WLFI has recently made headlines in the cryptocurrency world after successfully selling 73 Wrapped Bitcoin (WBTC) for an impressive $5.037 million. This notable transaction highlights the growing influence of the Trump family’s crypto project within the digital currency landscape. With ongoing cryptocurrency news and updates focusing on innovative projects, WLFI continues to capture the attention of investors looking for opportunities in the volatile market. Additionally, Onchain Lens monitoring has provided crucial insights into such transactions, keeping enthusiasts informed about the latest crypto project updates. As interest in blockchain technology and digital assets expands, WLFI’s substantial WBTC sales demonstrate its potential to thrive amid evolving trends.

The Trump family’s venture into digital currencies, known as WLFI, has garnered significant attention after a successful liquidation of 73 WBTC for a noteworthy $5.037 million. This recent development has solidified WLFI’s place within the dynamic realm of blockchain innovation, showcasing its proactive approach to leveraging cryptocurrency investments. As analysts and investors closely track movements in the market, the importance of reliable monitoring tools like Onchain Lens becomes increasingly apparent. Such insights into crypto project developments are essential for anyone interested in navigating this fast-paced industry, particularly as new trends continuously emerge within the broader financial ecosystem. With evolving narratives surrounding cryptocurrency assets, WLFI stands poised to shape the future of digital finance.

| Detail | Information |

|---|---|

| Project Name | WLFI |

| Crypto Sold | 73 WBTC |

| Value of Sale | $5.037 million |

| Monitoring Source | Onchain Lens |

| Association | Trump family |

Summary

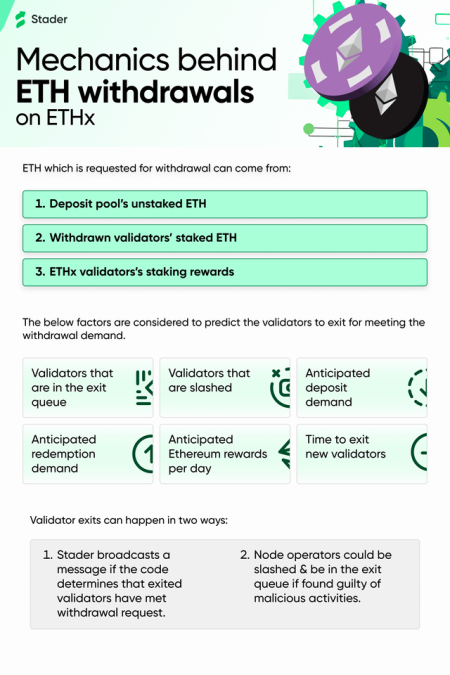

WLFI has recently made headlines as it sold 73 WBTC, totaling approximately $5.037 million. This sale, monitored by Onchain Lens, highlights the increasing involvement of the Trump family in the cryptocurrency space. Such significant transactions can impact market dynamics and offer insights into the evolving landscape of crypto investments.

Trump Family Crypto Project: WLFI’s Recent WBTC Sale

The Trump family’s crypto initiative, known as WLFI, has made headlines recently with the sale of 73 Wrapped Bitcoin (WBTC), which is valued at approximately $5.037 million. This significant move highlights the growing influence of high-profile figures in the cryptocurrency space, particularly how traditional investment strategies are blending with innovative blockchain technologies. As cryptocurrency continues to gain acceptance, tracking such sales helps us understand market dynamics and investor sentiment towards digital assets.

According to data provided by Onchain Lens, the episode of WLFI selling WBTC signifies a potential pivot or strategy being employed by the Trump family in managing their investments in the crypto market. The sale might reflect a broader trend where established figures leverage their influence to either stabilize or capitalize on fluctuating market conditions. This transaction is not just a sale of digital assets; it’s a reflection of confidence or opportunity in the ever-evolving landscape of cryptocurrency news, where each movement can impact prices and investor strategies.

Understanding the Role of WBTC in Today’s Crypto Market

Wrapped Bitcoin (WBTC) serves as a crucial bridge between Bitcoin and the Ethereum ecosystem, enabling users to utilize Bitcoin in a more flexible decentralized finance (DeFi) environment. As WLFI sells 73 WBTC, it falls in line with the increasing demand for tokenized versions of Bitcoin, which encourages liquidity and trading within various enterprise-grade applications. Notably, sales like these fuel crypto project updates, pointing towards an expansive future for DeFi and cross-chain interoperability.

Monitoring WBTC sales adds another layer of insight into cryptocurrency investment strategies, particularly when observed through platforms like Onchain Lens. With the rise of crypto project updates, the role of WBTC in shaping market momentum cannot be overlooked. By analyzing trends in WBTC trading, investors can better predict future movements in the market, leveraging knowledge about popular tokens to make informed decisions in the realm of cryptocurrency news.

The Impact of Strategic Sales on Cryptocurrency Trends

WLFI’s decision to sell 73 WBTC is indicative of possible strategic shifts within cryptocurrency investment paradigms. Major sales can set a precedent, influencing not only the trading price of WBTC but also the perception of crypto assets overall. Investors are keenly watching such events to glean insights and adjust their strategies accordingly. The implications of these trades often ripple through the market, impacting various altcoins and investment approaches.

Moreover, observing high-stakes transactions like the one executed by WLFI allows analysts to consider the broader implications on market trends and investor behavior. With the involvement of notable figures such as the Trump family, there is heightened visibility that could either attract new investors or introduce skepticism among cautious traders. Deciphering these trends could be critical for understanding how individual sales impact cryptocurrency’s maturation and acceptance in mainstream finance.

Tracking Cryptocurrency Sales with Onchain Lens

Onchain Lens plays an invaluable role in monitoring significant sales within the cryptocurrency ecosystem. By providing visibility into transactions such as WLFI’s recent sale of 73 WBTC, investors gain insight into market behavior and the strategies being employed by major players. This transparency is crucial for understanding the fluctuations and trends within the cryptocurrency markets, particularly during times of volatility.

The data captured by Onchain Lens not only catalogs sales but also reflects the intricacies of blockchain technology in real-time. Investors and analysts alike can use this information to anticipate market changes or potential bullish trends based on the aggregate behaviors of influential crypto projects. Keeping an eye on these analytics is essential for anyone looking to succeed in the fast-paced world of cryptocurrency news and investment.

Insights from WLFI’s 73 WBTC Sale

The sale of 73 WBTC by WLFI presents a substantial amount of capital that may be redirected into other crypto assets or traditional investments. For investors following WLFI, this strategic maneuver could indicate the family’s confidence in future opportunities or a shift towards diversifying their portfolio. Such decisions often spark curiosity and speculation in the wider community about the Trump family’s long-term vision regarding cryptocurrency.

Additionally, the ripple effects of such a significant sale can initiate a re-evaluation of market conditions among other crypto stakeholders. When prominent figures partake in large transactions like WBTC sales, it serves as a clarion call for both seasoned traders and new entrants. The implications of WLFI’s sale could lead to increased scrutiny of WBTC’s performance, influencing its price dynamics and shaping future crypto project updates in the sector.

Why WBTC Is Significant in the Cryptocurrency Realm

Wrapped Bitcoin (WBTC) holds a pivotal role in the cryptocurrency ecosystem due to its ability to bring Bitcoin’s value into the Ethereum blockchain. This integration opens up new avenues for liquidity and smart contract use cases that Bitcoin alone cannot utilize. As evidenced by WLFI’s recent sale of 73 WBTC, it highlights a growing preference among investors to leverage tokenized assets for enhanced functionality in the decentralized finance (DeFi) space.

Moreover, WBTC exemplifies the evolution of crypto investments as traditional financial mechanisms seamlessly converge with revolutionary blockchain technologies. This progression not only democratizes access to valuable digital assets but also amplifies their usability across various platforms. Hence, observing transactions like WLFI’s sell-off provides essential insights into market trends and the future potential of both Bitcoin and its derivatives.

The Future of Cryptocurrency Investments Post-WLFI Sale

In the wake of WLFI’s significant sale of WBTC, the cryptocurrency investment landscape may be poised for notable changes. The maneuver by such a high-profile project can catalyze shifts in market sentiment, prompting investors to reassess their strategies. By leveraging insights from WLFI’s activities, other stakeholders have an opportunity to evaluate potential investment pathways, feeding into broader cryptocurrency news narratives.

Furthermore, the evolving nature of crypto project updates, fueled by events such as WLFI’s actions, emphasizes the importance of adaptive strategies for investors. As market conditions fluctuate, informed participation rooted in historical data and strategic movements can serve as a compass for navigating future investment opportunities in the crypto realm.

Exploring the Intersection of Traditional and Digital Finance

The recent WLFI sale of WBTC serves as a compelling example of the intersection between traditional finance and the burgeoning crypto markets. By involving figures known for their influence in conventional sectors, this transaction signals an intriguing trend where affordability and accessibility in asset management are transforming. This blend of established practices with innovative technologies paves the way for broader adoption of crypto assets.

Investors from both worlds are likely to keep an eye on projects exemplifying this mix, particularly as they seek assurance and stability amidst the volatility often associated with cryptocurrencies. As news emerges from transactions like WLFI, the market could see more traditional investors entering the arena, harnessing their experiences to bridge the gap between traditional finance’s reliability and the dynamic nature of crypto investments.

Frequently Asked Questions

What is WLFI and how does it relate to the Trump family crypto project?

WLFI, associated with the Trump family crypto project, aims to leverage cryptocurrency to innovate in finance. Recent updates highlight WLFI’s active trading in WBTC, emphasizing its strategy and market presence.

How much WBTC has WLFI sold recently?

WLFI has recently sold 73 WBTC, which is valued at approximately $5.037 million, showcasing its significant activity in the cryptocurrency market.

What do the WBTC sales by WLFI indicate about the project’s status?

The recent sale of 73 WBTC by WLFI indicates a robust engagement in the cryptocurrency market, reflecting strong liquidity and an active operational strategy of the Trump family crypto project.

Where can I find cryptocurrency news related to WLFI?

For the latest cryptocurrency news regarding WLFI and its developments, including WBTC sales and other updates, stay tuned to dedicated financial and crypto news platforms.

How is Onchain Lens monitoring WLFI’s cryptocurrency activities?

Onchain Lens provides real-time monitoring of WLFI’s transactions, including the sale of WBTC, enabling investors and crypto enthusiasts to track the Trump family’s crypto project effectively.

What updates can we expect from WLFI in the crypto space?

WLFI continues to innovate in the cryptocurrency sector, and updates such as recent WBTC sales are fundamental. Keep an eye on their announcements for future project updates and developments.