Why DOGE’s Recent 5% Rally May Spell a Drop to Yearly Lows

Dogecoin (DOGE), the meme-inspired cryptocurrency that has captured the imagination of millions, recently witnessed a 5% rally. However, market analysts and cryptocurrency enthusiasts are speculating that this small spike could potentially precede a significant drop, taking DOGE to its lowest value in over a year. Let’s dive deeper into the factors that could lead to such a bearish outcome for this popular digital asset.

1. The Nature of the Rally

The recent 5% surge in Dogecoin’s value seems promising on the surface but lacks substantial backing from broader market trends or fundamental improvements in the token’s utility or framework. Rallies fueled primarily by speculative trading rather than intrinsic enhancements in the project often lead to sharp corrections. This short-lived enthusiasm may quickly dissipate, leaving the price vulnerable to a steep decline.

2. Market Sentiment and Speculation

Dogecoin has often been driven by social media buzz and celebrity endorsements rather than its technological advancements or adoption rates. While this has worked in favor of DOGE in the past, the current market sentiment is more cautious, with investors increasingly prioritizing fundamentals over hype. Without substantial support from continuous positive media coverage or celebrity tweets, the excitement around Dogecoin may wane, leading to reduced buying pressure.

3. Macro-Economic Factors

The broader economic climate plays a crucial role in shaping the destiny of cryptocurrencies, including Dogecoin. With looming concerns about inflation, interest rate hikes, and economic slowdowns, risk assets like DOGE are particularly vulnerable. These macroeconomic factors could drive investors toward more stable investments, putting additional downward pressure on the price of Dogecoin.

4. Technical Indicators

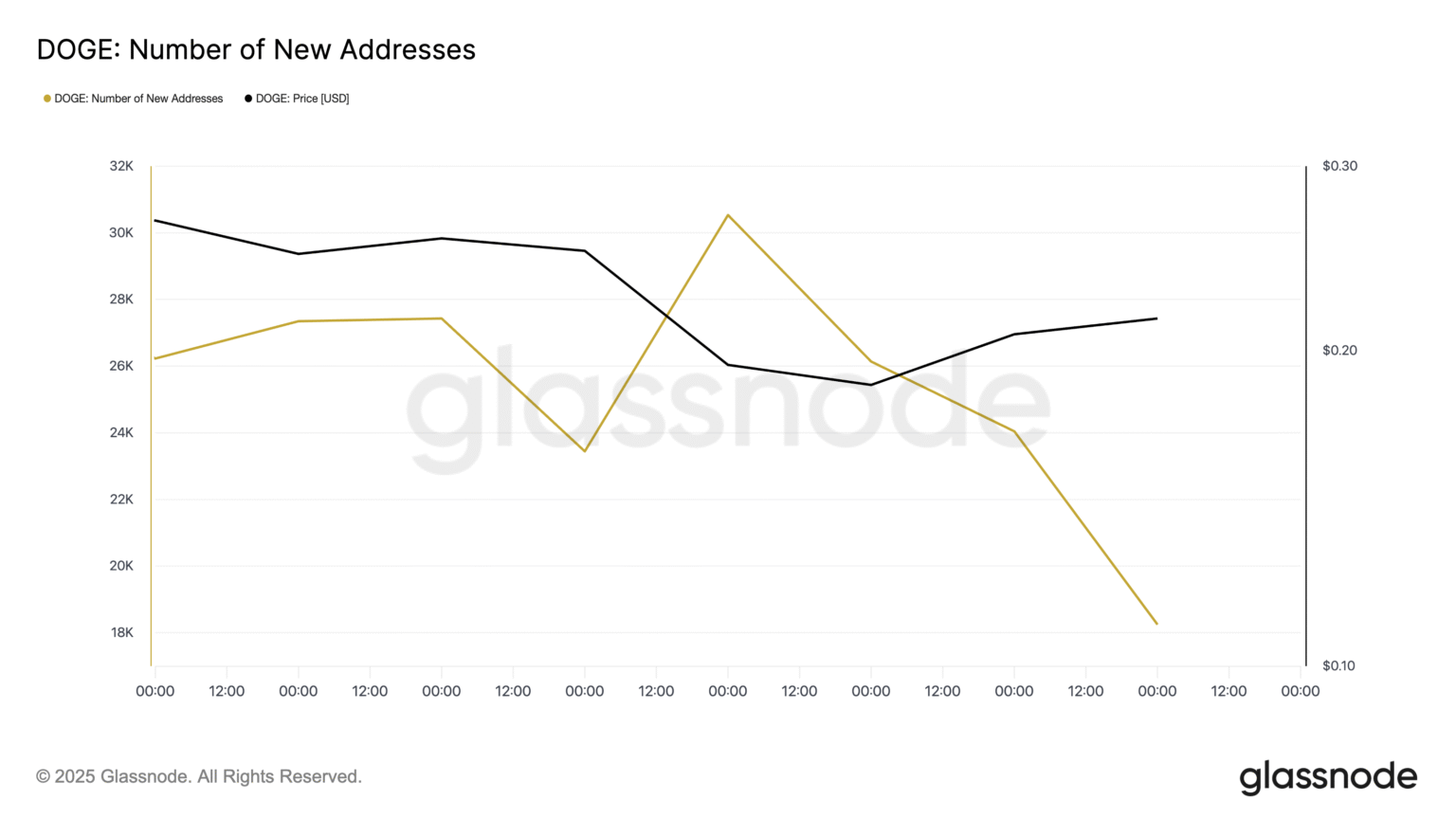

From a technical analysis standpoint, Dogecoin’s recent rally does little to break it out of a longer-term descending trend. The token is still trading below key resistance levels, which are crucial for reversing the bearish trend. If these levels continue to hold, DOGE could be facing a lower high formation – a bearish signal for traders and investors alike. Additionally, low trading volumes during the rally indicate a lack of conviction among buyers, possibly accelerating a downturn.

5. Impact of Competing Cryptocurrencies

The cryptocurrency market is continually evolving, with new tokens and projects emerging at a rapid pace. Many of these new entrants are offering superior utility, scalability, and security, aspects that Dogecoin lacks. As more investors and users flock to these newer and technically advanced projects, older and less innovative tokens like DOGE could suffer from reduced interest and value.

Conclusion

While Dogecoin’s 5% rally might have given hope to its ardent followers, the underlying factors do not support a sustained increase in price. Without robust fundamentals or significant technological improvements, and facing an increasingly competitive and uncertain economic environment, Dogecoin may be at risk of losing its foothold. Investors should be cautious, as this rally might just be a prelude to a drop, potentially marking the lowest value of Dogecoin in over a year. As always, conducting thorough research and considering multiple perspectives before making investment decisions in the volatile cryptocurrency market is advisable.