Will Zcash Surge to $300 or Stumble After Reaching Surprising Peaks?

The world of cryptocurrency is ever-evolving, with new tokens and technologies popping up consistently. However, some digital currencies like Zcash (ZEC) have consistently captured the market’s attention due to their unique offerings and promising technological foundation. Zcash, known for its privacy-centric features, has recently seen an impressive surge in its market value. This has led many investors and analysts to speculate whether Zcash will continue its upward trajectory to reach the $300 mark or face a downturn after the latest peaks.

Understanding the Surge

Zcash’s architecture provides enhanced privacy compared to other cryptocurrencies like Bitcoin by allowing users to shield their transactions using advanced cryptographic techniques. This feature has become increasingly appealing as concerns over digital privacy continue to grow globally.

The recent price surge can be attributed to several factors. Firstly, the increasing adoption of ZEC for private transactions in an era where personal privacy is highly valued has significantly contributed. Additionally, broader market dynamics, including institutional interest and retail investment in cryptocurrencies, have seen a positive uptick. The involvement of major exchanges and investment platforms in facilitating easier access and trade of ZEC has further fueled its rise.

Market Analysis on the Path to $300

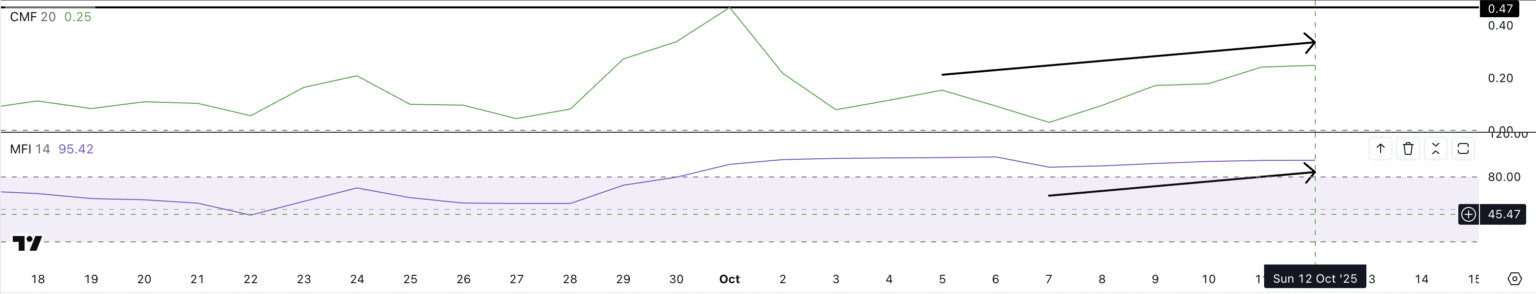

To predict whether Zcash might reach $300, it’s crucial to delve into both technical analysis and fundamental market conditions. From a technical standpoint, Zcash has shown strong bullish patterns, demonstrating a consistent uptrend in recent weeks. However, resistance levels around the $250-260 marks might pose significant barriers.

On the fundamentals side, the growth of Zcash depends greatly on its adoption within the privacy-focused sectors of crypto transactions. The ongoing developments and updates within the Zcash platform, aimed at enhancing security and transaction speed, also paint a promising picture, potentially leading to greater adoption.

Potential Stumbling Blocks

Despite the optimistic outlook, several challenges could hinder Zcash’s path to $300. One of the primary concerns is the regulatory landscape. Cryptocurrencies focused on privacy face intense scrutiny from governments and regulatory bodies worldwide, fearing their use for illegal activities. Any negative regulatory changes could impact Zcash’s market perception drastically.

Moreover, the competition from other privacy-centered coins like Monero (XMR) and the arrival of new technologies could divert investor interest. The cryptocurrency market is notoriously volatile, and shifts in investor sentiment can lead to rapid price changes.

Investor Sentiment and Market Watch

Investor sentiment currently leans positive, buoyed by the broader crypto market’s recovery and interest in privacy technologies. Monitoring social media, news outlets, and market analysis reports could provide further insights into potential shifts in sentiment that could either catapult ZEC to new heights or lead to declines.

Conclusion

Zcash’s potential to surge to $300 hinges on several factors including technological adoption, market dynamics, and regulatory environments. While there are significant hurdles, the overall trend and market sentiment towards privacy-preserving cryptocurrencies suggest a positive outlook. Investors interested in Zcash should keep a close watch on market trends and regulatory news, maintaining a balanced portfolio to mitigate the high volatility inherent in the crypto markets. As always, due diligence and careful analysis are paramount in navigating the cryptic and exciting world of cryptocurrencies.