Why ETH, BNB, and ZEC Might Experience Significant Liquidations This Week

The cryptocurrency market is notorious for its volatility, and the upcoming week might witness significant liquidations in major currencies such as Ethereum (ETH), Binance Coin (BNB), and Zcash (ZEC). Several factors contribute to this turbulent outlook. Understanding these could help investors and traders brace themselves for potential market movements.

1. Regulatory Concerns and Compliance Issues

One of the most significant factors influencing cryptocurrency markets is regulatory scrutiny. Both Ethereum and Binance Coin, being high-profile assets, often find themselves under the watchful eyes of regulatory bodies. Recent rumors and announcements regarding stricter regulations for cryptocurrencies could lead to a panic sell among investors. For instance, if a major economy announces unexpected rules concerning the holding or trading of cryptocurrencies, this could trigger sudden and massive sell-offs.

2. Technical Analysis Predictions

From a technical standpoint, ETH, BNB, and ZEC appear poised for potential downturns. Ethereum, after its significant run-up following the transition into a Proof-of-Stake model, has encountered substantial resistance. Analysts observing RSI (Relative Strength Index) levels and moving averages predict a retracement could be imminent, especially if ETH fails to sustain current support levels.

Binance Coin and Zcash are also showing similar trends with overbought indicators and weakening momentum, which could signal upcoming sell-offs. Traders using technical analysis to guide their decisions might see this as an opportune moment to liquidate positions and secure profits, thereby adding to the selling pressure.

3. Market Saturation and Investor Sentiment

Cryptocurrencies have seen a vast influx of new investors and traders over the past few years, leading to increased market saturation. With many new entrants looking to quick profits, the patience for holding onto assets during turbulent times is notably lower. This scenario is exacerbated by the current economic climate, with rising inflation and interest rates influencing global markets.

Furthermore, the sentiment among crypto investors can be heavily influenced by news and social media. Negative news cycles or bearish sentiment propagated through platforms like Twitter or Reddit can result in rapid shifts in investor behaviour, often leading to large-scale liquidations.

4. Macroeconomic Factors

Global economic conditions, such as changes in interest rates, inflation rates, and other macroeconomic factors, have a significant impact on the crypto market. For instance, the U.S. Federal Reserve’s policy on interest rates can affect the dollar’s strength, indirectly impacting cryptocurrencies. If the dollar strengthens, cryptocurrencies usually drop in price, leading to potential liquidations. Upcoming economic announcements or unexpected bad economic data can exert sudden pressure on ETH, BNB, and ZEC.

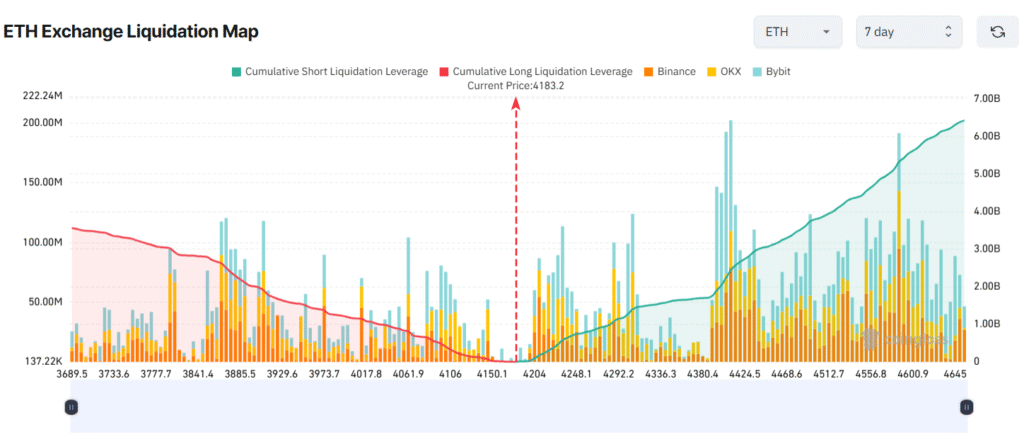

5. Leverage in the Cryptocurrency Markets

The availability of high leverage on many cryptocurrency exchanges means that price movements can be significantly exaggerated. Ethereum, Binance Coin, and Zcash, being popular among leveraged traders, are particularly susceptible to cascading liquidations once certain price thresholds are breached. This scenario can create a domino effect, where initial liquidations cause the price to drop and trigger further liquidations in a continuous cycle.

Conclusion

In conclusion, ETH, BNB, and ZEC are facing a week where multiple factors could conspire to induce significant market liquidations. Traders and investors should keep a keen eye on regulatory news, technical indicators, market sentiment, and macroeconomic developments. Staying informed and being prepared to react quickly will be crucial for navigating the potential market turbulences ahead. As always in the crypto markets, vigilance and caution are advisable.