Whales Liquidate $5 Billion in XRP; Selling Reaches Peak Since October 2022

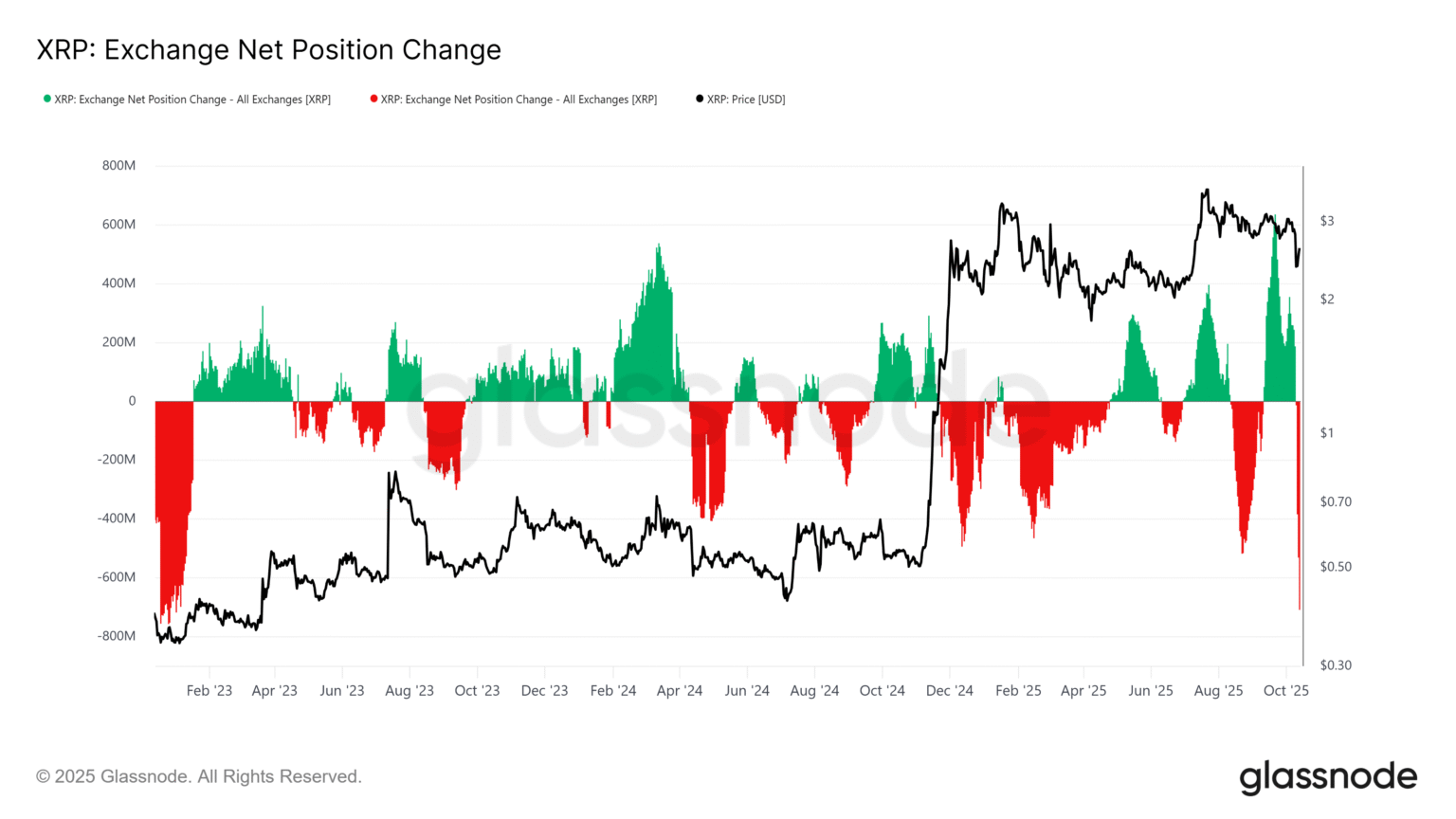

In an unprecedented move, cryptocurrency whales have liquidated over $5 billion worth of XRP, marking a peak in selling activity not seen since October 2022. This massive sell-off has sent shockwaves through the cryptocurrency market, sparking widespread speculation and concern among investors and analysts alike.

The Scale of Liquidation

The significant liquidation event involved large-scale XRP holders, commonly referred to as whales, who disposed of their assets in various cryptocurrency exchanges around the globe. Data from blockchain analytics firms indicate that this sell-off is one of the largest in terms of volume and value in the past year. The last time a comparable sell-off occurred was back in October 2022, when macroeconomic factors and market instability prompted similar actions.

Implications on XRP Price

The immediate impact of this large-scale disposal has been a sharp decline in the price of XRP. Following the liquidations, XRP’s value plummeted by over 15%, complicating the market’s recovery path, especially after the bearish trends experienced in the previous months. Investors and traders have been closely monitoring the price action, attempting to gauge the market’s direction amidst these new developments.

Reasons Behind the Sell-off

While the specific motives behind this whale activity remain largely speculative, several plausible factors could be driving this behavior:

- Market Sentiment and Economic Indicators: Broader market sentiments, often influenced by global economic conditions and regulatory news, can lead to such strategic moves by large holders.

- Portfolio Adjustment and Profit Taking: Some analysts suggest that whales could be taking profits after previous price increases or adjusting their portfolios in anticipation of future market dynamics.

- Regulatory Concerns: Ongoing regulatory scrutiny in key markets, particularly in the United States, might be prompting some investors to reduce their exposure to assets like XRP, which have been under significant regulatory uncertainty.

Market Reaction

The market reaction to this significant sell-off has been mixed. While some traders see this as a buying opportunity, viewing the dip as a temporary setback, others are more cautious, concerned about potential further declines resulting from such high-profile liquidations. Cryptocurrency forums and social media platforms are abuzz with debates and discussions on the rationale and future implications of this move by the whales.

Historical Context and Future Outlook

Looking historically, XRP and other cryptocurrencies have experienced similar large-scale sell-offs, which often lead to short-term market downturns followed by stabilization. Predicting the future trajectory of XRP, in this case, remains challenging due to the volatile nature of cryptocurrencies and external market factors.

However, this event underscores the inherent volatility and the significant influence that large holders have on the market dynamics of cryptocurrencies like XRP. Investors and market participants will undoubtedly keep a close eye on whale activity, which continues to play a pivotal role in shaping market trends.

Conclusion

The recent XRP liquidations by whales are a testament to the volatile and unpredictable nature of the cryptocurrency market. While the long-term impact of this event is yet to be fully understood, it serves as a reminder for investors about the risks involved in crypto investments, emphasizing the need for diverse portfolios and sound risk management strategies. Moving forward, monitoring whale movements and broader market indicators will be crucial for both seasoned traders and new entrants in the cryptocurrency space.