In a significant move within the cryptocurrency world, WLFI TRX Deposit has made headlines by transferring an impressive 40.71 million TRX, equivalent to 11.23 million USD, into the HTX exchange. This strategic maneuver comes as part of the WLFI Strategic Reserve’s asset management, underscoring their commitment to maximizing TRX value for future operations. Analyzing this transaction reveals that the allocated TRX was purchased at an average price of 0.2415 USD, showcasing the foresight of WLFI in the ever-fluctuating landscape of cryptocurrency transactions. The implications of such TRX deposits not only affect market dynamics but also highlight the evolving investment strategies of cryptocurrency entities. As WLFI continues its foray into various exchanges, keen observers will undoubtedly monitor the influence of these transactions on TRX value and the overall health of the digital asset market.

In the realm of digital assets, the recent WLFI TRX deposit reflects a calculated effort by WLFI to enhance its cryptocurrency portfolio. This notable transfer of TRX to HTX not only illustrates WLFI’s strategic approach but also emphasizes the importance of liquidity management in the cryptocurrency exchange ecosystem. By reallocating significant resources, WLFI taps into various opportunities for enhancing long-term value within the market. This scenario is yet another example of how entities navigate the complexities of cryptocurrency transactions, aiming for optimal investment returns. As the landscape evolves, the actions of WLFI serve as a blueprint for others engaging in similar reallocation strategies within the burgeoning cryptocurrency markets.

Understanding WLFI TRX Deposit Trends

The recent deposit of 40.71 million TRX by WLFI into HTX signifies a strategic maneuver in cryptocurrency transactions. This action not only highlights WLFI’s confidence in the TRX value but also represents a pivotal point in the management of their assets. By monitoring such deposits, investors can gain insights into market trends and the operational strategies of significant players in the crypto landscape.

Over the past months, WLFI’s strategic reserve has been making calculated moves, acquiring TRX at advantageous prices and strategically timing its deposits into platforms like HTX. This particular deposit was valued at approximately 11.23 million USD, reflecting the unit’s strength in today’s market. The meticulous handling of TRX deposits shows WLFI’s intention to leverage its hold on this digital currency to further its business objectives.

The Role of WLFI Strategic Reserve in Cryptocurrency Markets

WLFI’s strategic reserve has become a notable player within the cryptocurrency domain, especially after the substantial TRX deposit into HTX. This reserve acts as a buffer and growth mechanism for WLFI, enabling them to make significant investments and tactical allocations. The deposit of 40.71 million TRX not only indicates a strong belief in TRX’s future but also serves as a testament to the strategic foresight of WLFI’s asset management team.

Prior to this deposit, WLFI had previously engaged in various cryptocurrency transactions, purchasing tokens like LINK and AAVE, which suggests a diversified approach to its investments. Such strategic movement of assets — buying and reallocating — not only enhances WLFI’s portfolio but also reflects on the overall health of the crypto markets. As the cryptocurrency landscape evolves, contributions by entities like WLFI highlight the importance of strategic reserves in sustaining value among digital assets.

Impact of TRX Deposits on HTX Exchange Dynamics

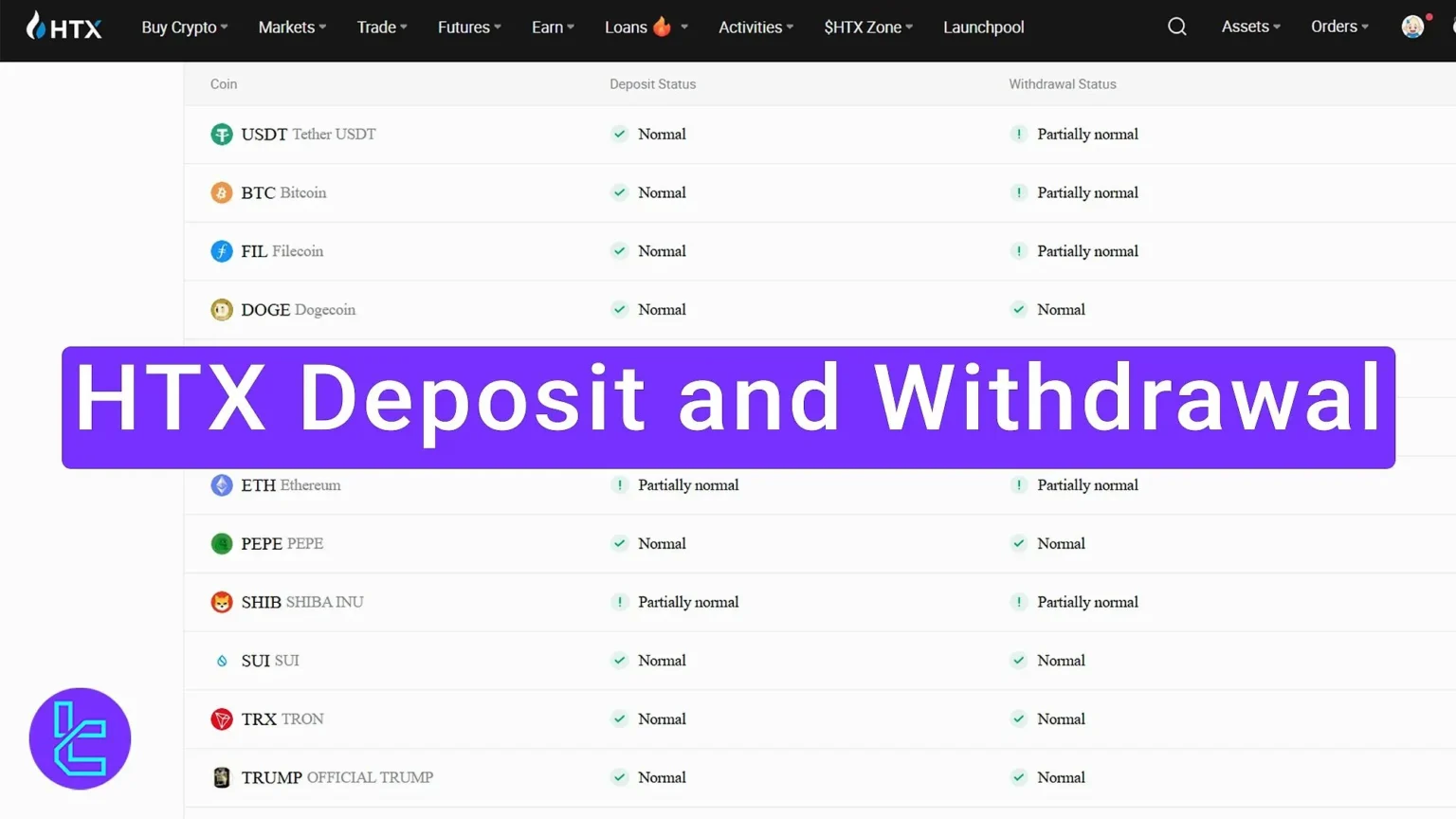

The entry of 40.71 million TRX into the HTX exchange underscores the platform’s growing significance in the ecosystem of cryptocurrency transactions. As a repository for liquidity and trading, HTX provides a vital channel for traders and investors looking to engage with robust assets like TRX. This specific deposit could lead to increased trading activity on HTX, potentially influencing the TRX value positively in the short term.

Moreover, such large deposits create ripple effects across the market, impacting sentiment among traders and affecting the broader trading landscape. Investors are likely to watch HTX closely for potential shifts in TRX’s liquidity and price movements resulting from WLFI’s actions. Overall, the dynamics at HTX following these deposits can be a barometer for market health and investor confidence in major cryptocurrencies.

Analyzing WLFI’s Previous Cryptocurrency Transactions

WLFI’s past transactions provide critical context for their recent actions involving TRX deposits. Having previously acquired tokens like LINK, AAVE, ENA, and MOVE, WLFI has established a diversified portfolio aimed at long-term value generation. By understanding these previous investments, one can glean insights into their current strategy regarding the TRX deposits and how they’re planning to position their assets in the market.

The statement by WLFI regarding the reallocation of assets for daily business purposes indicates a calculated approach rather than a panic sell-off or liquidation. This past behavior emphasizes a thoughtful strategy aimed at maintaining a strong market position while actively managing their treasury in response to shifting market conditions.

The Future of TRX Value in the Crypto Ecosystem

With WLFI’s substantial deposit into HTX, analysts are now carefully projecting the future of TRX’s value. Given the considerable capital involved, many are predicting a bullish trend for TRX, particularly if WLFI continues to accumulate and deposit shares like this. The emphasis on reallocation rather than liquidation suggests that WLFI sees a promising future for TRX, potentially influencing other investors and stakeholders in the market.

Market analysts often focus on key indicators that could affect TRX value, including trading volume, market sentiment, and operational activities of significant market players like WLFI. As WLFI engages further with TRX and platforms like HTX, the implications for TRX’s future could resonate broadly, creating opportunities for both current holders and potential investors looking to enter the market.

Strategic Asset Management in Cryptocurrency Investments

The management of assets within the cryptocurrency arena, particularly for reserves like WLFI, requires a perfect balance of risk analysis and strategic foresight. In light of their recent 40.71 million TRX deposit into HTX, it’s clear that careful asset management is pivotal for navigating the volatile landscape of cryptocurrencies. Such decisions can impact liquidity ratios, investor confidence, and market perceptions significantly.

By utilizing exchanges wisely and timing their transactions strategically, entities like WLFI can enhance their market presence. This efficient management not only solidifies their portfolio but also contributes positively to the overall health of the cryptocurrency markets, as seen with their historical operations involving TRX and other major digital assets.

Potential Implications of WLFI’s TRX Movement

WLFI’s recent movements with a significant TRX deposit could be pivotal for the long-term perception of the asset. The 40.71 million TRX deposited into HTX is more than just a statement of intent; it can have broader implications for market liquidity and pricing trends. As more institutional players take such actions, the overall supply-demand mechanics of TRX may shift, affecting how the asset trades on various exchanges.

Moreover, such moves may influence smaller investors, prompting them to reassess their positions or enter the market. The narrative surrounding WLFI’s strategic reserve emphasizes the importance of institutional confidence in TRX, further driving interest and investment in the asset class. This type of market engagement is crucial for fostering a healthy cryptocurrency ecosystem.

How to Monitor Major Cryptocurrency Deposits

Investors seeking to stay ahead in the cryptocurrency market must actively monitor significant deposits like WLFI’s into HTX. Tools such as blockchain analytical platforms allow users to track large transactions and analyze flow trends to better understand market movements. Understanding the implications of major movements can inform trading strategies and investment decisions.

Additionally, following news from reputable sources and blockchain experts can provide context around large deposits. Being aware of the rationale behind a transaction — for instance, reallocation for business operational purposes as stated by WLFI — can help investors ascertain the potential impact on TRX value and associated market activities. Keeping abreast of such developments is essential for making informed investment choices.

The Significance of HTX in Future Cryptocurrency Transactions

HTX has emerged as a significant exchange for cryptocurrency transactions, evidenced by WLFI’s recent deposit that signals growing institutional confidence in the platform. With its robust trading infrastructure and liquidity options, HTX is positioned to become a key player in facilitating significant transactions, particularly as more entities recognize its value for distributing and acquiring digital assets like TRX.

The relationship between HTX and major players like WLFI represents a critical juncture in the cryptocurrency market’s development, suggesting that the platform may continue to play a vital role in how assets are exchanged. Monitoring HTX’s performance will be crucial for investors looking to capitalize on potential price movements and shifting market dynamics surrounding TRX and other prominent cryptocurrencies.

Frequently Asked Questions

What is the significance of the WLFI TRX deposit into HTX exchange?

The WLFI TRX deposit into HTX is significant as it showcases the strategic management of WLFI’s assets, indicating a shift in operational strategies within the cryptocurrency market. With 40.71 million TRX deposited, valued at 11.23 million USD, it reflects WLFI’s ongoing commitment to cryptocurrency transactions and strategic reserve adjustments.

How much TRX was deposited by WLFI into HTX and what was its value?

WLFI deposited 40.71 million TRX into the HTX exchange, which is valued at approximately 11.23 million USD based on recent market evaluations. This substantial deposit indicates WLFI’s confidence in the TRX value and the strategic allocation of its assets.

What can we learn about WLFI’s asset strategy from the TRX deposits?

From the WLFI TRX deposits, we can infer that WLFI is reallocating its assets for operational needs rather than selling its holdings. This strategic reserve management could be crucial for liquidity and operational flexibility in cryptocurrency transactions.

Why did WLFI deposit TRX into HTX instead of another exchange?

WLFI’s decision to deposit TRX into HTX may be driven by strategic partnerships, favorable trading conditions, or a better alignment with WLFI’s operational objectives. This deposit marks a notable move as it is the first time WLFI has utilized HTX for its TRX transactions.

What does the WLFI Strategic Reserve mean for cryptocurrency transactions?

The WLFI Strategic Reserve, which includes the recent TRX deposit, plays a vital role in managing liquidity and ensuring smooth cryptocurrency transactions. By maintaining a strategic reserve, WLFI can respond dynamically to market changes and operational requirements.

| Key Point | Details |

|---|---|

| Deposit Amount | 40.71 million TRX |

| Value in USD | 11.23 million USD |

| Deposit Date | 2025-11-25 01:52 |

| Previous Purchase Value | 9.85 million USD |

| Average Purchase Price | 0.2415 USD |

| Asset Reallocation Claim | Not a sale, but a reallocation for daily business purposes |

| Previous Tokens Deposited | LINK, AAVE, ENA, MOVE, ONDO |

| First Deposit to HTX | Yes |

Summary

WLFI TRX Deposit marks a significant move in the crypto landscape with the strategic allocation of 40.71 million TRX into HTX, valued at 11.23 million USD. This action illustrates WLFI’s ongoing strategy of reallocation rather than liquidation, highlighting their commitment to managing their assets effectively. The deposit follows previous investments into well-known cryptocurrencies, showing a pattern of asset management aimed at business operations rather than mere sales.