements, speculative trading has significantly fueled the rise. An increased presence of retail investors, driven by viral social media content and news coverage, has amplified demand and possibly exaggerated market valuations.

Analytical Insights: Overvaluation Signals

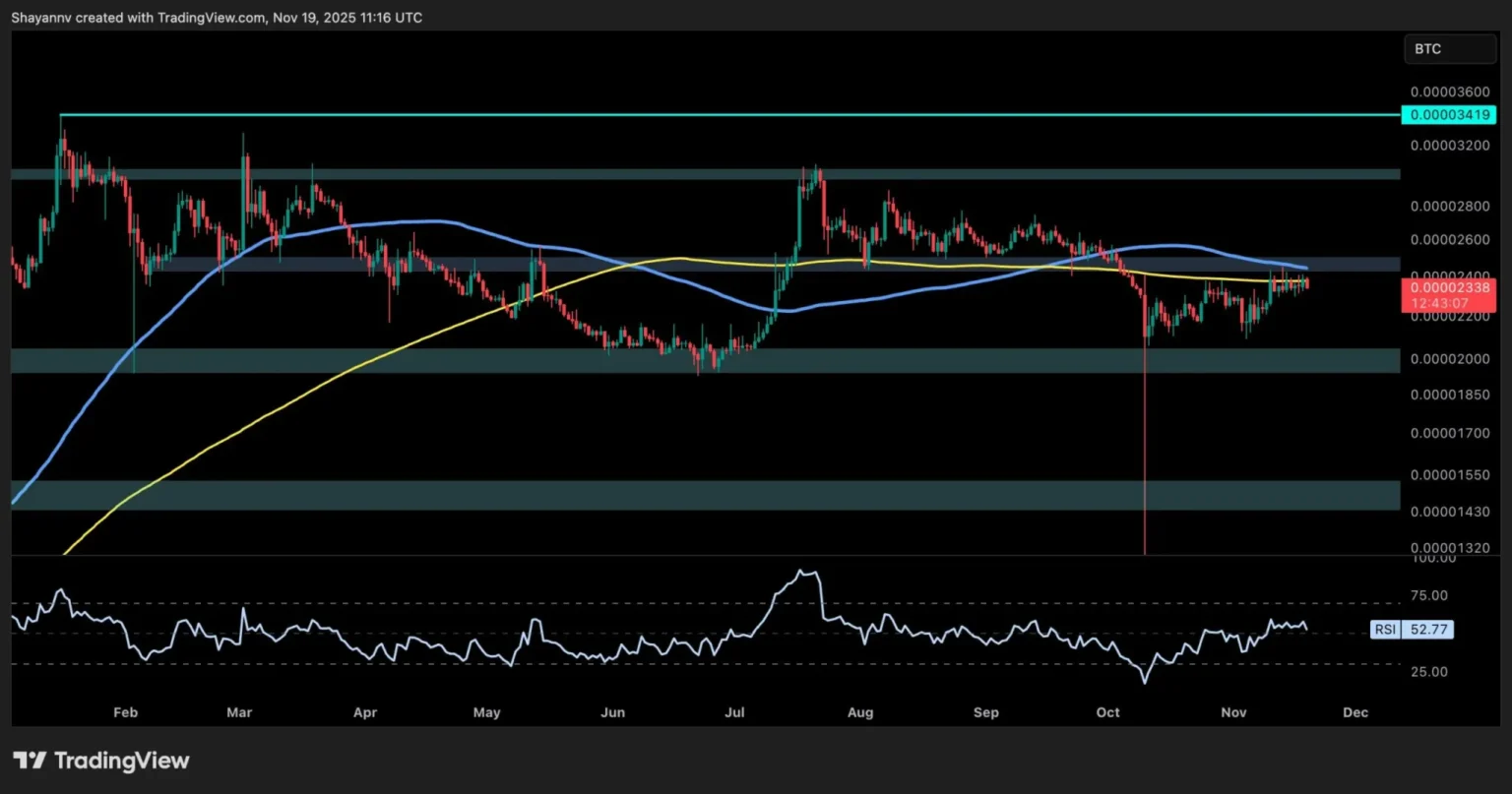

Analysts use a variety of tools and indicators to determine whether a particular cryptocurrency like XRP is overvalued. One popular metric is the price-to-earnings ratio, adapted from traditional stock market analysis to fit crypto assets, interpreting it through metrics such as network value to transactions ratio (NVT) and relative trade volumes.

By these and other measures, XRP appears to be stretched in terms of valuation. The abrupt rise in its price without a proportional increase in usage in real-world transactions raises red flags. Excessive valuations often precede price corrections, as history has shown with numerous assets in the cryptocurrency space.

The Role of Regulatory Uncertainty

Another factor contributing to concerns around XRP is the ongoing regulatory scrutiny faced by Ripple Labs in the United States. The SEC’s lawsuit alleging that Ripple conducted an unregistered securities offering has been a dark cloud over XRP’s market performance. The outcome of this legal battle is likely to have significant implications for XRP’s valuation. A favorable ruling might justify its current market value or propel it further, whereas a negative outcome could lead to a steep decline.

Market Sentiment and Future Outlook

The community sentiment around XRP remains mixed. On one hand, die-hard supporters continue to believe in the long-term potential of XRP, especially given Ripple’s increasing footprint in the financial industry. On the other hand, the fear of overvaluation and a potential price drop concerns short-term traders and investors.

Moving forward, it is crucial for potential investors to stay informed through a balanced approach, considering both technical analyses and fundamental valuation techniques. Watching closely the developments in Ripple’s court case and new enterprise deployments of XRP will provide further clues.

Conclusion

As XRP nears a potential state of overvaluation, investors are advised to tread cautiously. The volatile nature of cryptocurrency markets, combined with regulatory uncertainties surrounding Ripple, could result in unexpected price movements. While XRP continues to hold promise, particularly with its underlying technology and strategic partnerships, its current valuation calls for a careful assessment of risk and strategy from investors. Witnessing how it navigates these choppy waters will be key for everyone with a stake in its journey.