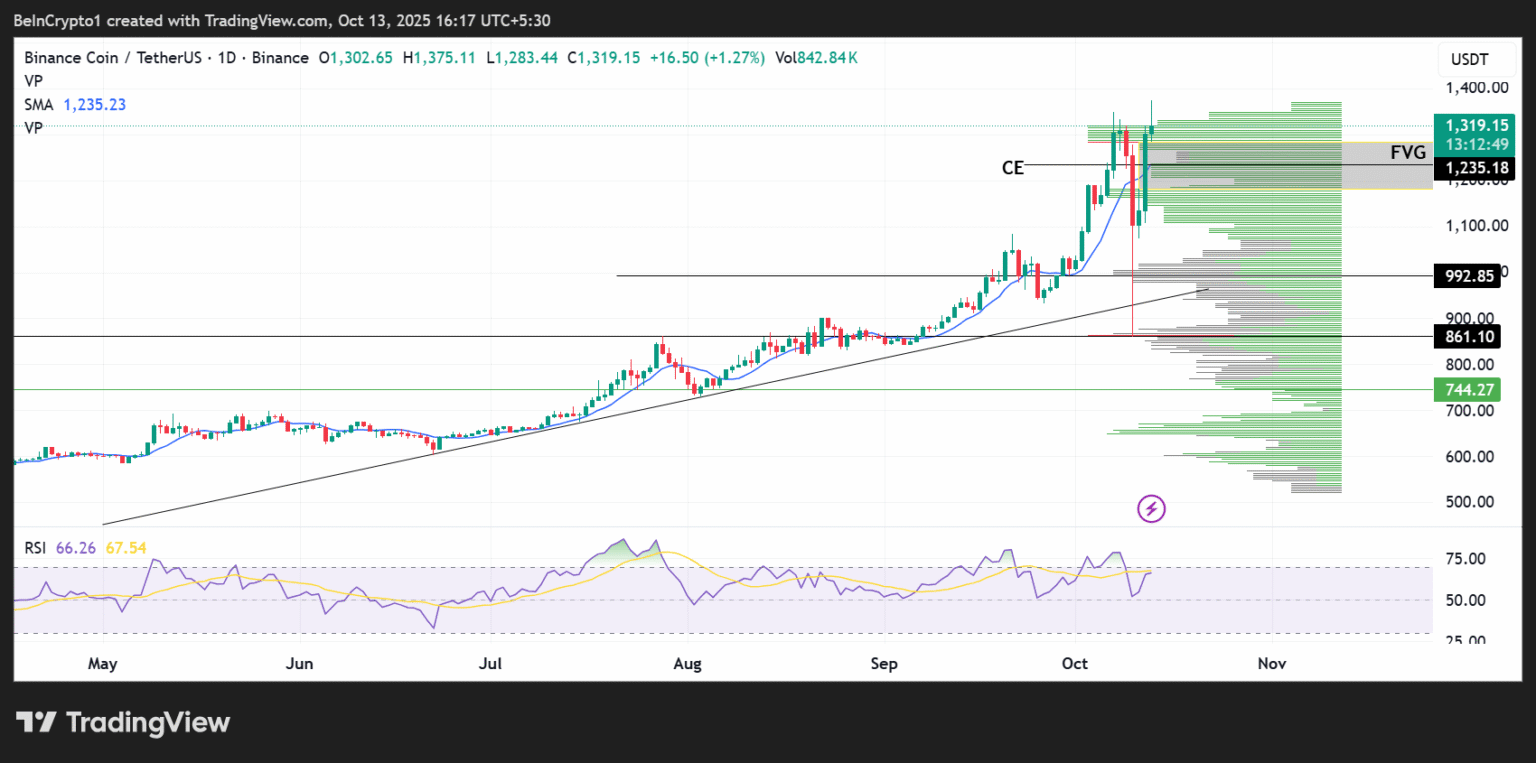

Why Chinese TradFi Interest is Crucial to the $1,235 BNB Price Point

In the evolving landscape of cryptocurrency, Binance Coin (BNB) has emerged as a significant player, with its price ambitions casting wide ripples across the globe. A particular interest has grown around the potential $1,235 price point for BNB, an ambitious yet plausible target given the right market conditions and investor interest. Among the most pivotal factors that could elevate BNB to these heights is the involvement of traditional finance (TradFi) sectors in China. This article explores why Chinese TradFi interest is not just beneficial but crucial for BNB to potentially reach and sustain a price point of $1,235.

The Powerhouse of Chinese TradFi

China, known for its robust economic infrastructure and rapid technological advancements, has an expansive traditional finance sector that deals with billions of dollars in assets daily. TradFi in China encompasses various state and private banks, investment funds, insurance companies, and a burgeoning fintech sector. The integration of blockchain technologies and cryptocurrencies within these traditional systems is viewed with a growing interest, sparked by China’s regulatory and economic strategies and its global financial aspirations.

Regulatory Environment

The Chinese government’s stance on cryptocurrency has been historically fluctuous, swinging between strict regulations to progressive endorsements of blockchain technology. Recent trends, however, indicate a cautious but more structured approach to integrating digital currencies with traditional financial operations. This shifting landscape offers a conducive environment for the broader adoption and investment in cryptocurrencies like BNB.

BNB’s Strategic Position

BNB operates on the Binance Smart Chain (BSC), which is recognized for its low transaction costs and high efficiency, factors that appeal strongly to business transactions and financial services. The strategic positioning of BNB as a utility token within BSC’s ecosystem means it benefits directly from the volume and nature of the transactions conducted.

Furthermore, Binance’s continuous efforts to comply with international and local regulations boost its credibility and appeal to traditional financial institutions considering blockchain integration. If Chinese TradFi entities begin to adopt Binance Smart Chain for its efficiency and cost-effectiveness, the demand and, subsequently, the price of BNB could witness significant growth.

Expansion Through Collaboration

Collaborations between cryptocurrency platforms and traditional finance institutions are not new but remain a cornerstone for crypto adoption at scale. With BNB, the opportunities for partnerships with Chinese TradFi companies are particularly promising. Such collaborations could range from using BSC as a platform for secure transactions to creating bespoke financial products that combine the strengths of both TradFi and DeFi protocols.

Market Potential in China

The sheer market size of China’s financial sector is a colossal force that can drive significant demand for BNB. The adoption of BNB and BSC by even a fraction of this market owing to increased interest from TradFi sectors could set off a demand spiral, pushing BNB towards the $1,235 mark.

The Ripple Effect

The influence of China in global economic dynamics cannot be understated. An uptick in TradFi interest in BNB within China could serve as a strong signal to markets worldwide, potentially leading to a global increase in investor confidence and BNB’s price.

Conclusion

For BNB to reach and sustain an ambitious price point like $1,235, it requires not just intrinsic value but substantial and sustained external demand, which the Chinese TradFi sector is uniquely positioned to provide. The integration of Binance Smart Chain technology with traditional financial operations in China could serve as a critical driver for the widespread adoption and price increase of BNB. As we move forward, keeping an eye on developments within China’s TradFi landscape will be essential for anyone keenly watching BNB’s price trajectory.